CashFlow & Budgeting

Benefits of Budgeting - Financial Planning in Dubai

“A budget is telling your money where to go instead of wondering where it went.”- Dave Ramsey

Living in the UAE can be expensive, so it's important to have a budget in place to track your spending and ensure you're not overspending.

Contrary to the popular understanding; the purpose of a budget is not to curb your expenses and deprive you! Its actual purpose is to enable you to do more with your money.

A budget can help you optimize your income and wealth in such a way that you can achieve your long-term financial goals while having enough to spend for today's needs and wants. It helps you gain control over your money, instead of being controlled by the lack of it.

A budget can help you save money for your future goals, such as buying a house, saving for retirement, or taking a dream vacation.

There are many budgeting tools like an Excel template, mobile applications, and Desktop applications, which can help in setting up a personal budget and tracking expenses regularly.

I have created a simple and efficient Budgeting Template in Excel to help you take control of your finances.

Click here to download the Budget Planner Template.

If you prefer using a smartphone app, you can use the HomeBudget app.

Choose the tool you are most comfortable with; you can even start with a pen, paper, and calculator; if you don't want to use an app or an Excel template.

The following steps can help you create an effective budget and take control of your finances.

The biggest mistake most of us do is that we pay bills, expenses, loans, and everything else before we pay ourselves. When all bills and expenses are paid, there is very little or nothing left to pay ourselves.

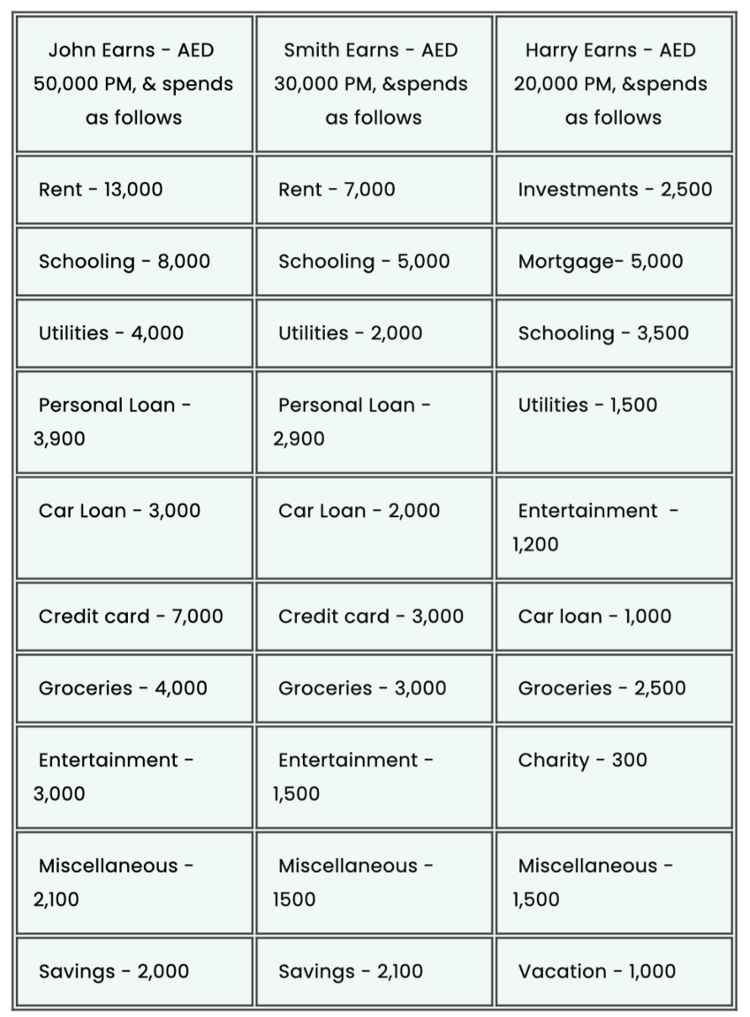

Who do you think is wealthy? John, Smith, or Harry?

Harry is most likely to lead a happy and fulfilled life while being able to save for his retirement, pay off his mortgage, and afford to give to charity from his income, thanks to the robust budget he follows.

Exercise: Download and use this template to prepare a similar statement of income and expenses for yourself and compare it with John, Smith, and Harry to determine where you stand.

The most common advice shared in almost all financial self-help books, like Rich Dad Poor Dad & The Richest Man in Babylon is to pay ourselves first.

George Clason states that paying yourself first is a cure for a lean purse!

(Image Credit - quotefancy)

(Image Credit - quotefancy)

Determine a certain percentage of your income ( 10% of your income is highly recommended) and set up an auto debit into a SIP/Investment/Savings plan.

I know that you are possibly thinking it is impossible to set aside 10% of your income, given your current state of affairs...

Don't be disheartened, start with a 10% provision, we are still in the planning stage, and you can always come back to firm the percentages before you fix your budget...

When I say, monthly income, add only the regular and recurring income.

Only include actual income, do not consider the income you are likely to receive or notional income.

For best results, add your last 12 months' actual income from your bank account and take the average figure as your planned income.

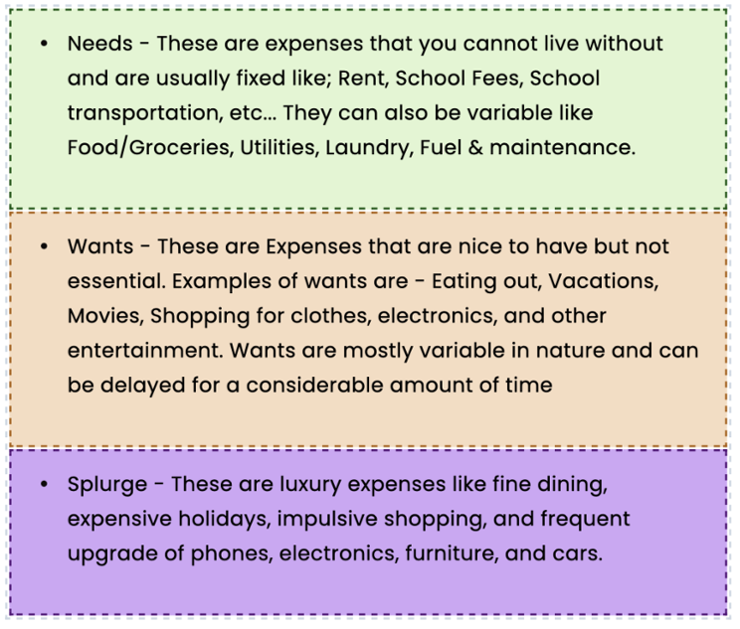

Classifying your expenses in separate buckets gives you a perspective, making it easy to prioritize the important from the rest.

The Free Budget Planner Template helps you classify your expenses in the above format. Click here to download it.

Make a list of all the payments you make on the credit card(s), personal loan, car loan, mortgages, student loan, and hand loans.

Organize the list in the order of highest interest to lowest interest.

For Example, Credit cards always come first, as they are likely to charge the highest interest, followed by personal loan, mortgage, car loan, and other loans.

Knowing how much goes into repayments is the first step toward Debt Elimination.

Savings can be for short-term or long-term financial needs and wants

It helps you pay for your wants like the annual vacation, purchase of gadgets & furniture, saving for buying jewelry, or buying a car guilt-free and debt free.

You can also save to Splurge once in a while. What is the point of earning and saving if you do not allow yourself a few luxuries?

In addition to retirement savings, you may also set aside money for buying a property, Children’s education, Marriage, Starting a business, or immigrating to another country.

Allocate at least 1.00% of your income to your favorite charity.

When you give without remorse, it creates a feeling of fulfillment, which is essential to lead a happy life...

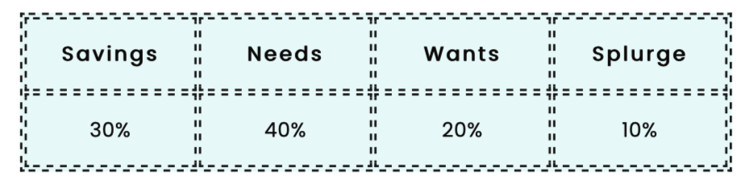

An ideal budget should have the following ratios

In an ideal budget there is no provision for Debt repayments because the goal of an ideal budget is to help you;

Initially, your budget may be near or entirely far from an ideal budget, and that is ok. If you stay focused and disciplined, you can get there.

Your first goal should be to reduce Bills, expenses, and repayments to 80% of your total income, allowing 20% for long-term and short-term savings.

If your expenses and loan repayments are more than 80% of your earnings, then you have a severe cost-cutting exercise to undertake.

An upgrade to iPhone 14, when you have an iPhone 12/13 or change your car every three years is a splurge and not a need or even a want

Likewise, a vacation or a new dress for your office party are wants and not needs.

Revisit all your expenses. Focus on the wants and splurge, that is where you can save the most. Involve your family members and identify expenses, which can be avoided or trimmed.

Reduce your wants and if possible put them off for a few months.

Learn to say no to yourself and your family on Splurge items, till your budget is streamlined.

Look out for cheaper alternatives to address your needs.

Consider debt consolidation to make the repayments more affordable.

Banks like ADIB and NBAD and Mashreq are offering debt consolidation loans to residents of the UAE to help them better manage cashflows and save on interest costs...

Keep reviewing your budget every month, and in a few months, you will notice the pattern of your spending. This insight can help you prioritize your expenses and further refine your budget.

In the next post, we will discuss "How to keep your budget on track". Click here to read the post.

To know more about budgeting, saving, investing, or protecting income and wealth, connect with me on a Discovery Call

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

“A budget is telling your money where to go instead of wondering where it went.”- Dave Ramsey

Sign up for our newsletter to receive the latest updates on new topics, events and more. You will also get a chance at special discounts only available through this channel!