Retirement Planning in UAE

One day, you may stop working, but your expenses won’t. That’s why a smart retirement plan is essential to secure the lifestyle you deserve.

With longer lifespans and less job security, how can you retire stress-free and financially secure?

The answers are just ahead.

Keep reading to explore practical solutions and expert advice to take control of your financial future. Your journey to a secure retirement starts now!

Imagine how life would be if you lived more than 100 years.

Is it possible?

Well, it appears to be

According to Professor Stuart Kim from Stanford University, the first person who might live up to 200 years has already been born! That's groundbreaking!

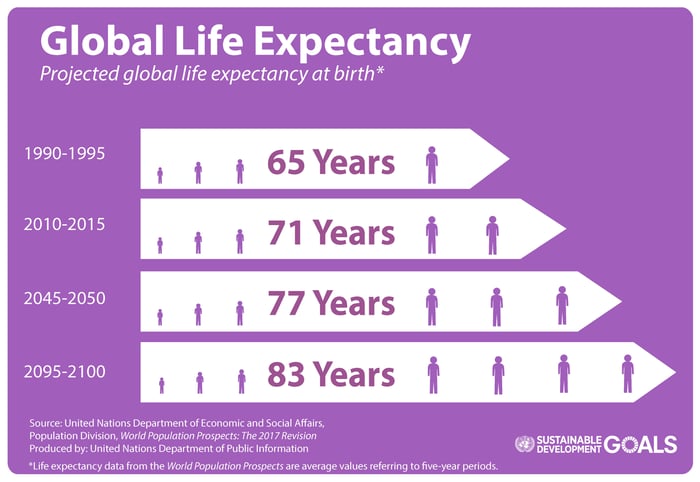

Now, consider this: global life expectancy is on the rise. In just two decades, it increased by more than six years, from 66.8 years in 2000 to 73.4 years in 2019. (Source: WHO)

Longer Life, Bigger Retirement Savings Needed

Higher life expectancy means a longer retirement.

Think about it – more years in retirement means more expenses, the increasing impact of inflation over time, and the need for bigger retirement savings.

Outliving your retirement savings is a challenge we all could face, if we do not plan efficiently.

On the other hand, the concept of a stable job is fading slowly but steadily, and the Gig economy is fast emerging. The recent COVID-19 crisis and the rapid technological innovations have disrupted the future of the economy and employment.

So, while the world is changing rapidly, one thing hasn't changed much – how people approach their retirement savings.

That's where I come in.

Connect with me to explore new-age retirement planning and passive income solutions.

Together, we can ensure your long retirement goals are not just dreams, but a well-funded reality. Your financial future is waiting – let's make it secure and exciting!

What is retirement planning?

Retirement planning is preparing financially to ensure that even after you stop working, you can still live life on your own terms, achieving your goals and fulfilling your dreams.

This process involves defining how you want your retirement to look like, figuring out how much money you'll need to make that happen, and then investing wisely to grow your retirement nest egg.

Tailor-Made Retirement Plans for Every Stage of Life

Early Career (20s and 30s):

Get Ahead with FIRE: Financial Independence & Early Retirement (FIRE) is all about sowing the seeds of financial security in your 20s and 30s.

Think of it like planting a tree today that will provide comforting shade in the future. Starting early sets the stage for a worry-free retirement.

Cultivate an Investing Habit: Start building wealth by investing a portion of your income. I'll show you how simple and achievable it is. The goal is to make saving and investing a natural part of your financial life, allowing your wealth to grow steadily.

Unlock the Power of Compounding: Albert Einstein once said, "Compound interest is the eighth wonder of the world." Starting early means your wealth compounds more, and it's likely to last longer. So, let time work its compounding magic for your financial future.

Mid-Career (40s and 50s):

Boost Your Savings: When you enter your 40s and 50s, your career typically reaches its peak, bringing with it the potential for increased income. This is the phase to boost your retirement savings.

I can show you how to make the most of your income and invest towards your retirement and other crucial life goals.

Balance is Key: While investing for retirement is crucial, it should not impede your other goals and current goals and vice versa.

Your retirement plan should seamlessly integrate with your current lifestyle needs and complement the achievement of your other financial goals.

Let's work together to ensure that your retirement aspirations don't come at the cost of your present enjoyment, striking a balance between living well today and securing your tomorrow.

Close to Retirement:

Fine-Tuning for the Future: As retirement approaches, the focus shifts towards securing the investments you've accumulated over the years.

I can help fine-tune your financial portfolio to ensure it's resilient and prepared for your golden years.

This phase is about safeguarding what you've diligently built, so you can confidently step into a comfortable and fulfilling retirement.

Retirement Planning in UAE.

If you are a UAE national working in either in government or private sectors you are eligible for pensions and other retirement benefits. However, the retirement corpus accumulated may not be enough to fund your retirement lifestyle, so you will have to save and invest in a private pension plan or retirement plan.

Very few companies provide retirement benefits to Expats. While it is mandatory to provide a gratuity for expats, it is usually not enough to fund a comfortable retirement.

So if you are an expat, so you are on your own when it comes to Retirement Planning in the UAE. Typically there is also the uncertainty of how long you can live and work here, so it isn't easy to make a viable long-term investment plan for your retirement!

Considering the above challenges, our objective is to provide new-age retirement solutions blended with passive income strategies, ideal for a UAE resident like you.

Depending on your retirement income goals, risk appetite, potential cash flows, and retirement timelines, I can help you design the best pension plan or investment plan for retirement.

Planning to retire in Dubai - UAE?

Here is what it takes:

- As part of the Golden Visa Program, expatriates aged 55 and above, along with their spouses and dependents, can qualify for a 5-year residency visa with renewal possibilities.

- Financial Eligibility: To qualify, meet one of these criteria:

1. a minimum yearly income of AED180,000 (approx. US$49,000) or AED15,000 (approx. US$4,100) per month

2. AED1 million (approx. US$275,000) in a 3-year fixed deposit, AED1 million (approx. US$275,000) in property,

3. or a combination of deposits and property totaling AED1 million (approx. US$275,000).

Frequently Asked Questions

1. What is the ideal age for retirement in the UAE?

Typically UAE residents aim to retire between the ages of 55-60, but nowadays they are hoping to become financially independent much earlier. Given the stressful work environments, people are burning out faster so the concept of FIRE - Financial Independence & Early Retirement is catching up among UAE residents rapidly.

2. At what age should I begin Retirement Planning?

Ideally, you should start planning for your retirement as soon as you start earning. However, it is important to create at least 3 months of emergency savings, before any investment is made.

The sooner you start investing for your retirement, the easier it would be. As it would help you benefit from the power of compounding.

“Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.” - Albert Einstein.

Chicken or Egg Retirement Planning dilemma

When you start early, you can also focus on other important financial goals like Children's higher education, property investment, etc. Otherwise, you could be in a Chicken or Egg dilemma to prioritize your retirement or children's higher education.

Both are major financial goals and you cannot compromise on either of them. Hence starting early on your retirement savings makes the achievement of other goals easy.

3. Is the advice you give personalized to me?

Yes, We don't follow a one size fits all formula.

We use the GAiM Plan - A comprehensive financial planning, investment advisory, and portfolio management system. We provide bespoke advice based on your retirement objectives, current and projected cash flows, inflation, and your attitude to risk.

4. How does retirement planning work?

We begin with understanding where you are with your money now and where you want to be in 5, 10 15 20 years. We also take into account what other goals you would want to achieve in between. ( Children's Higher Education, property investment, seed money for business, etc..)5 Steps of Retirement Planning

-

When do you want to retire?

This is the first step of your retirement planning. It helps you determine how long you have to save for your retirement and how long your retirement corpus has to last.

-

Where do you want to retire?

Knowing where you want to retire will help you visualize the lifestyle you would want to maintain. for Eg: if you want to live in a major city like Dubai, Mumbai, London, etc, your cost of living and inflation will be relatively higher

If you want to live outskirts or in a town, you may have to consider access to affordable and quality health care, while the inflation and cost of living could be relatively low.

-

What income would you need during retirement?

When you know where and when you want to retire, it is easy to estimate how much you would need to spend every month on retirement.

While it is difficult to exactly predict your retirement lifestyle and expenses, we can make a fair estimate based on the above factors. Also, there is lots of information on the internet to help with this aspect.

-

What will be the impact of inflation?

-

How much will need for my retirement?

Investment Planning

You will receive a detailed report and recommendation after our financial planning session.

5. What kind of Retirement Solutions do you provide?

Based on your retirement goals, investment, and risk appetite, we can choose from a wide range of investment solutions like;

-

- Best Pension Plans in UAE.

- Dividend-yielding International Mutual funds, Stocks, and ETFs.

- Structured products.

- Best Retirement Plans from leading insurance companies.

- Passive income yielding REITs.

- Bond and Bond Funds providing regular coupons.

6. Can I continue the investment after moving out of UAE?

Yes, all plans we recommend are international and you can continue to hold, manage, and encash them even after moving out of UAE. We will provide all the necessary support in managing your plans throughout the investment period.

7. How do I know whether I have enough money to retire?

I can help you project your retirement corpus by estimating your retirement expenses, potential inflation, and a conservative growth rate on your investments.

Click here to Arrange a Free Consultation to get a detailed analysis of your retirement cash flow needs.

8. Where can I get more information about your retirement planning services?

Read the following blog posts to know more about our Retirement Planning Solutions, or click here to arrange a Free Consultation;