The ultimate early retirement – FIRE guide for expats in the UAE

Last week I met a young couple, who wants to become financially independent at age 40.

Both are passionate about music. They plan to start a music band, create music albums, and travel all over the world while being able to live in the UAE and provide for their children.

Off-late, I am seeing more people wanting to retire early (FIRE) from their active employment/profession to pursue their passion.

With the introduction of the Golden Visa, residents are no longer dependent on their employers to live in the UAE. Thanks to this welcome initiative, many expats are looking to make UAE their permanent home.

You can retire early / Become Financially Independent when you build a steady stream of income that supports your lifestyle and keep up with inflation.

What is FIRE?

FIRE is an acronym. It represents The Financial Independence – Retire Early movement.

The “Financial Independence, Retire Early” (FIRE) process is fairly simple. You save and invest aggressively when you’re young, with the aim of retiring by your 30s, 40s, or 50s.

This movement has gained significant momentum since it was first introduced by Vicki Robin and Joe Dominguez through their 1992 best-selling book Your Money or Your Life. The idea was further propagated through Jacob Lund Fisker’s 2010 book Early Retirement Extreme.

It all starts with the awareness that retiring early is possible and knowing what it takes to do so.

Although daunting, once you know what is required of you and you are ready to do what it takes, early retirement is achievable.

The general idea is that you increase your income, lower your expenses and invest wisely in long-term growth and passive income-generating investments.

So, how can you, as an expat in the UAE, look forward to early retirement?

Understanding FIRE

The F.I.R.E movement encourages saving and investing as much as you can during your 20s, 30s, and 40 so you may retire early in life.

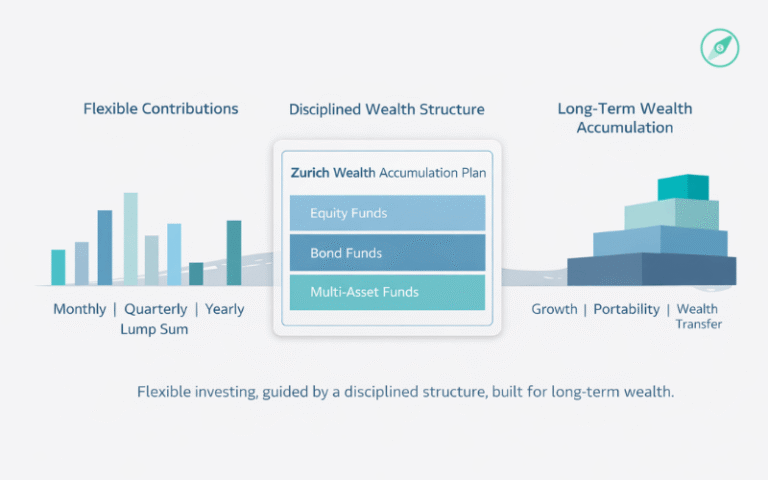

Its core principle is that you save and invest around 30% to 60% of your income in assets that can generate passive income and/or provide high returns over the long term. These can come in the form of stocks, bonds, mutual funds, ETFs, Property, and Gold.

Types of F.I.R.E

The different types of F.I.R.E include:

- Lean FIRE. This requires following a minimalist or lean approach, where you save as much as you possibly can by living on bare minimums. Lean F.I.R.E can get you on the path to retirement sooner than other types.

- Fat FIRE. Unlike Lean F.I.R.E, Fat F.I.R.E lets you follow a more financially relaxed approach, where you don’t have to make too many changes in your existing spending pattern. However, this might mean that you take longer to reach retirement unless you have a significantly high income.

- Barista FIRE. This is when you follow the F.I.R.E system but have quit your regular nine-to-five job and are supporting your existing expenses through some type of part-time or freelance work.

- Coast FIRE. While this term also applies to part-time workers, these individuals have already met their retirement fund requirements and also have enough money to meet existing expenses. They, in essence, are already coasting through.

Then, there’s regular F.I.R.E too, where you don’t make major sacrifices in your spending, but continue to save and invest with gusto.

Is FIRE Right For You?

Early retirement is possible by following the principles of F.I.R.E, provided you start saving and investing at an early age.

If you are unsure about how and when to start investing, if you feel overwhelmed by the wide range of investments, or if you’re getting mixed opinions from different sources and have become skeptical, you might benefit by getting professional assistance.

Thinking about investing while you’re still young is particularly important now. This is because technology is disrupting employment opportunities across sectors, and the need to update skill sets and switch careers has become more pronounced than ever.

On the other hand life expectancy is constantly increasing. A longer life expectancy means you will live more number of years in retirement. So you would need a bigger retirement corpus and the impact of inflation would be more pronounced.

Early retirement in UAE

This is an excellent time for young people to invest as their investable surplus will continue to remain high until they go the family way. Understand that your priorities are bound to change once you have children, and it is only normal for expenses to rise. Besides, postponing your retirement is never a good idea.

Expats in the UAE want to continue experiencing their high standards of living as they explore potential retirement opportunities in or outside the country. What helps is that there’s a positive economic outlook for the UAE over the next three to five decades.

From a young investor’s point of view, it’s best to make hay while the sun shines – by putting your tax-free income to work in the right manner. For all you know, you might even be able to retire in your 30s or 40s if you play your cards right.

5 tips to achieve early retirement through FIRE

Achieving early retirement might be easier than you imagine if you follow these pointers.

- Create focused retirement goals

- Cut back on major expenses

- Pay off your credit as quickly as possible

- Create multiple streams of income

- Diversify your investments

Following a few simple steps can also ensure that you have a relatively big retirement corpus for when the time comes.

Benefits and Challenges of FIRE

The pros of following the F.I.R.E approach include:

- Increased flexibility with your time at a relatively young age

- The ability to follow your passion once you retire

- Being able to travel at your discretion

- Being able to spend time with your loved ones

- Not having to worry about finances upon retiring

Seeking early retirement by following this approach comes with its share of drawbacks as well.

- Need to make lifestyle changes

- Being unable to scale lifestyle.

- Unpredictability about the future

- Not finding retirement fulfilling

- Difficulty in rejoining the workforce is so desired

Common misconceptions about FIRE

Some common misconceptions have made people wary about following the F.I.R.E process. The following statements DO NOT hold true.

- You have to be a high-income earner to retire early

- You need to save at least half of what you earn.

- You cannot retire early if you have children.

- You will have to live an extremely frugal life.

- You need to be in your 20s to begin.

- The method works only if you’re lucky or privileged.

- F.I.R.E is just a fad.

- This trend will last only until the market goes bearish again.

Bear in mind that the aim of following the F.I.R.E system should not be you want to spend the rest of your life partying. It should be making your money work for you so you may gain financial freedom early in life.

How I Can Help

With over 10 years of experience, I have worked with scores of young expats who have begun their careers in the UAE. I follow a holistic financial planning approach coupled with a diversified investment strategy to ensure that my clients make the most of changing market conditions. If you choose to use my services, you can expect regular reviews and a rebalancing of your portfolio.

Contact me for your free consultation now and find out how I can help you get on the path to early retirement.