Financial Resolutions

Useful Financial Resolutions To Make And Keep In 2022 And Beyond.

How often have you read an article on Financial resolutions and found it irrelevant to your...

Every time you receive your paycheck, you pay so many people!

You pay your...

The list goes on and on...

But do you Pay Your Self and when?

"Do not save what is left after spending, but spend what is left after saving." - Warren Buffet.

Paying yourself first is saving money for your future before spending on your needs, wants, and, more importantly, luxuries!

It is one of the fundamental principles of financial success.

The pay yourself first strategy is quite simple to understand, isn't it?

But, it seems easier said than done!

Because not many are following this strategy, and among those who do, only a few are doing it consistently.

You may find it difficult if you follow the traditional budgeting approach of saving what is left. It is quite possible that not much is left after spending on your needs, wants and luxuries. And sometimes there could also be too much month at the end of money.

Reminds me of the funny but ironic song Too Much Month (At The End Of The Money) by Marty Stuart. Listen here...

You could keep going back to this comfort zone, with an excuse that bills come first or I don't have enough for today; how can I think about the future?

The best and the easiest way to pay yourself first is by following the Payday Savings Strategy.

It is deciding how much you can and want to save, automating the savings to coincide with your payday, and then spending the rest guilt-free and at your discretion.

So let's say you earn 30000 Dhs a month, and you can and want to save AED5000 every month. Then you could set up an automatic transfer every month(5000) into a savings account or an investment plan and spend the rest(25000) on your needs, wants, and luxuries. It looks simple, isn't it?

Let's see in detail how this strategy works?

Pay Yourself First is perhaps easier said than done!

Although it appears to be simple, not many are doing it. And among those who are doing it, only a few are doing it consistently.

We find it difficult because we are so accustomed to the traditional budgeting approach of saving what is left. Unfortunately, not much is left after spending on our needs, wants, and luxuries. And sometimes there is more month left at the end of the money.

It is a comfort zone we keep going back to, with an excuse that bills come first or I don't have enough for today; how can I think about the future?

The best and the easiest way to pay yourself is by following the Payday Savings Strategy.

It is deciding how much you can and want to save, automating the savings to coincide with your payday, and then spending the rest guilt-free and at your discretion.

In his book and super successful Ted Talk, Simon Sinek identified one common trait of successful individuals and companies. They start with "Why."

Here is the link to the video on youtube. If you haven't watched it yet, I encourage you to watch it.

If you have already seen the video, please watch it again. The video is very inspiring.

Knowing why to save money will not only help you start saving, it will also keep you motivated all the way.

Identify your short, medium, and long-term financial goals and create visual cues helping you to remember them constantly.

Here are some goals you can consider for yourself

Ideally, saving 30-50% of your income would be best. It might be difficult, at the outset, but if you persist, you will certainly, reach 30% savings earlier than you thought.

EAB's The 50/20/30 rule of thumb guides you to allocate your income; 50% to needs, 20% to wants and luxuries, and 20% to savings.

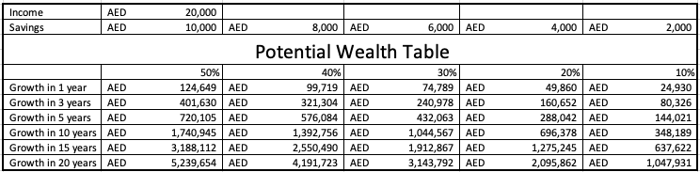

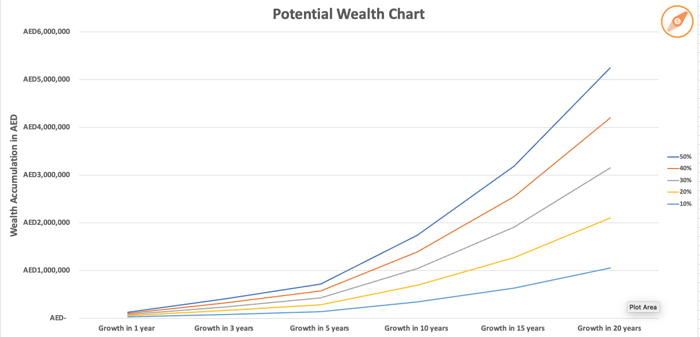

The more you save, the faster you can achieve your financial goals. Here is a potential wealth table showing how much wealth you can create by saving a certain percentage of your income.

When you use the EAB, you will the potential wealth you can create at the current savings rate. This can be a powerful motivator to save, invest, and grow wealth.

"A penny saved is a penny earned."

This famous quote by Benjamin Franklin no longer holds true; not at least for Expats in UAE.

A friend of mine once said...

"A penny saved is a penny spent elsewhere."

And he is so right...

While savings can be helpful for short-term goals, it hardly helps for long-term goals like retirement.

Create an automatic investment like a SIP or a Regular Savings Plan, or even a recurring deposit according to the goals identified. This will help you accumulate capital and grow wealth.

You cannot manage what you don't measure.

Most people fail not because they don't have goals or act on them but because they don't have a system to measure progress and make necessary changes.

It is essential to measure how close to or far from your financial goals are at least once in 6 months.

This way, you can ensure that you are making consistent progress towards your financial goals.

Pay Yourself first is the cornerstone of efficient financial planning. It helps you accumulate capital and grow wealth to secure your financial future.

While it seems like a pretty efficient strategy, not many follow it, and among those who follow it, only a few do it consistently.

The four steps to implement this strategy efficiently are;

Prioritizing your saving ahead of your expenses makes it easier to achieve your financial goals as an ex-pat; it also helps you make the best out of the tax-free income in UAE.

I can help you automate your savings into a regular savings plan for your medium or long-term goals. Let's connect on a discovery call to understand how.

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

How often have you read an article on Financial resolutions and found it irrelevant to your...

-2.png?width=300&name=7%20Compelling%20Reasons%20to%20retire%20in%20the%20UAE.png%20(350%20%C3%97%20250%20px)-2.png)

The UAE is quickly emerging as a favorable destination for retirement as it continues to attract...