Life Insurance

How life insurance works during pandemics like Covid-19?

What started as a local outbreak in Wuhan - China late last year, has now locked-up almost the...

The average net worth of a resident in UAE is $99000, while the global average is $87,489.

Do you know much is yours?

Networth, in simple words, is the difference between what you own(assets & belongings) and what you owe(Liabilities or loans)

Just like companies have their financial statements, a personal balance sheet is a statement that helps you clearly see, where you are in terms of money on a particular date.

It shows how much you own and how much you owe...

It is an organized statement of your assets and liabilities grouped under different heads, helping you understand your net worth at a given point.

Hence it is also known as Net-Worth Statement.

Your net worth is positive if your assets are more than your liabilities. It is negative if your liabilities are more than your assets.

In addition to the net worth, this template also enables you to calculate the number of months you can survive on your liquid assets without an income.

It is a very useful template, providing vital insights into your financial situation on a single page.

Download and use this Net-worth & Cash Flow Template to give you a snapshot of your financial affairs for a given period.

Don't be perturbed by the accounting jargon when you hear the word Balance sheet. This template makes the process easy, needing no prior accounting knowledge or background

This template is very simple. It helps you prepare a snapshot of your income, expenses, and net worth in less than 15 minutes.

It helps you classify your assets and liabilities under different heads for better understanding and improving your finances.

This template also helps you calculate how long you can last without an income, helping you plan for emergencies.

The template consists of 4 sheets.

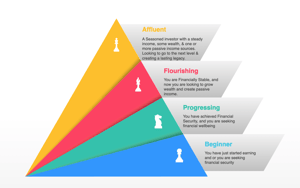

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

What started as a local outbreak in Wuhan - China late last year, has now locked-up almost the...

How often have you read an article on Financial resolutions and found it irrelevant to your...

Zurich Simple Wealth, as the name suggests is a simple & straightforward lump-sum investment plan...