Life Insurance, Critical Illness Insurance, Zurich Futura

Zurich Futura Critical Illness List - Updated 2025

One illness can disrupt your income and one payout can help protect your future.

Take control of your finances with the Expat Advantage Budget (EAB)—a simple Excel tempalte for UAE expats to save more and turn surplus income into lasting wealth.

As a UAE expat, your financial journey is unique. Here’s why:

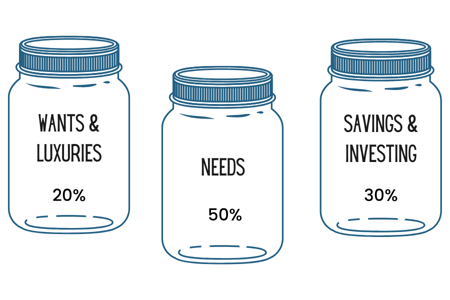

The traditional 50/30/20 rule—designed for countries with significant taxes—doesn’t address the unique realities of expats in the UAE. Higher disposable income, uncertainty about the future, and cultural temptations require a smarter, tailored approach.

The Expat Advantage Budget (EAB) goes beyond the basics to help you save consistently, manage your income effectively, and turn your earnings into financial freedom.

I’m Damodhar Mata - Financial Advisor in Dubai.

I designed and built the Expat Advantage Budget (EAB) based on my 17 years of experience as an expat, optimizing income, managing expenses, and increasing savings.

This template is also informed by insights from hundreds of financial planning sessions with expat couples.

The EAB is a proven approach to achieving consistent savings and effective wealth accumulation.

Start with your current bank balance & capture your income and expenses under different heads carefully categorized for UAE expats.

Choose the auto populate option to fill the entire year's expenses. Edit the varying expenses in the particular month(s).

Choose the currency you want to display and wacth the magc happen in the secondary currency page and the summary page, giving you deep insights about your expenses and welath projeciton.

Stuck in the RAT RACE: Without a disciplined savings and a Budget Plan, you could remian stuck in the RAT RACE, going around in circles and getting no where

disciplined savings and a Budget Plan, you could remian stuck in the RAT RACE, going around in circles and getting no where

Financial Security: Inadequate savings could lead to unplanned borrowing during emegencies or economic downturns, putting your financial future at risk.

Lost Opportunities: Inconsistent saving and investing means missing out on the power of compounding, which could have significantly boosted your wealth over time.

Peace of Mind: Without a robust savings and investment plan, you might face uncertainty about your financial future, leading to unnecessary stress and hindering your path to financial freedom.

The EAB’s dynamic charts and graphs make it easy to see and understand where your money is going and how your bank balance evolves over time.

Seamlessly switch between AED and 8 other currencies (INR, USD, GBP, EUR, CAD, SAR, OMR, SGD) to manage your budget in the most relevant currency.

One illness can disrupt your income and one payout can help protect your future.

Income looks impressive. Net worth tells the real story.

-2-2.png?width=300&name=The%20GAiM%20PLan%20(350%20x%20250%20px)-2-2.png)

Remember when life felt simple?