Financial Planning, Whole life insurance

What Is Whole Life Insurance: Explore Pros, Cons & Best Plans In UAE

Why do I need Whole life insurance? It is the immediate question people ask when they hear about...

Are you a millennial?

If you were born between 1981 and 1996, you are a Millennial or Generation Y in your late 20s to early 40s.

Source:https://getrapl.com/blog/microlearning-for-millennials/

Typically known for being tech-savvy and exceptionally informed, Millennials like you are forging ahead, and reshaping the world we know.

Most of your generation are in the busiest phase of your lives, starting families, buying homes, building a start up, or making significant career advancements.

This is the perfect time to begin long-term financial planning.

Your financial planning needs to be as dynamic as you are, while providing the strength and stability to sustain adverse situations with ease.

It should go far beyond saving smartly, investing digitally, or picking the right online life insurance.

Your financial plan should reflect what's most important to you, identifying potential financial hurdles and opportunities and providing strategies that align with your goals and challenges.

While A robust financial plan may use various solutions to address the protection needs of millennials like you. This blog post explores the role of Whole Life Insurance as a comprehensive and cost efficient protection plan.

Continue reading to find out why whole life insurance in the UAE is a smart money move?

Unlike term life insurance, which only provides coverage for a certain number of years; Whole life insurance aims to provide coverage for your entire lifetime.

Another key benefit of whole life insurance is the accumulation of cash value over time. A portion of the premium you pay is invested and it grows tax-deferred. You can withdraw the cash value of your insurance by surrendering the benefits to complement your retirement savings.

Understanding the benefits of whole life insurance is important to help you make informed decisions about your financial future.

When considering life insurance options, as a millennial you may face the decision between whole life insurance and term life insurance. While both have their advantages, whole life insurance can be a better choice, for the following reasons;

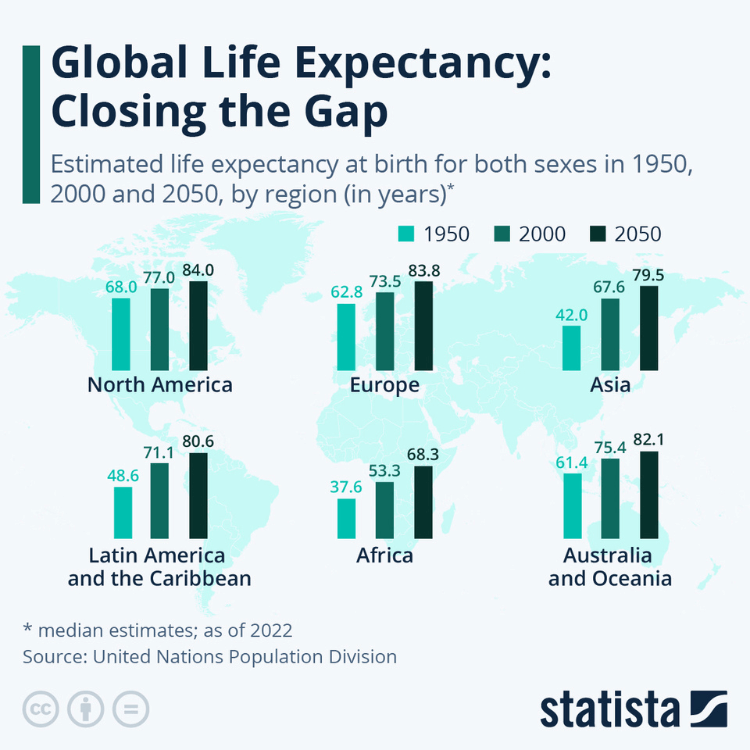

Global life expectancy has sharply increased in the last few decades and is continuing to rise steadily. This means, Millennials, Gen Z and the future generations could live much longer than the Gen X and Baby boomers...

Hence there is a distinct need for your life insurance to cover longer than just a few years...

Whole life insurance offers lifelong coverage, providing peace of mind that your loved ones will be financially protected during your working life and you can leave a legacy for your loved ones when you retire.

In contrast, term life insurance only provides coverage for a specific term, such as 10, 20, or 30 years. If you outlive the term, the coverage expires and there is no cash back or coverage.

The average global life expectancy in 2024 is 73.16 years. So if you are 30-35 years old, you can expect to live for another 38-43 years on an average. If you buy a 30 year term insurance, the cover would end at 60-65. Between ages 60 and 73 the probability of you dying are much higher than dying young...

Why would you want to throwaway the umbrella, just when it is about to rain?

Plus, all the money you pay as premium is an expense.

Whole life insurance includes a cash value component that can serve as a savings or investment vehicle. This can be particularly beneficial for you, to complement your retirement savings goal.

It's Like Buying a House vs. Renting One:

Think of whole life insurance as buying a house. It's a long-term investment where you are putting money into something that not only provides shelter (or in this case, financial security) but also builds equity over time.

This house is yours for life; it offers stability, grows in value, and can be passed down to your children, becoming part of your legacy.

On the other hand, term life insurance is like renting a house. It's more affordable in the short term and meets your needs now, but when you vacate the house, you have to leave empty handed. You’ve had a roof over your head for a while, but in the end, you walk away with nothing.

Whole life insurance, like buying a house, represents a lasting investment that pays off over the long haul, offering both immediate security and future benefits.

Whole life insurance plans offer a comprehensive coverage, which can be further enhanced with living benefits and riders like;

It almost takes a life time, lots of planning, discipline and meticulous execution to build adequate retirement savings. You don't want it all spent on curing a major ailment during retirement.

Whole life insurance with a critical illness, pays out a cash lump sum in the event of diagnosis of a critical illness for your whole life, providing you peace of mind protecting your retirement savings.

The Whole Life insurance is more cost efficient. Given the increasing life expectancy, legacy planning needs and critical illness benefit during retirement - millennials like you need a longer coverage terms.

The term-life insurance tends to lose its advantage when the cover term extends beyond 25/30 years, then it becomes relatively costly.

On the other hand Whole Life Insurance can be more affordable for longer term cover needs, as it works on the principle of sum at risk.

You could argue that the premium on the Whole life insurance is higher. Yes, at first glance, whole life insurance looks pricier than term insurance.

But think long-term.

The premium you pay on the Whole life insurance is typically lower than a term insurance over 30 years. So, in the long game, it might be cheaper, especially when you consider the added benefits and savings part.

You may also argue that you could invest the difference between the term plan and Whole life premium to build a corpus, but even in that case, the whole life insurance is better in most scenarios.

I have explained this in the case studies below.

In Simple Terms: Whole life insurance is like a Swiss Army knife for your financial plan. It gives you permanent coverage, helps you save money, offers a bunch of extra protective features, and can be a smarter long-term money move. It’s designed to support your big life plans, protect your loved ones, and even give you peace of mind knowing you're covered, come what may.

One of the key advantages of whole life insurance is its flexibility and customisation to suit your specific protection needs and financial goals.

As a millennial you may have unique financial circumstances and commitments. While your protection needs may be big, your budget could be relatively small. Whole life insurance policies can be tailored to address these specific needs by adjusting the cover amount, premium payment duration, or cash value growth potential.

Additionally, riders, such as critical illness coverage or disability income protection, can be added to enhance the scope of your policy.

This allows you to create a comprehensive insurance plan that aligns with your individual protection needs and budget, thus ensuring that you have the right coverage to protect you and secure your loved ones' financial future.

Whole life insurance policies can be customised to suit your specific needs and financial goals, allowing for greater flexibility. You can increase or decrease the cover amounts and premiums. Add or remove benefits, extend or reduce the premium payment term and make Ad-hoc investments or withdrawals from your policy.

As a millennial, you can take advantage of lower premiums when getting a Whole life plan. Coupled with the investment and the sum at risk calculation of premiums, you can end up paying much less as cost of insurance on your Whole life policy.

Given the long term nature of a Whole Life plan, the benefits of dollar cost averaging and compounding are pronounced. You can take advantage of 3 - 4 market cycles when investing over 15 - 20 years of premium payment term.

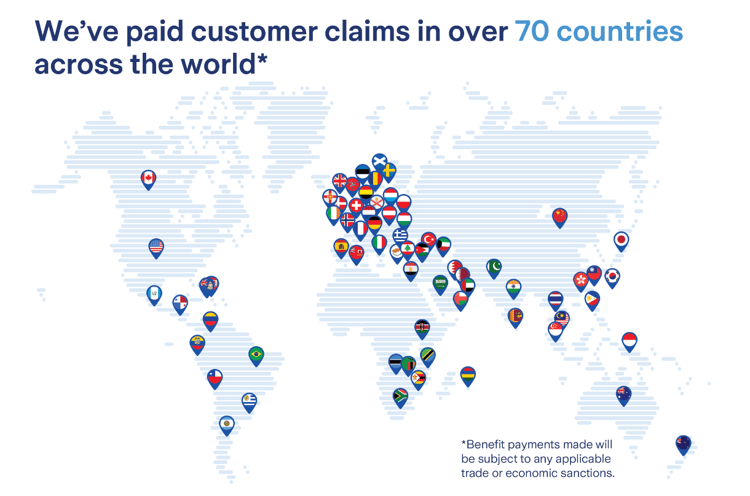

UAE has a large expat population. If you are an expat - you can buy a plan in the UAE, continue to hold, manage and claim the benefits in most countries, except USA, UN sanction countries and active war zones.

Zurich is one of the top insurance companies in the UAE, they have made benefits payment in 70 countries across the world.

Zurich is one of the top insurance companies in the UAE, they have made benefits payment in 70 countries across the world.

The underlying investment of the Whole life plan grows tax-deferred, allowing it to accumulate and compound without immediate tax implications.

Whole life insurance is an ideal tool for estate planning, allowing millennials to leave a financial legacy for their loved ones.

These reasons make whole life insurance an ideal choice for millennials in the UAE who are looking for comprehensive coverage and long-term financial benefits.

Real-life case studies can provide valuable insights into how whole life insurance has benefited millennials in the UAE.

Case Study 1:

Sarah, a 30-year-old millennial, purchased a whole life insurance policy when she got married. During Covid-19, with she and her partner were laid off resulting in loss of income for 7 months.

During these 7 months, they were able to pause the premiums on their policy, which the cover continued and restart when they were employed again.

Case Study 2:

Suresh and his wife Seema, a 35-year-old millennials, purchased a whole life insurance policy when they were in the UAE. They moved to Australia with his after 3 years. They continue to hold and manage the plan online from Australia. The regular reviews of the policy are done online.

Case Study 3:

Raman, a 31 -year-old millennial, purchased a whole life insurance policy when he was in the UAE. After 5 years he moved to India. He had a heart attack and recovered in 3-4 weeks time. He submitted the claim from India online and it was admitted and paid in 6 working days.

Case Study 4

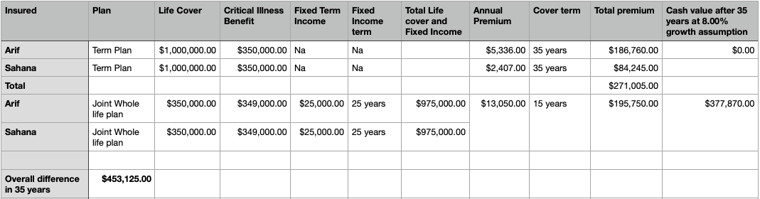

Arif(Smoker) and Sahana(Non smoker) are 35 and 32 years old. They recently bought a Whole life plan, after carefully considering the cost and benefits of a term life insurance. They were able to make an overall savings of $450K with the Whole life plan.

The details were as follows;

For millennials in the UAE, now is the right time to consider whole life insurance for the following reasons.

Firstly, by starting a whole life insurance policy at a younger age, you can benefit from lower premium rates. As you grow older, insurance premiums tend to increase due to factors such as health conditions and lifestyle choices.

Secondly, whole life insurance offers the advantage of cash value accumulation over time. By starting early, you give your policy more time for the cash value to grow and potentially use it to complement your retirement savings.

Lastly, life is unpredictable, and unexpected events can happen at any time. By having whole life insurance in place, you can ensure that your loved ones are protected financially.

Considering these factors, now is the right time for millennials like you to consider whole life insurance as part of your financial planning.

Choosing the right whole life insurance policy is essential for millennials in the UAE. Here are some tips to consider when getting started:

1. Assess Your Financial Needs: Evaluate your financial goals, including short-term and long-term needs. Determine the amount of coverage to protect at least the following;

- Corpus to ensure a good Life style for your family

- Schooling, college and marriage expenses of your children

- Corpus for Parents support if you are supporting your parents financially

Provide for the impact of inflation of the above expenses when calculating your coverage needs.

2. Compare Policies: Research and compare different whole life insurance policies from reputable insurance providers like Zurich, Metlife, Salama, Sukoon and Orient. Consider factors such as premium rates, cash value growth potential, and additional benefits.

3. Understand Policy Terms: Read and understand the terms and conditions of the policy, including premium payment duration, death benefit payout options, and any exclusions or limitations.

4. Seek Professional Advice: Consult with a financial advisor or insurance agent who specializes in life insurance. They can provide guidance tailored to your specific needs and help you make an informed decision.

5. Review Regularly: Once you have chosen a policy, regularly review and reassess your coverage to ensure it continues to meet your evolving needs and financial goals.

By following these tips, you can choose the right whole life insurance policy that provides comprehensive coverage and aligns with your protection needs and financial situation.

As a Financial Advisor I have more than 11 years experience, I can help you asses your protection needs and buy a custom made policy with suitable riders and best underlying investments.

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

-2.png?width=300&name=What%20is%20Whole%20Life%20Insurance%20Why%20consider%20buying%20it%20(350%20%C3%97%20250%20px)-2.png)

Why do I need Whole life insurance? It is the immediate question people ask when they hear about...

-2.png?width=300&name=Term%20or%20Whole%20Life%20Insurance%20(350%20%C3%97%20250%20px)-2.png)

When buying life Insurance in the UAE, you mainly consider a term life or whole life insurance.

Zurich Futura: A Premier Whole Life Insurance in the UAE