The dance of greed and fear, orchestrated by exit polls, lost and made trillions of rupees in a zero sum game, where one must lose for another to win.

The naive lost heavily, and the scheming made loads of money...

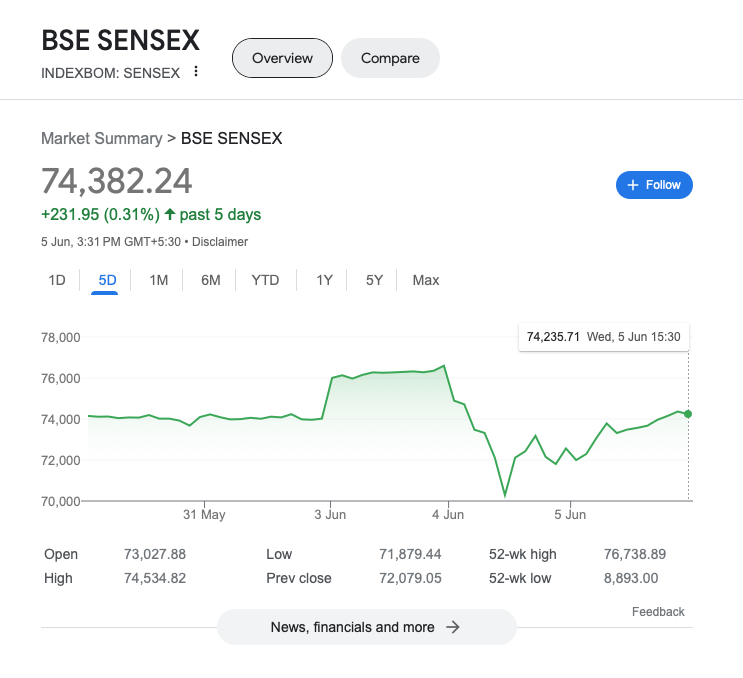

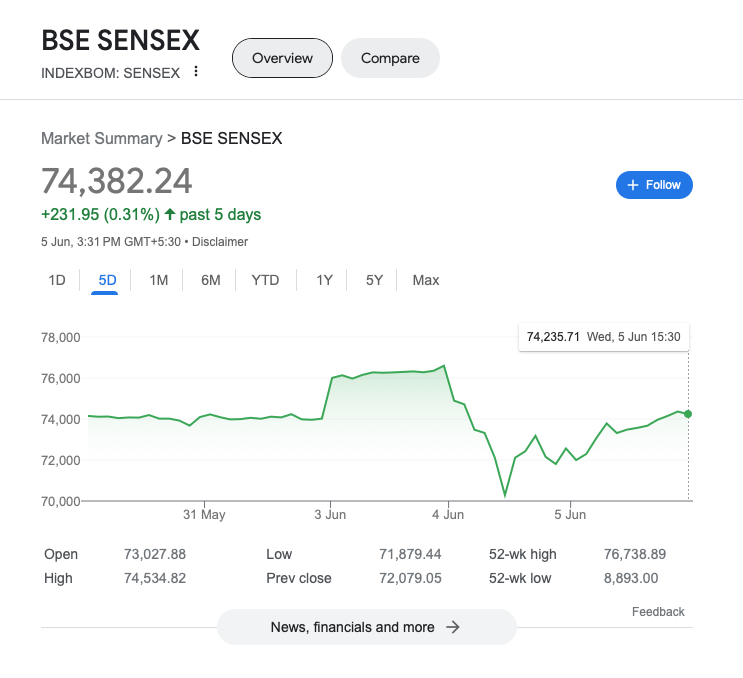

What happened in 3 days...

- Market Volatility: The Sensex was at 74018 on Friday 31st May and went up to 76599 on Monday and crashed to 70284 on Tuesday, only to recover back to 74235 on Wednesday. Over 6000 points volatility in a single day, driven by uncertainty and investor sentiments of fear and greed.

- Not real representation: These movements are largely influenced by speculators with very short term outlook, and may not reflect the underlying fundamentals of the economy or companies.

- Rumour Mill: In fact rumour is that such scenarios are orchestrated to move money from the naive to scheming.

Inaction Is The Best Action Sometimes.

In the last 3 weeks, I had more than a few clients reach out, to check if we could realign the investments to take advantage of upcoming India election results.

I advised them not to take any action, as their investments were geared for the long term growth and are well diversified in multiple geographies and asset classes. The outcome of this election will have very little impact on their long term financial goals.

So we did no action, other than regular review and rebalancing of portfolios.

If you are an investor with a long term investment horizon and outlook, here’s what this and any another political drama means for you. Also discussed is whether you should try to take advantage of these short-term market movements or stay away..

Should Common Investors Take Advantage of These Movements?

Don't Participate In The Zero Sum Game

- Risk of Losses: Short-term trading is a zero sum game, that requires precise timing, and the potential for losses is high if the market moves against your expectations.

- Lack of Expertise: You may often lack the expertise and resources to successfully navigate volatile markets.

- Investment Goals: When investing for long-term goals such as retirement or children's higher education, short-term volatility should be ignored. Focusing on long-term growth and fundamentals is a more stable approach.

- Emotional Decision-Making: Volatile markets can lead to emotional decision-making, which often results in poor investment choices and undue losses.

- Speculation vs. Investment: Betting on political events is akin to speculation and is very unlikely to pay off. It is not a sound investment strategy and can lead to significant financial losses.

Recommended Strategy for Common Investors

- Stick to Long-term Plans: Maintain a focus on long-term investment goals and ignore short-term market noise.

- Diversification: Ensure a diversified portfolio to spread risk across various grographies, asset classes and sectors.

- Regular Monitoring: Review and rebalance the portfolio periodically to stay aligned with investment goals and risk tolerance.

- Systematic Investment Plan (SIP): Continue with SIPs / regular investments to benefit from Dollar Cost Averaging, which reduces the impact of market volatility.

If You Choose to Engage in Short-term Trading (Not Recommended):

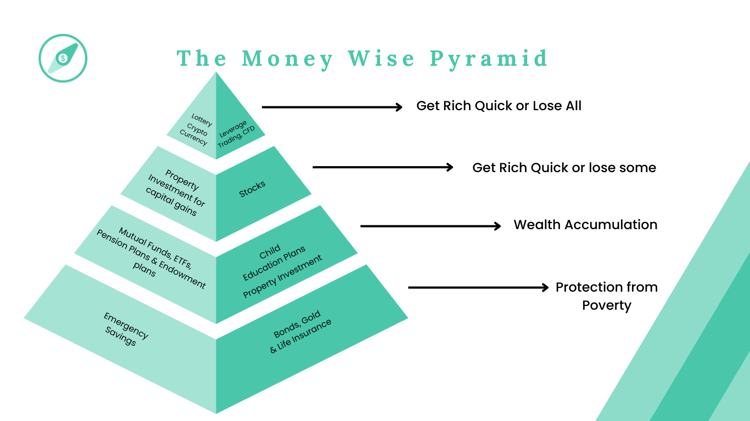

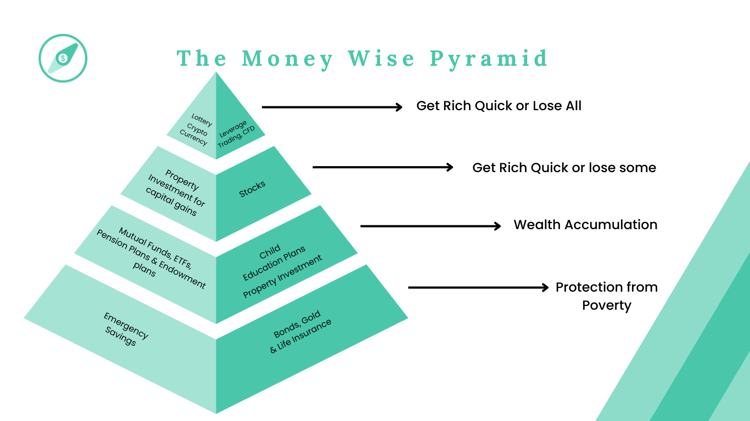

- Money Wise Pyramid: Engage in speculation, only if you are on stage 3 or preferably in stage 4 of the Money Wise Pyramid(See Image). If you are in Stage one or two, stay away from this zero sum game.

- Peer Pressure: Don't get carried away by what other people are saying or doing. They may not be in the same financial situation like yours. Or they may have vast experience in trading, which you may or may not have. Also, when people make money, they tend to gloat, and when they lose, they keep it a secret. Additionally their threshold for risk could be relatively higher than your's. Stick to your financial plans and investment goals.

- Research and Analysis: Conduct thorough research and use technical analysis to make informed decisions.

- Stop-Loss Orders: Use stop-loss orders to limit potential losses.

- Small Allocations: Allocate only a small portion of the portfolio to short-term trades to mitigate overall risk.

- Stay Informed: Keep abreast of market news, trends, and economic indicators to make timely decisions.

Conclusion

For common investors, it is generally advisable to avoid attempting to capitalize on short-term market movements due to the associated risks and the potential for significant losses.

Betting on political events is akin to speculation and is very unlikely to pay off.

A disciplined, long-term investment strategy focused on diversification and regular monitoring is more likely to yield stable and positive results over time.

Expert Help

I can help you with Holistic Financial Planning and an investment strategy aligned to your goals and risk appetite. Book a Discovery call now to jumpstart your journey towards financial freedom.

Click here to book a Discovery Call

-2.png?width=300&name=Reluctant%20Investor%20Poem%20(350%20x%20250%20px)-2.png)