Regular Cashflow Plan from LIC International

Guaranteed Investments

LIC International - Regular Cashflow Plan can help you grow wealth and create a regular cash-flow for a specific number of years.

It also provides Life cover and optional Accidental Death Benefit, helping you create a legacy for your loved ones

Who can benefit from this plan?

This plan is ideal if you are of age between 20 - 45 and looking to create a regular cash flow for a certain number of years. However, it can also suit older individuals for generating an income during retirement.

The following are some possible scenarios, where this plan can be beneficial;

- Expats looking to create a regular income to support their lifestyle after moving out of UAE

- A young couple planning to start a family - To replace a working mother's income

- A young couple planning to start a family - for child's school fees

- Parents - For child(ren)'s Higher Education

- Parents of Teen-agers - For creating income during retirement

- Wannabe Entrepreneurs - Looking to start a business in 5,10 or 15 years

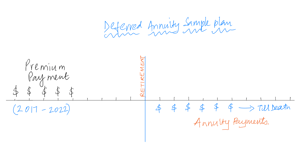

How does it work?

You can invest in this plan either as a lump-sum or on a yearly basis for five years, and choose to receive a regular cash-back from a particular age for a specific number of years.

Example:1. Varun Kumar - 30-year-old - Indian Expat in UAE is planning to return to India after ten years and needs $20,000 PA for 5 Years to support his family while he is establishing his restaurant in Mumbai.

He can choose one of the following two premium payment options;

1. Lump sum investment of $31,862.19

2. Annual Investment of $7004.04 for five years.

He would receive the following amounts from age 41 onwards;

| AGE | Cashflow |

| 41 | $10,452.75 |

| 42 | $10,703.00 |

| 43 | $10,953.25 |

| 44 | $11,203.50 |

| 45 | $11,453.75 |

| Total | $55,766.25 |

Example 2

Swetha & Ramesh are recently married and are planning to start a family after three years. They are looking to create a regular cash flow to support the school fees for their child.

They can choose one of the following two premium payment options;

1. Lump sum investment of $121,159.16

2. Annual Investment of $24,231.83 for five years.

They would receive the following amounts from age 4 of the child;

| Child Age | Cash Flow | Child Age | Cash Flow |

| 4 | $12,170 | 11 | $14,550 |

| 5 | $12,480 | 12 | $14,875 |

| 6 | $12,790 | 13 | $15,200 |

| 7 | $13,100 | 14 | $15,525 |

| 8 | $13,575 | 15 | $15,850 |

| 9 | $13,900 | 16 | $16,175 |

| 10 | $14,225 | 17 | $16,500 |

Swetha and Ramesh are able to save more than 50% of their joint incomes; as they do not have any liabilities and also their living expenses are not much, they chose the regular premium option.

The plan also provides a Sum assured of $140,000. This ensures that the education goal is not affected even in the case of death of the insured.

The above figures are calculated based on the current year's bonus rates. Click here for detailed bonus history.

Summary & Expert Help

As the name suggests, LIC International Regular Cashflow plan is ideal if you are looking to address your future cash flow needs. The above-listed scenarios and examples are just a few ways you can use this plan.

It can also be customised based on your budget, financial goals and cash-flow needs.

As an Independent Financial Advisor with more than 15 years experience, I can help you choose the most suitable plan and customise it to match your budget and goals.

Feel free to call me or schedule a Free Consultation to know more.

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...