LIC International offers a wide spectrum of Capital Protected plans like;

- Children's Professional Education Plan

- Participating Marriage and Education Plan

- Jeevan Anand - Whole of Life Plan

- Cash Back Plan

- Participating Endowment Plan

- Double Cover Endowment Plan

These policies are in US Dollar Denomination, hence an expat in UAE can save in such plans, without worrying about currency depreciation. The returns provided by these plans are based on the Bonus declared by LIC International each year.

Bonus Calculation - How it works?

In layman terms, the Bonus paid by an insurance company can be defined as the extra payment added to the policy each year; over and above the Sum Assured of the policy.

Like how companies pay a dividend to its shareholders when they make a profit, Life Insurance companies declare a bonus each year based on the profit or surplus generated during that year.

This surplus is the excess of assets over the liabilities of the insurance company during the year.

This surplus is distributed amongst the policy owners each year as Bonus. It is usually expressed in Dollars per 1000 dollars of Sum Assured. For Eg: 32$ per 1000$ of Sum Assured.

LIC International Bonus History

| Year |

|

| 1990 |

17 |

| 1991 |

17 |

| 1992 |

17 |

| 1993 |

17 |

| 1994 |

17 |

| 1995 |

17 |

| 1996 |

17 |

| 1997 |

17 |

| 1998 |

17 |

| 1999 |

20 |

| 2000 |

20 |

| 2001 |

20 |

| 2002 |

21 |

| 2003 |

22 |

| Year |

|

| 2004 |

23 |

| 2005 |

24 |

| 2006 |

25 |

| 2007 |

26 |

| 2008 |

28 |

| 2009 |

29 |

| 2010 |

30 |

| 2011 |

31 |

| 2012 |

32 |

| 2013 |

31 |

| 2014 |

32 |

| 2015 |

32 |

| 2016 |

32.5 |

| Year |

Endowment |

| Regular Bonus |

| less than 10 yrs |

11 -20 yrs |

above 20 yrs |

| 1990 |

17 |

17 |

17 |

| 1991 |

17 |

17 |

17 |

| 1992 |

17 |

17 |

17 |

| 1993 |

17 |

17 |

17 |

| 1994 |

17 |

17 |

17 |

| 1995 |

17 |

17 |

17 |

| 1996 |

17 |

17 |

17 |

| 1997 |

17 |

17 |

17 |

| 1998 |

17 |

17 |

17 |

| 1999 |

20 |

20 |

20 |

| 2000 |

20 |

20 |

20 |

| 2001 |

20 |

20 |

20 |

| 2002 |

21 |

21 |

21 |

| 2003 |

22 |

22 |

22 |

| 2004 |

23 |

23 |

23 |

| 2005 |

24 |

24 |

24 |

| Year |

Endowment |

| Regular Bonus |

| less than 10 yrs |

11 -20 yrs |

above 20 yrs |

| 2006 |

25 |

25 |

25 |

| 2007 |

26 |

26 |

26 |

| 2008 |

28 |

28 |

28 |

| 2009 |

29 |

29 |

29 |

| 2010 |

29 |

30 |

31 |

| 2011 |

30 |

31 |

32 |

| 2012 |

30.5 |

32 |

33 |

| 2013 |

29.5 |

31 |

32 |

| 2014 |

30.5 |

32 |

33 |

| 2015 |

30.5 |

32 |

33 |

| Year |

Endowment |

| Regular Bonus |

| upto 10 yrs |

11 -15 yrs |

16 -20 yrs |

above 20 yrs |

| 2016 |

31 |

32.5 |

32.5 |

33.5 |

| Year |

Endowment – single |

| Regular Bonus |

| less than 10 yrs |

11 -20 yrs |

above 20 yrs |

| 1990 |

17 |

17 |

17 |

| 1991 |

17 |

17 |

17 |

| 1992 |

17 |

17 |

17 |

| 1993 |

17 |

17 |

17 |

| 1994 |

17 |

17 |

17 |

| 1995 |

17 |

17 |

17 |

| 1996 |

17 |

17 |

17 |

| 1997 |

17 |

17 |

17 |

| 1998 |

17 |

17 |

17 |

| 1999 |

20 |

20 |

20 |

| 2000 |

20 |

20 |

20 |

| 2001 |

20 |

20 |

20 |

| 2002 |

21 |

21 |

21 |

| 2003 |

22 |

22 |

22 |

| 2004 |

23 |

23 |

23 |

| 2005 |

24 |

24 |

24 |

| Year |

Endowment – single |

| Regular Bonus |

| less than 10 yrs |

11 -20 yrs |

above 20 yrs |

| 2006 |

25 |

25 |

25 |

| 2007 |

26 |

26 |

26 |

| 2008 |

28 |

28 |

28 |

| 2009 |

29 |

29 |

29 |

| 2010 |

29 |

30 |

31 |

| 2011 |

30 |

31 |

32 |

| 2012 |

30.5 |

32 |

33 |

| 2013 |

27.5 |

27.5 |

27.5 |

| 2014 |

27.5 |

29 |

30 |

| 2015 |

27.5 |

29 |

30 |

| Year |

Endowment – single |

| Regular Bonus |

| upto 10 yrs |

11 -15 yrs |

16 -20 yrs |

above 20 yrs |

| 2016 |

28 |

29.5 |

29.5 |

30.5 |

| Year |

Cash Back |

| Regular Bonus |

| Term 12 |

Term 15 |

Term 18 |

<=20 yrs |

| 1990 |

17 |

17 |

17 |

17 |

| 1991 |

17 |

17 |

17 |

17 |

| 1992 |

17 |

17 |

17 |

17 |

| 1993 |

17 |

17 |

17 |

17 |

| 1994 |

17 |

17 |

17 |

17 |

| 1995 |

17 |

17 |

17 |

17 |

| 1996 |

17 |

17 |

17 |

17 |

| 1997 |

17 |

17 |

17 |

17 |

| 1998 |

17 |

17 |

17 |

17 |

| 1999 |

19 |

19 |

19 |

19 |

| 2000 |

19 |

19 |

19 |

19 |

| 2001 |

19 |

19 |

19 |

19 |

| 2002 |

20 |

20 |

20 |

20 |

| 2003 |

21 |

21 |

21 |

21 |

| 2004 |

22 |

22 |

22 |

22 |

| 2005 |

22 |

24 |

24 |

24 |

| 2006 |

24 |

25 |

25 |

25 |

| 2007 |

25 |

26 |

26 |

26 |

| 2008 |

27 |

28 |

28 |

28 |

| 2009 |

28 |

29 |

29 |

29 |

| Year |

Term<=15 |

Term >15 |

| 2010 |

29 |

30 |

| Year |

Term<=15 |

16-20 |

Term >20 |

| 2011 |

30 |

31 |

32 |

| 2012 |

31 |

32 |

33 |

| 2013 |

30 |

31 |

32 |

| 2014 |

31 |

32 |

33 |

| 2015 |

31 |

32 |

33 |

| Year |

Term<=15 |

16-20 |

Term 25 |

| 2016 |

31.5 |

32.5 |

33.5 |

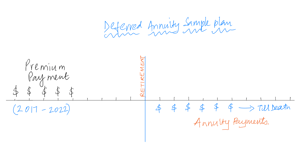

| Year |

Deferred annuity plans |

| Regular Bonus |

| upto 5 yrs |

6-10 yrs |

11-15 yrs |

above 15 yrs |

| 2006 |

22 |

22 |

22 |

22 |

| 2007 |

23 |

23 |

23 |

23 |

| 2008 |

25 |

25 |

25 |

25 |

| 2009 |

26 |

26 |

26 |

26 |

| 2010 |

26 |

27 |

27 |

28 |

| 2011 |

27 |

28 |

28 |

29 |

| 2012 |

27.5 |

28.5 |

29 |

30 |

| 2013 |

26.5 |

27.5 |

28 |

29 |

| 2014 |

27.5 |

28.5 |

29 |

30 |

| 2015 |

27.5 |

28.5 |

29 |

30 |

| 2016 |

28 |

29 |

29.5 |

30.5 |

| Year |

The following table provides the bonus history of participating endowment plans with Limited Term and Full-term premium payment. |

| Regular Bonus Per Thousand Sum Assured |

| less than 10 yrs |

11 -20 yrs |

above 20 yrs |

| 1990 |

17 |

17 |

17 |

| 1991 |

17 |

17 |

17 |

| 1992 |

17 |

17 |

17 |

| 1993 |

17 |

17 |

17 |

| 1994 |

17 |

17 |

17 |

| 1995 |

17 |

17 |

17 |

| 1996 |

17 |

17 |

17 |

| 1997 |

17 |

17 |

17 |

| 1998 |

17 |

17 |

17 |

| 1999 |

20 |

20 |

20 |

| 2000 |

20 |

20 |

20 |

| 2001 |

20 |

20 |

20 |

| 2002 |

21 |

21 |

21 |

| Year |

Endowment |

| Regular Bonus |

| less than 10 yrs |

11 -20 yrs |

above 20 yrs |

| 2003 |

22 |

22 |

22 |

| 2004 |

23 |

23 |

23 |

| 2005 |

24 |

24 |

24 |

| 2006 |

25 |

25 |

25 |

| 2007 |

26 |

26 |

26 |

| 2008 |

28 |

28 |

28 |

| 2009 |

29 |

29 |

29 |

| 2010 |

29 |

30 |

31 |

| 2011 |

30 |

31 |

32 |

| 2012 |

30.5 |

32 |

33 |

| 2013 |

29.5 |

31 |

32 |

| 2014 |

30.5 |

32 |

33 |

| 2015 |

30.5 |

32 |

33 |

[/et_pb_tab][et_pb_tab title="Single Premium Endowment Plans" tab_text_color="#e09900" disabled="off"]

| Year |

The following table provides the bonus history of participating endowment plans with Single Premium Payment. |

| Regular Bonus |

| less than 10 yrs |

11 -20 yrs |

above 20 yrs |

| 1990 |

17 |

17 |

17 |

| 1991 |

17 |

17 |

17 |

| 1992 |

17 |

17 |

17 |

| 1993 |

17 |

17 |

17 |

| 1994 |

17 |

17 |

17 |

| 1995 |

17 |

17 |

17 |

| 1996 |

17 |

17 |

17 |

| 1997 |

17 |

17 |

17 |

| 1998 |

17 |

17 |

17 |

| 1999 |

20 |

20 |

20 |

| 2000 |

20 |

20 |

20 |

| 2001 |

20 |

20 |

20 |

| 2002 |

21 |

21 |

21 |

| Year |

Endowment – single |

| Regular Bonus |

| less than 10 yrs |

11 -20 yrs |

above 20 yrs |

| 2003 |

22 |

22 |

22 |

| 2004 |

23 |

23 |

23 |

| 2005 |

24 |

24 |

24 |

| 2006 |

25 |

25 |

25 |

| 2007 |

26 |

26 |

26 |

| 2008 |

28 |

28 |

28 |

| 2009 |

29 |

29 |

29 |

| 2010 |

29 |

30 |

31 |

| 2011 |

30 |

31 |

32 |

| 2012 |

30.5 |

32 |

33 |

| 2013 |

27.5 |

27.5 |

27.5 |

| 2014 |

27.5 |

29 |

30 |

| 2015 |

27.5 |

29 |

30 |

[/et_pb_tab][et_pb_tab title="Whole of Life Plans" tab_text_color="#07910e" disabled="off"]

| Year |

Bonus for each 1000$ Sum Assured |

| 1990 |

17 |

| 1991 |

17 |

| 1992 |

17 |

| 1993 |

17 |

| 1994 |

17 |

| 1995 |

17 |

| 1996 |

17 |

| 1997 |

17 |

| 1998 |

17 |

| 1999 |

20 |

| 2000 |

20 |

| 2001 |

20 |

| 2002 |

21 |

| Year |

Bonus for each 1000$ Sum Assured |

| 2003 |

22 |

| 2004 |

23 |

| 2005 |

24 |

| 2006 |

25 |

| 2007 |

26 |

| 2008 |

28 |

| 2009 |

29 |

| 2010 |

30 |

| 2011 |

31 |

| 2012 |

32 |

| 2013 |

31 |

| 2014 |

32 |

| 2015 |

32 |

[/et_pb_tab][et_pb_tab title="Cash Back Plans" tab_text_color="#0c71c3" disabled="off"]

| Year |

Bonus for each 1000$ Sum Assured |

| 1990 |

17 |

| 1991 |

17 |

| 1992 |

17 |

| 1993 |

17 |

| 1994 |

17 |

| 1995 |

17 |

| 1996 |

17 |

| 1997 |

17 |

| 1998 |

17 |

| 1999 |

20 |

| 2000 |

20 |

| 2001 |

20 |

| 2002 |

21 |

| Year |

Bonus for each 1000$ Sum Assured |

| 2003 |

22 |

| 2004 |

23 |

| 2005 |

24 |

| 2006 |

25 |

| 2007 |

26 |

| 2008 |

28 |

| 2009 |

29 |

| 2010 |

30 |

| 2011 |

31 |

| 2012 |

32 |

| 2013 |

31 |

| 2014 |

32 |

| 2015 |

32 |

[/et_pb_tab][et_pb_tab title="Deffered Annuity Plans" tab_text_color="#8300e9" disabled="off"]

| Year |

Bonus for each 1000$ Sum Assured |

| 1990 |

17 |

| 1991 |

17 |

| 1992 |

17 |

| 1993 |

17 |

| 1994 |

17 |

| 1995 |

17 |

| 1996 |

17 |

| 1997 |

17 |

| 1998 |

17 |

| 1999 |

20 |

| 2000 |

20 |

| 2001 |

20 |

| 2002 |

21 |

| Year |

Bonus for each 1000$ Sum Assured |

| 2003 |

22 |

| 2004 |

23 |

| 2005 |

24 |

| 2006 |

25 |

| 2007 |

26 |

| 2008 |

28 |

| 2009 |

29 |

| 2010 |

30 |

| 2011 |

31 |

| 2012 |

32 |

| 2013 |

31 |

| 2014 |

32 |

| 2015 |

32 |

Summary

It is evident from the above tables that LIC International has been very consistent with the Bonus declaration every year since its inception.

Also, the bonus has been consistently growing each year. Given the capital protection and consistent Bonus History, LIC international plans are an attractive investment option.

To know more about LIC International plans, feel free to arrange a free initial meeting with me by filling out the following form or calling me on 050-2285405.

-1-1.jpeg?width=300&name=LIC%20International%20Participating%20Endowment%20Plan%20-%20Portable%20(1)-1-1.jpeg)