My Two Fils

Beyond Spider-Man: Life Lessons from Uncle Ben and Aunt May's Story

Two unrelated events highlighted my Eid holiday break:

Are you 50 or older and concerned about retirement savings and financial future?

You're not alone.

This phase of life is the perfect opportunity to take stock of your financial future and make empowering decisions.

You only need an efficient retirement plan to optimize your time, money, and experience to enhance your retirement savings and achieving financial independence.

Around 50 years of age, you would be at the top of your professional skills, and abilities, thus resulting in an increase in income.

(Source: https://taxfoundation.org/data/all/federal/average-income-age/)

Most of your personal responsibilities would be more or less over.

Children probably would be out of college, ready to propel their own future. Goals like owning a home, starting a business, touring may have been achieved, thus resulting in higher disposable income.

More income and fewer expenses is a wonderful recipe for successful retirement savings.

Financial Assessment and Goal Setting: Begin by evaluating your current financial situation, including savings, debts, and income. Set clear retirement goals considering your desired lifestyle, retirement age, destination and major future expenses.

Optimizing Retirement Savings and Investments: Maximize your retirement contributions, especially through employer pension plan if available. Alternatively you can start your personal investment plan or increase the contributions if you already have one. Diversify your investments across various asset classes to balance risk and enhance potential returns.

Healthcare and Insurance Planning: Plan for healthcare costs and provide for a comprehensive health insurance during retirement.

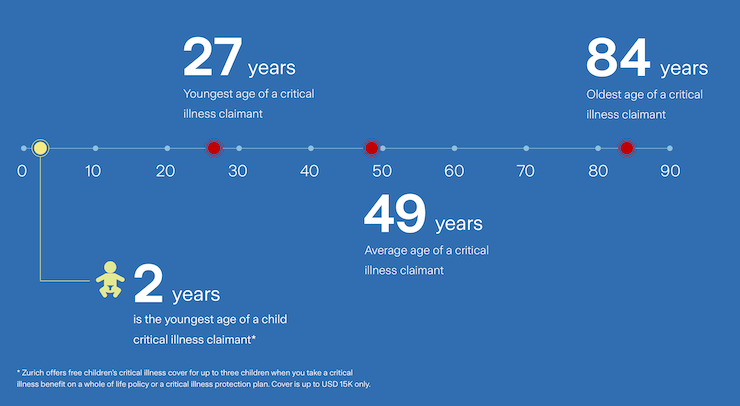

Did you know that the average age for critical illness claims with Zurich Middle East is 49?

Source: Zurich Claims Report 2023

Source: Zurich Claims Report 2023

In the unfortunate event of a diagnosis of a major illness, you may have to pre-pone your retirement, and the critical illness insurance can come in very handy then. Ascertain the adequacy of your life and critical illness insurance. Top up or buy a new one if there is a gap.

This step is crucial for protecting yourself against unforeseen medical expenses and providing security for your loved ones.

4. Debt Management and Emergency Funds: Work towards reducing or eliminating debts and establish an emergency fund to cover unexpected expenses, thereby safeguarding your retirement savings.

Legacy and Estate Planning: Include legacy planning in your strategy by setting up wills, trusts, and ensuring your assets are distributed according to your wishes. Inheritance laws in the UAE are different for Muslims and non muslims. Seek professional guidance on legacy planning to ensure seamless transfer of wealth.

Open communication with your family about these plans is essential for clarity and to avoid future disputes.

Regular Review and Adaptation: Continuously assess and adjust your plan to align with changing financial circumstances, market conditions, and personal objectives. This includes considering additional passive income streams if needed.

Work with a Financial Professional: Engage with an Independent Financial Advisor or investment professional who can provide Holistic Advice. They can provide personalized advice, help navigate complex financial decisions, and tailor your investment strategy to your unique situation and goals. Also that can help you avoid the the common retirement planning myths.

While savings is essential to build a nest egg, wise investment of your savings is crucial to mitigate inflation and currency risks.

You should carefully choose a good retirement savings plan which takes into account the following aspects;

Compatibility with Retirement Goals/Objectives and risk appetite : Ensure that your investment choices align with your specific retirement goals, timeline, and income needs. Also ensure that they align with your personal risk tolerance. As you approach retirement, a more conservative approach might be appropriate to protect your savings.

Short and Flexible Investment Term: Given the fact that your have to catch up quickly, you have to invest big chunk of your savings towards retirement.

However this investment should be flexible to adapt your change income and residency status. It should not be a long term commitment or contractual in nature, making it difficult to exist when things don't go your way.

There are many short and flexible investment options in the UAE to choose from. Book a discovery call now to learn more.

Inflation Protection: Investments should ideally keep pace with or exceed inflation to ensure that your purchasing power is not eroded over time. Assets like Mutual funds, ETF, stocks, real estate, or inflation-protected securities can be effective in this regard.

Diversification: A diversified portfolio across various asset classes, sectors, and geographies can help mitigate risk. This means a mix of stocks, bonds, real estate, and possibly other assets like pension plans and other passive income assets.

Liquidity: Some level of liquidity is important, especially as you approach retirement age. This ensures that you have access to your funds when you need them, without incurring significant penalties or losses.

Low Fees and Costs: High investment fees can significantly eat into your returns over time. Opt for investment options with lower fees to maximize your retirement savings.

Tax Efficiency: Consider potential future tax implications in the UAE and tax implications in your home country. Certain retirement accounts offer tax advantages that can be beneficial for long-term growth.

Favorable Currency Investment and Exchange Risk Consideration: For residents having investment in more than one currency, it's important to consider currency exchange risks. Investing in stable currencies or using hedging strategies can mitigate these risks. Consider investments in currencies that are likely to remain strong or stable relative to your home or resident currency.

Flexibility: Look for retirement plans that offer flexibility to adapt to changes in your financial situation, including options to increase or decrease premiums/investments, partial withdrawals, and full surrender.

Transparency: Understand all charges and terms associated with your retirement plan. Work with your financial advisor to ensure clarity and make informed decisions.

Reaching 50 is a great time to get your retirement plans on track. You've got the experience and resources to make smart choices for your future. Remember, it's never too late to start planning for a comfortable retirement.

Let's make it happen.

Book a free consultation with us to discuss how you can save and grow your retirement fund. We're here to help you create a plan that works for you.

Click here to begin your journey to a worry-free retirement.

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

Two unrelated events highlighted my Eid holiday break:

The Good, the Bad, and the Ugly is a 1966 movie starring Clint Eastwood (the good), Lee Van Cleef...

Many would argue that Zurich Futura is the best Whole of Life Insurance in UAE, and they may be...