Financial Planning, Zurich Insurance

Zurich Insurance Dubai - Life, Savings & Investment Solutions.

Zurich International is a leading international insurance and investment provider.

They serve...

FPI's International Protector Middle East is an Affordable & International Term Insurance Plan for UAE residents.

It aims to provide an International Cover against loss of income due to Death, Disability, or Critical Illness, for a specific and agreed length of time.

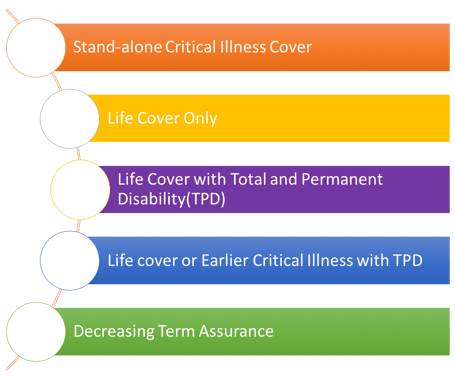

The International Protector Middle East(IPME) is more affordable in comparison to a whole of life plan or an endowment plan. It offers a wide scope of cover at low costs and is ideal to cover protection needs like;

The International Protector Middle East(IPME) is more affordable in comparison to a whole of life plan or an endowment plan. It offers a wide scope of cover at low costs and is ideal to cover protection needs like;

Also, read the difference between Term Insurance and Whole of life insurance.

Critical Illness Cover

Critical Illness Cover International Protector Middle East covers more than 35 critical illnesses including Cancer, Heart Attack, loss of limbs, Major Organ Transplant, Loss fo independent Existence, and many more.

Like all major insurance companies Friends Provident International pays out a cash lump sum on diagnosis of an illness covered under the policy.

Click here to download the list the critical illness guides, providing detailed information on the list of critical illnesses, the scope, limitations, and the definition of each critical illness.

Click here to download the Critical Illness Claims Statistics of International Protector ME

The plan can adapt to your changing protection needs, subject to insurability at the time of change. it allows you;

Term insurance is the most affordable way of protecting against loss of income against death & serious illness. Although it will never acquire a Cash or Surrender value, it certainly provides invaluable peace of mind.

The minimum premiums for all types of cover are as follows;

| Currency | Monthly | Annually |

| US Dollars (USD) | USD 17.50 | USD 175.00 |

| UK Sterling ( GBP) | GBP 10.00 | USD 100.00 |

| EURO (EUR) | EUR 15.00 | EUR 150.00 |

| UAE Dirhams (AED) | AED 64.50 | AED 645.00 |

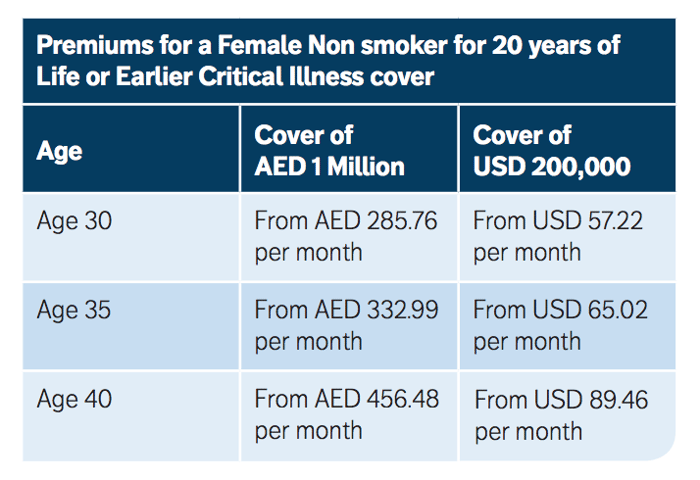

The following table shows the indicative premiums for life or earlier critical illness cover for different ages and sum assured;(Source - FPI International)

Click here to arrange a meeting, to ascertain how much International Protector will cost you?

If you choose life cover only or a life cover with Total and Permanent Disability, your premiums are guaranteed not to change for the entire duration of the policy.

If you choose Life cover or earlier Critical Illness Cover, or Critical Illness Cover only then your premiums are guaranteed for 5 years and are reviewed for every 5 years thereafter.

Click here to know how and when your premiums will be reviewed.

| Particulars | Minimum | Maximum |

| Age at entry for Life cover | 18 | 64 |

| Age at entry for Critical Illness Cover | 18 | 59 |

| Age at Maturity for Life cover | NA | 80 |

| Age at Maturity for Critical Illness Cover | NA | 70 |

| Sum Assured Dollars | USD 17,500 | USD 10,000,000 |

| Sum Assured Pounds | GBP 10,000 | GBP 5,650,000 |

| Sum Assured EUROs | EUR 15,000 | EUR 8,362,000 |

| Sum Assured Dirhams | AED 64,400 | AED 36,780,000 |

FPI international may not pay the claim if you do not answer all the questions, truthfully, accurately, and completely to the best of your knowledge, at the time of application and when making a claim.

If you fail to disclose the following, at the time of application;

| Sl. No | Benefits | Shortfalls |

| 1 | International Cover & Affordable premiums | The maximum age at Critical illness cover maturity is 70 |

| 2 | A wide scope of critical illness cover. It covers up to 35 critical illnesses | Premiums for plans with critical illness cover will be reviewed every 5 years, and can change. |

| 3 | Choice of 4 currencies including Dirhams | No Cash Surrender Value |

| 4 | Simple and hassle-free application and claim process | |

| 5 | Live support online and via call center, with a regional office in Dubai | |

| 6 | Guaranteed no change in premiums for life cover for the term of the plan. |

While there are a couple of shortfalls, the benefits overwhelm the shortfalls by large.

International Protector Middle East is an ideal term insurance plan, one among the most preferred plans by clients and widely recommended by Financial Advisers in UAE.

For more information on the International Protector Middle East and other Life Insurance in UAE contact Damodhar on +97150-2285405, or arrange a free initial meeting.

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

Zurich International is a leading international insurance and investment provider.

They serve...

Zurich International Life (ZIL) has recently launched an updated and enhanced version of Zurich...

Are you retired or approaching retirement?