Best Term Insurance in UAE (2026 Guide)

Advisor Insights, Pricing Benchmarks & Claim Realities

Most UAE expats overlook their most valuable asset: their income, the engine that funds everything else.

If your income stops, rent doesn’t pause, school fees don’t freeze, and banks don’t care. Term life insurance keeps your family funded when you no longer can.

After advising 500+ UAE families over the past 14 years, I’ve seen what happens when people get this wrong:

wrong currency, wrong jurisdiction, wrong riders, delayed claims, or no claims at all in worst cases.

This is a reality check guide to the Best Term Insurance in UAE, not a brochure.

Why Term Life Insurance Matters in the UAE?

Most high-income expats don’t need a masterclass on life insurance, they need the math and clear action steps.

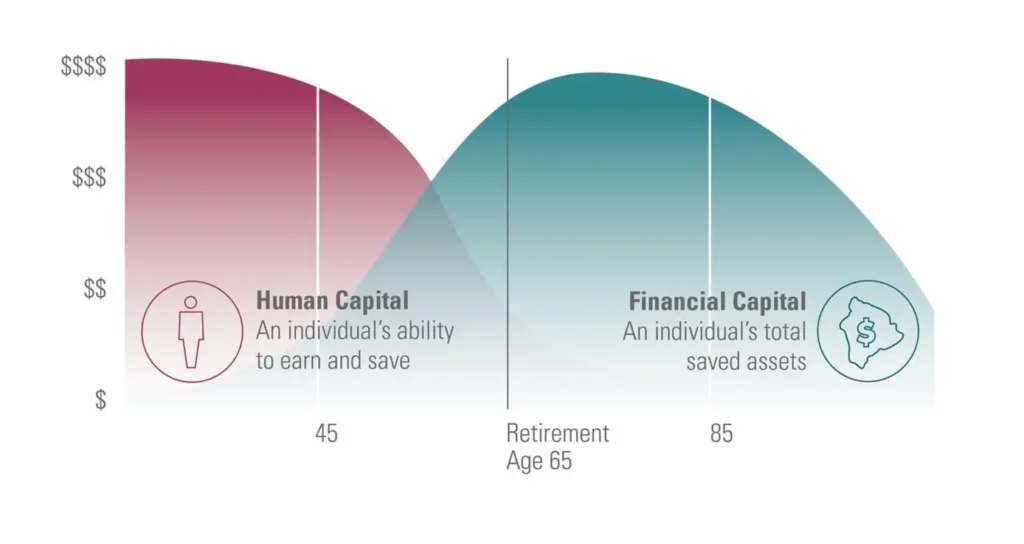

1. Human Capital Math

If you earn AED 600,000 per year, your future earning power over the next 10–15 years is worth:

AED 6 million – AED 9 million

That’s your real asset. Not your car, not your investments, not your property. It’s your ability to generate income.

Term insurance exists to ensure your family doesn’t lose that capital overnight, and it does so at a cost that’s a fraction of the value protected.

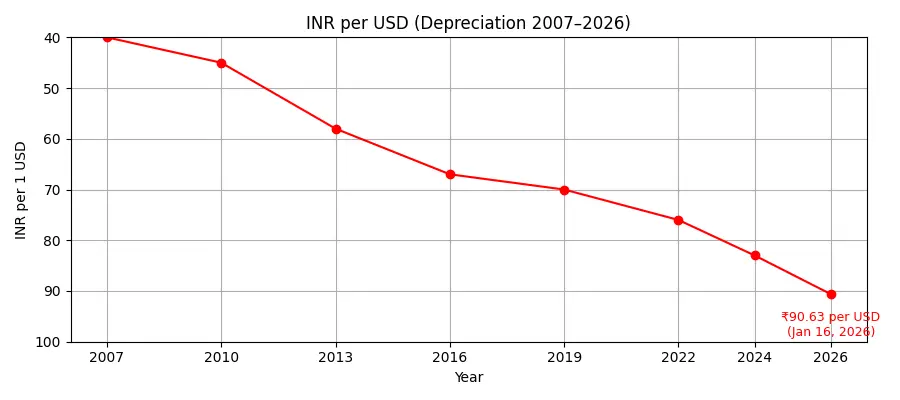

2. Currency Risk

NRIs buying INR-based plans ignore a critical fact:

INR loses 3–5% against AED/USD annually.

A ₹2 crore plan in India sounds big today — until it converts to ~AED 885K and loses value every year.

3. Residency Instability

Expats cannot live here forever.

Job change = visa change = country change.

Your insurance must follow you, not the other way around.

Premiums rise with age and insurability declines. Buying a new policy after relocation usually means paying more, getting exclusions, or not qualifying at all

4. Claim Logistics

Claims are fundamentally jurisdictional.

When the insurer is based in the UAE, you get a cleaner pathway:

local medical reports + local laws + local claim teams = faster, documented, traceable outcomes, even when the death or illness happens overseas. UAE insurers are built for expats, so international claim handling is part of their core infrastructure.

Didi you know?

Zurich Middle East paid out claims in 73 countries in the last 3 years with a 98% claim settlement ratio! – Source : Zurich – Customer claims report-2025

That’s what expat-aligned claims processing looks like.

Now compare that with the reverse scenario — trying to push a foreign insurer to process a claim that originated in the UAE. In practice, this often triggers jurisdiction conflicts, additional medical documentation requests, embassy/legal attestations, repatriation complications, and long processing times. India- or UK-based insurers were built around domestic claims, not expat mobility.

5. Education Inflation

School fees in the UAE and abroad consistently inflate at 6–8% per year, and university costs climb even faster. If you have school-age children, income replacement isn’t optional — it’s the only way to ensure their education plans don’t collapse if your income stops.

Most international education is paid in USD, GBP, EUR, or other hard currencies. Holding your life cover in USD through a UAE-issued international policy makes payout currency-aligned, easily repatriable, and insulated from INR depreciation, which is a real threat for NRI families funding overseas education.

Who Actually Needs Term Insurance in the UAE?

Not everyone — but if you fit any of these, you should not ignore this:

✔ Primary Breadwinners & Dual Income couples

✔ High-income professionals

✔ NRIs planning India exit

✔ Business owners & partners (Key Person + Shareholder protection)

✔ Mortgage holders

✔ Parents with school-age children

✔ Stay-at-home spouse

If your family’s lifestyle depends on your income, Life Insurance is non negotiable.

UAE vs India vs UK Term Plans (2026 Reality Check)

NRIs ask this all the time:

“Should I buy from India or UAE?”

Here’s the unfiltered comparison:UAE vs India Term Insurance — Practical Comparison (2026)

| Factor | UAE-Issued Plans | India-Issued Plans |

|---|---|---|

| Currency | USD / AED (stable) | INR (depreciates) |

| Claim Speed | Fast, local support | Slower, bureaucratic |

| CI Riders | Strong, global cover | Weak & lower cover amounts |

| Taxes | No GST / VAT | GST applies |

| Medicals | Local & simple | Painful for NRIs (testing + paperwork) |

| Repatriation | Straightforward | Complex |

| Residency Dependence | No (policy travels with you) | Yes (residency-dependent) |

Advisor Insight:

For long-term NRIs in the Gulf, UAE-issued international term plans are cleaner, faster, and currency-stable.

India-based plans many be cheaper upfront but lose value through INR depreciation and claim delays.

How Term Life Insurance Works (2026 Crash Course)

You’re not buying investment. You’re buying pure risk transfer.

Here’s what matters:

1. Level vs Decreasing Term

- Level term → same cover throughout (recommended)

- Decreasing term → used for mortgages and other loans

2. Smoker vs Non-Smoker Pricing

Nicotine detection is biochemical (cotinine test).

If you vape, you are a smoker — pricing can increase by 30 – 40%

3. Passive War & Terror Coverage

Relevant in this region.

Not all companies include it by default.

4. Riders Matter More Than Marketing

The riders that actually matter:

- Critical Illness (CI)

- Family Income Benefit

- Total Permanent Disability (TPD/PTD)

- Accidental Death (AD)

- Waiver of Premium

Underwriting Realities in the UAE (Advisor-Level Intelligence)

Insurance companies don’t advertise these realities, but these are crucial underwriting factors

- BMI over 28.5+ = potential premium loading

- Nicotine, vape, shisha = smoker pricing

- Aviation workers = special underwriting

- Oil & Gas + offshore sites = special underwriting

- Travel to sanctioned/conflict zones = exclusions apply

- Diabetes / Thyroid = rated premiums, medical tests

- Pre-existing disclosure = potential premium loading

Term Insurance Pricing in UAE (2026 Benchmarks)

Prices vary by age, smoker status, health, and term length. To give you directional clarity without turning this into a price-shopping exercise, here’s a realistic sample from a leading international insurance company operating in the UAE:

Sample 2026 Term Insurance Pricing Range—

USD 1,000,000 Level-Term Cover • Non-Smoker • UAE Resident

- Age 30: ~$77 – 90/month

- Age 35: ~$99–$115/month

- Age 40: ~$135–$175/month

- Age 45: ~$230–$300/month

Smoker premiums are typically 25 – 40% higher, and riders like Critical Illness (CI) and Total Permanent Disability (TPD) can increase premiums by 30–200% depending on age and underwriting class.

Advisor Insight:

Pricing differences between insurers can be 5–50%, and the cheapest premium is not always the smartest decision. Claim handling speed, international payout ability, passive war coverage, and currency matching matter as much as price — especially for expats.

Prices vary by age, smoker status, health, and term length.

Best Term Insurance Plans in UAE (2026 Advisor Review)

These are the top 5 plans worth considering — not an endorsement, just reality:

🥇 Zurich International Life — International Term Assurance (ITA)

Best For: Global portability, clean underwriting, digital onboarding

Strengths:

- Cover up to age 80

- 34 CI conditions (Optional Rider)

- Simple online application

- Good for NRIs & people looking to relocate to the USA / Europe / Worldwide

- Contingent beneficiary nomination possible

- Strong global claims history

Limitations:

- Max 35-year term

- Smoker rates can be high

- Limited partial disability riders

Advisor Insight : Best for non-smokers and globally mobile expats who value claim simplicity over rider complexity.

🥈 MetLife UAE — Live Life

Best For: Disability income + premium flexibility

Strengths:

- Level or decreasing cover

- Forever Plan rider (rare) = lifetime income if disabled

- Free second medical opinion

- Single, limited, or regular pay options

Limitations:

- Passive war rider must be added

- Max cover age: 85

Advisor Insight

Ideal for residents who want disability income + CI flexibility, not just death cover.

🥉 Friends Provident International — IPME

Best For: Younger Western expats & NRI + affordability

Strengths:

- Life-only / CI-only / Combined choices

- Premiums from $17.50/mo

- Access to Best Doctors® service

- Limited or regular pay options

Limitations:

- Paper-based onboarding

Advisor Insight

Good fit for British & European expats looking for low-cost, flexible cover.

🧩 Sukoon (Oman Insurance) — Lifeguard

Best For: Simple, affordable, no-nonsense protection

Strengths:

- Covers ages 1–80

- Riders: AD, TPD, 40 CI, Waiver, Hospital indemnity

- Single premium option

Limitations:

- Paper-based onboarding

Advisor Insight

Solid local option for residents seeking straightforward cover without complexity.

🕌 Salama — Hemaya Plus (Takaful Term)

Best For: Shariah-compliant family protection

Strengths:

- Cover up to age 100

- Family income benefit option

- Monthly–Annual payment modes

- CI + Accident riders

Limitations:

- CI limited to 50% of life cover

- Paper-based onboarding

Advisor Insight

Ideal for Muslim families seeking ethical, Takaful-based global protection.

How to Choose the Right Term Plan in UAE

Use this advisor framework:

1. Coverage Amount

Use 10–15× annual income as baseline.

2. Term Length

Until expected retirement age + 5-year cushion.

3. Riders

Non-negotiable riders for breadwinners, joint income families and home makers:

- CI (Critical Illness)

- TPD / PTD (Disability)

- Waiver of Premium

4. Claims

Check:

- claim ratios

- local claim support

Common Mistakes That Destroy Claims (2026 Edition)

Most claim problems don’t happen at the time of death or diagnosis — they happen years earlier during the application. These are the most common mistakes people make when dealing directly with insurers:

1. Incomplete Travel Disclosure

Frequent travel, future relocation plans, and trips to sanctioned or high-risk regions must be declared. For expats, travel patterns directly affect underwriting and claims.

2. Misrepresenting Lifestyle Habits

High-risk hobbies (diving, aviation, rock climbing), nicotine/vape use, and alcohol consumption are not “personal details” — they’re underwriting factors. Misrepresenting them creates claim conflicts later.

3. Omitting Family Medical History

Heart disease, cancer, stroke, and diabetes in immediate family matter. Not declaring family history doesn’t lower risk — it weakens the legal file used during claims assessment.

4. Hiding Pre-Existing Conditions

Hypertension, diabetes, thyroid disorders, and mental health conditions are not automatic exclusions — non-disclosure is. Most claim disputes originate from incomplete health disclosure, not from the condition itself.

5. Assuming Vaping/Shisha = Non-Smoker

Nicotine detection is biochemical. Cotinine tests classify vape, shisha, and heated tobacco users as smokers, and smoker rates are 2–3.5× higher. Misclassification here is one of the fastest ways to trigger a claim investigation.

6. Treating the Application Form Casually

Many people answer based on memory, skip details, or let someone else “fill it in.” The insurance application is a legal declaration. Errors here become legal grounds for delay or denial later.

7. Incomplete Documentation During Claims

Even legitimate claims get delayed when medical reports, travel records, death certificates, or employment details are incomplete. Insurers need documentation to verify cause, location, and circumstances — especially for expats.

Advisor Insight:

Claims are assessed against what was declared at underwriting. If the disclosure file and the reality don’t match, the insurer is legally obligated to investigate — which slows down or jeopardizes payouts. Clean files get paid faster.

Value of a Financial Advisor in the Insurance Buying Process

Most people assume insurance buying is about comparing premiums. It isn’t. The insurer sells a product, but what a family needs is a strategy.

Here’s the reality:

- Companies sell products — they don’t compare competitors.

- Aggregators sell price — they don’t explain claim obstacles.

- Banks sell products — they don’t advice

- Advisors build strategy — because your life is not a brochure.

So what does “strategy” actually mean in the insurance context?

A qualified advisor helps you:

✔ Match currency to dependents

Your family spends in USD, AED, GBP, or others — the policy payout must match that or inflation will eat it.

✔ Structure CI/TPD riders correctly

Disability is more common than death. Rider design matters more than most premiums.

✔ Manage underwriting positioning

Age, BMI, travel, occupation, vaping, family history — these determine cost and eligibility.

✔ Navigate medical & nicotine testing

Vape, shisha, or nicotine gum can reclassify you as a smoker and increase your premium.

✔ Avoid currency & INR depreciation traps

INR loses 3–5% annually. A ₹2 crore policy today won’t fund USD school fees tomorrow.

✔ Prevent jurisdictional claim delays

Claims are paid faster when jurisdiction, medical documentation, and insurer are aligned.

✔ Ensure passive war & aviation coverage

Not standard, and extremely relevant in the Middle East for certain expats and sectors.

✔ Review and scale cover as income grows

Your income, liabilities, dependents, and geography change — your policy needs to follow.

Final Thoughts — Protect Today, Secure Tomorrow

If you’re the primary breadwinner or a dual income couple, your family has two paths:

Path A:

You transfer financial risk to an insurance company for a few dollars a month.

Path B:

Your family absorbs the full financial impact when your income(s) stops.

One of those paths is reversible.

The other isn’t.

If You Want This Done Properly

If you want help with:

✔ Choosing the right plan & riders

✔ Matching currency correctly

✔ Structuring CI/TPD

✔ Optimizing underwriting

✔ Avoiding INR/claim traps

✔ Integrating into a financial plan

Then book a discovery call.

No pressure. No sales scripts. Just clarity.