Financial Advice for Couples in UAE: 5 must know Smart Money Rules

Fast forward 10, 15, or even 20 years from now.

Imagine, you are leaving the UAE for good, or maybe retiring here.

Will you look back knowing that the time you spent here helped you build real financial security and long-term wealth?

Or will you realize that despite earning well, much of that opportunity disappeared through lifestyle upgrades, delayed investing, and lack of structure?

After working with hundreds of expat families in the UAE, one pattern becomes very clear:

Couples who align their money decisions early tend to build far more wealth than those who operate independently.

The difference is rarely income or luck.

It’s structure, alignment and shared financial discipline.

Here are five pieces of financial advice for couples that can help turn good incomes into lasting wealth.

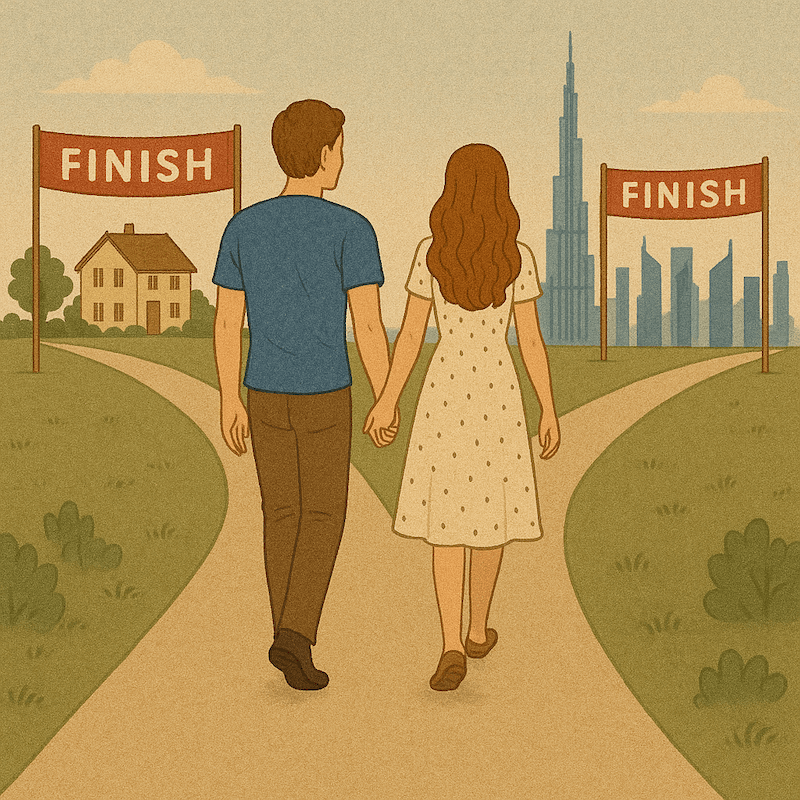

1. Define Your Financial Goals as a Couple

One of the most important foundations of wealth building is clarity.

Yet many couples never properly discuss their financial goals for the future.

You can start with asking your partner questions like:

- Where can we retire? When can we retire?

- What kind of lifestyle do we want in the future?

- How much money we need to retire?

- Where should we send our child(ren) for University?

Often the answers are surprisingly different.

One partner may imagine retiring in their home country surrounded by family.

The other may imagine retiring here in the UAE, traveling more, or starting a business later in life.

Without realizing it, many couples are walking toward different financial destinations.

This is why defining financial goals for couples is the first step in smart financial planning.

A simple habit that works well is a monthly “money conversation.”

Spend 30 minutes reviewing:

• income

• expenses

• investments

• progress toward shared goals

When couples make financial decisions together, they stay aligned and accountable.

Smart couples understand that building wealth is a shared project.

2. Protect Each Other First

Every financial plan assumes that income(s) will continue until retirement.

But life doesn’t always go as planned!

Illness, disability, or Death can interrupt income suddenly.

For expat families this risk is even greater because many people living in the UAE do not have:

• Social Security

• Employer Sponsored Pensions

• Guaranteed income replacement

This makes income protection a critical step in financial planning for couples.

Protection planning may include:

• life insurance

• critical illness cover

• disability or income protection

Life Insurance is about ensuring your partner and family are financially secure even if life changes unexpectedly.

Hope is not a strategy. Protection is.

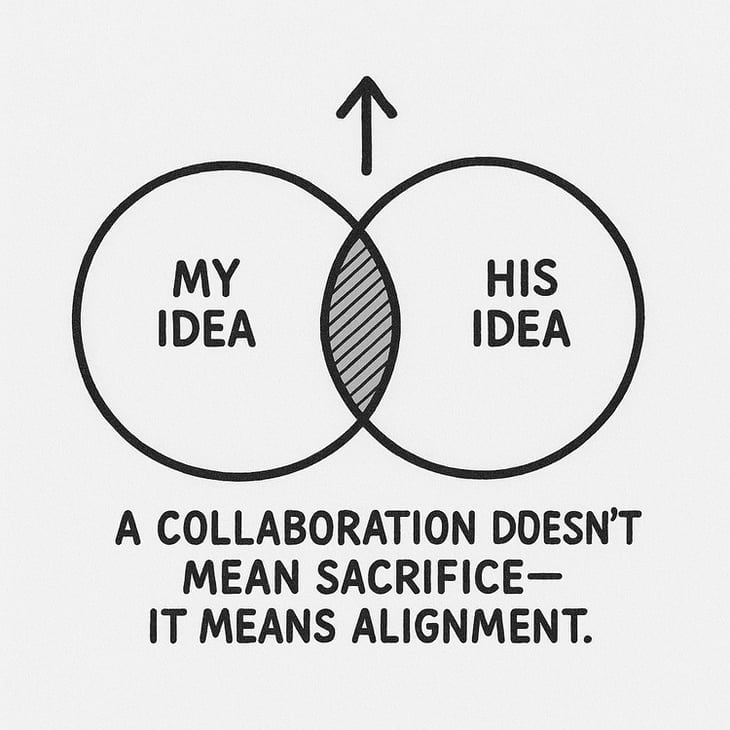

3. Unity in Diversity: Align Your Investing Styles

When it comes to investing, your styles might differ…

One of you may love the idea of owning property.

The other might lean toward mutual funds, stocks, or ETFs.

And that’s perfectly okay; as long as your strategies work together, not in conflict.

💡 Don’t discount your partner’s ideas.

Explore them. Evaluate the pros and cons together. Then decide what fits your shared future, not just individual preferences.

The goal is to invest with shared outcomes in mind, not just personal comfort zones.

Start by identifying what you’re investing for:

🏡 A house?

🎓 Children’s education?

⏳ Financial freedom before 50?

📥 A steady retirement income?

Then, apply the Bucket Strategy to structure your investments around these timelines:

- Bucket 1: Emergency Fund

At least 6 months of living expenses in cash or low-risk instruments. - Bucket 2: Medium-Term Goals (3–7 years)

For education, home down payment, or life upgrades. Use a mix of balanced mutual funds, bond funds, or capital-protected solutions. - Bucket 3: Long-Term Wealth (8+ years)

This is where real growth happens—equity mutual funds, ETFs, global funds, or alternatives, based on your combined risk appetite. - Bucket 4: Legacy & Generational Planning

Whole life insurance, income-generating real estate, or long-term trust-based investments to secure your family’s future.

💡 Prudent investing as a couple isn’t about who is right; it’s about what’s right for both of you.

How smart couples finish rich?

When your investment styles are aligned with your shared timelines, life goals, and risk comfort as a couple, you build wealth faster and with far fewer arguments.

This is how smart couples finish rich; not through speculation, but through disciplined and structured investing.

This is also where the guidance of a professional financial advisor becomes invaluable.

A good advisor acts as a neutral sounding board—

✅ Helping you evaluate both perspectives

✅ Translating personal preferences into practical strategies

✅ And structuring your investments so they serve both individual and collective goals

Think of it this way: You bring the vision, your partner brings the energy; and your advisor brings the strategy that makes it work.

4. Prepare for Life’s Interruptions

Financial plans often focus on milestones:

- Buying a home.

- Funding education.

- Retirement planning.

But life rarely follows a straight path.

Many couples experience unexpected interruptions such as:

• career breaks

• maternity or childcare pauses

• relocation to another country

• job loss or industry changes

Without preparation, these interruptions can slow financial progress.

This is why couples should maintain:

• an emergency fund of 6–12 months of expenses

• flexible investment structures

• assets that remain portable across countries

Financial flexibility allows couples to adapt to change without derailing long-term plans.

5. Automate Wealth Creation

One of the biggest advantages couples living in the UAE have is the opportunity to save more than what is possible in many other countries .

Many couples benefit from:

• two incomes

• No Income tax

• Relatively higher salaries

But without a system, rising income often leads to lifestyle inflation instead of wealth creation.

This is where automation becomes powerful.

By setting up monthly investments into a structured portfolio, couples can remove emotion from investing and benefit from long-term compounding.

Automation provides three powerful advantages:

Dollar-Cost Averaging

Investing regularly helps reduce the risk of entering markets at the wrong time.

Compounding

Returns generate additional returns over time, turning consistent investments into substantial wealth.

Tax Efficiency

Unlike many countries, the UAE does not tax capital gains or dividends for individuals, allowing investments to grow without annual tax drag.

💡 Consistency beats intensity. Always.

Big one-off investments feel good—but small, regular ones done automatically? They actually work better in the long run.

If you and your partner want to make your time in the UAE truly count; automate your way to finaincial freedom.

Let your lifestyle follow your plan; not the other way around.

Financial Tips for Newly Married Couple

If you are newly married or recently starting your financial journey together, a few simple habits can make a huge difference.

Some of the most practical tips for newly married couples include:

Create a Simple Bank Account Structure

One practical approach is to maintain four bank accounts:

• One current account for each partner for personal spending

• One joint current account for household expenses

• One joint savings account for emergency funds and long-term goals

Both partners contribute to the joint account for shared expenses such as rent, groceries, utilities, and travel.

If you prefer keeping finances more separate, maintain:

• individual accounts for personal income and savings

• one joint current account only for shared expenses

The key objective is clarity. Each dirham should have a defined purpose.

- Start investing early, even with small amounts

- Maintain a shared emergency fund

- Avoid unnecessary lifestyle inflation

- Review your protection planning early

- Set clear financial goals for the future

Couples who build strong financial habits early often find that wealth accumulates naturally over time.

Final Thought

Many couples working in the UAE earn well.

But income alone does not create financial freedom.

Couples who build wealth successfully usually follow the same pattern:

They define shared financial goals.

They protect their income.

They invest strategically.

They prepare for uncertainty.

And they automate wealth creation.

The result is not just financial security.

It is freedom of choice later in life.

Want to See What This Could Look Like for You?

I recently worked with an expat couple whose financial plan showed how they could double their net worth in just six years, simply by structuring their investments properly and staying consistent.

No speculation.

No high-risk bets.

Just disciplined wealth building aligned with their goals.

If you’d like to explore what a structured financial plan could look like for you and your partner: