What is inflation, why is it bad, how it impacts you & your investments?

Inflation in Dubai, Inflation

Imagine going to the supermarket with a cartload of money and still not being able to fill your shopping trolley!

This is precisely what happened in Zimbabwe, Germany, Greece, Hungary, Venezuela, Argentina, and a few other countries in the past.

.jpeg?width=700&name=Hyperinflation%20(1).jpeg) Source: Multiple websites - Google Images

Source: Multiple websites - Google Images

We have seen prices of goods and services rising rapidly in the last few months. Initially, everyone, including central banks, ignored the inflation, thinking it was transitionary.

Now, It has taken an ugly form, and central banks are scrambling to contain inflation before it becomes out of control and eventually Hyperinflation.

What is inflation, and why is it bad?

Inflation is the least understood and the most potential financial risk.

It is a measure of an increase in the prices of goods and services.

So when you have to spend more money to buy the same amount and quality of goods and services, the purchasing power of money decreases.

This means you will have to earn more to keep up the same standard of living or compromise on your lifestyle.

Sometimes it is possible to earn more as wages and salaries could increase with inflation, but sometimes they don't.

If they don't, you may have to compromise your lifestyle and cut down on your expenses, savings, and investment.

Like you, millions of people would cut down on their lifestyle, savings, and expenses. This will hurt the sales, revenue, and profits of companies. So now they will start cutting down on production, workforce, and expansion plans.

Now it becomes a vicious cycle, which can move very quickly and spread over the whole world as many economies are interdependent, triggering a global recession.

On the other hand, if the wages and salaries increase with inflation, you will not feel the need to cut down on expenses, so you maintain your lifestyle and purchases.

But the companies cannot afford to pay higher wages and salaries without further increasing the prices of goods and services. When

This triggers an upward spiral in prices and further deterioration of the purchasing power of money.

If left unchecked through efficient monetary and fiscal policies, this could lead to above-average or even Hyperinflation. Like what is happening now in Srilanka and what happened in the past in Zimbabwe, Germany, etc.,

Srilanka Inflation Chart

source: tradingeconomics.com

Source: trading economics: https://tradingeconomics.com/sri-lanka/inflation-cpi

In either case, inflation will significantly impact retired people who live on the returns generated from their investments, which cannot keep up with inflation.

How do Central Banks control inflation?

As we all know, the money we use is literally created out of nothing, and its value exists because central banks and governments worldwide say so.

This system of money is called the Fiat currency. It retains its value through

- The stability of a government

- The strength of a nation's economy

- Liquidity in the market

- And the level of acceptance of a currency by other countries in exchange for goods and services

Central banks aim to maintain the strength of the economy and the value of the money through their Fiscal and monetary policies.

The fiscal policy is using government spending, taxation, and borrowing to expand or contract economic activity and money flow in a country or region.

Monetary policy is adjusting the supply of money in the economy to accomplish moderate inflation and stable growth in economic activity.

It involves injecting or withdrawing money and increasing or decreasing borrowing rates.

When the economic activity is low, and a recession is looming, the governments increase spending, reduce taxes and interest rates and inject more money into the economy through increased government spending, and, quantitative easing.

This is precisely what central banks did at the advent of the Covid-19 crisis to promote economic activity and avoid a recession. As a result, the money supply was abundant, and people were more confident while spending and investing in stock markets. Also, because interest rates were low, people preferred investing and even speculating in the stock markets and cryptocurrency instead of saving.

However, supply chain bottlenecks and impaired production pushed prices up quickly.

And then came the Russian invasion of Ukraine, further exacerbating energy and commodity prices, pushing inflation higher and higher!

Now central banks have no other choice expect limiting the supply of money in the economy through stringent fiscal and monetary policies.

With a limited supply of money and higher borrowing costs, people, companies, and countries will have to pay more interest on their loans. Banks will be more selective in lending and people and institutions will be more content saving than spending and investing.

But, a stringent monetary policy is like Chemotherapy and radiation, while it can contain inflation, it also erodes consumer confidence and economic activity, potentially leading to a recession.

How does this impact your investments?

Stock market investors dread the word recession and they scramble to sell their holdings to book profits or to cut losses. Sustained selling pressure in anticipation of a recession is what we are seeing in the markets now.

If you are a short-term investor or if your goal is due shortly, then you may also want to book profits or cut losses to get your money out.

But, if you are a long-term investor, you need not worry so much, because this is a phase of the economic cycle. The Government and Central bank's policies will become neutral if they achieve their desired inflation objectives. They could also become accommodative if they believe that the economy has contracted more than necessary. This will again trigger expansion in the economy and stock markets.

However, now is also the right time to rebalance your portfolio and buy more to lower your average holding costs.

For those who are sitting on the sidelines, now is the best time to grab great companies at a deep discount.

Just remember. When in doubt Zoom Out...

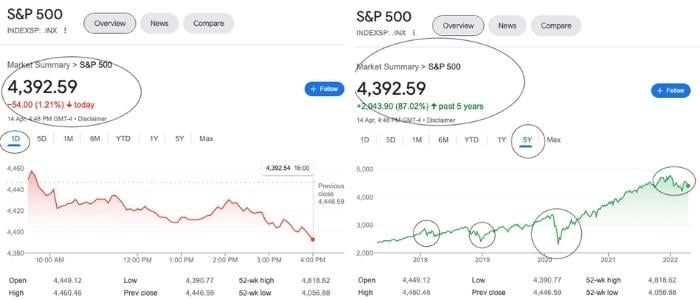

These are two different charts of the S&P 500 index as of today. But they paint a totally different picture.

So when in doubt Zoom Out...

Expert Help

Are you holding back on your investment, fearing a market correction or recession?

Or are you unsure how to invest for your retirement or other important financial goals?

I can help...

Click here to schedule a free online meeting to help you build a financial plan and a robust investment strategy.

You can also get a free second opinion of your investment portfolio, to help you review and rebalance it.

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

%20(1).png?width=300&name=financial%20decisions%20based%20on%20facts%20or%20opinion%20(350%20%C3%97%20250%20px)%20(1).png)