Inflation in Dubai, Inflation

What is inflation, why is it bad, how it impacts you & your investments?

Imagine going to the supermarket with a cartload of money and still not being able to fill your...

In this article:

Riders are optional add-ons that can be added to your life insurance policy. They help you to customize your policy to provide living benefits and additional features not covered by the basic life insurance.

They are like toppings of a Pizza, adding different flavors and texture to the meal.

Critical Illness Benefit, Accidental Death Benefit, and Cancer Cover are some examples of Riders.

A living benefit paid out as a cash lump sum in the unfortunate event of diagnosis of a major illness covered by the policy. Futura covers 35 critical illnesses with an add-on of Children's critical illness.

It includes all major illnesses like Heart Attack, Cancer, Loss of Speech, Loss of Eyesight / Hearing, Major organ failure, etc. Most of these benefits cover for the whole Life.

It also includes a handy benefit called "Loss of Independent Existence". This benefit widens the scope of critical illness benefits by large. It is a state when a person cannot perform activities of daily living on their own due to an illness or an accident.

Retirement Planning by no means is an easy task, especially when the probability of a major ailment is high after age 60. Adding the critical illness benefit to your policy can make your retirement plan relatively more straightforward and dependable.

In the unfortunate event of a diagnosis of a major ailment during retirement, your policy would pay out a cash lump sum to help you manage the medical expenses without having to dip into your retirement savings.

Click here to learn more about the Critical Illness Benefit of Zurich Futura.

Cancer coverage can be a relief for those who cannot get more comprehensive critical illness coverage due to an existing health condition.

Including this rider to your policy can cover;

Click here to download the cancer cover guide of Zurich Futura.

Fixed-term income benefit is designed to replace your income on death before age 70. It makes regular payments for a period selected to your nominees over and above the life cover.

The life cover can be used for large expenses like paying off a mortgage, buying a property, or keeping it aside for children's higher education/Marriage, etc.. The regular payments can be a dependable source of income for managing the living expenses.

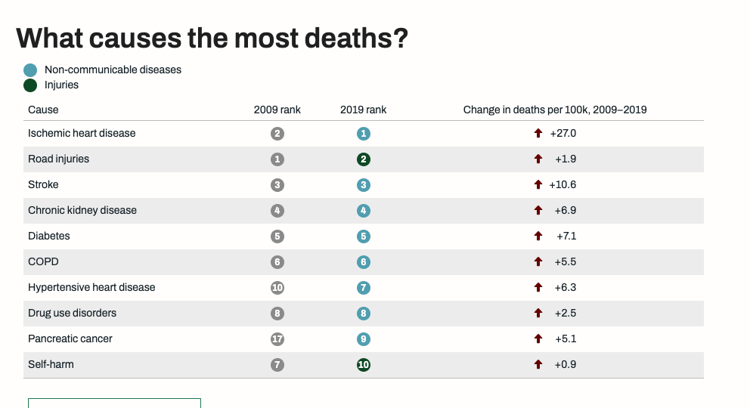

According to The Institute for Health Metrics and Evaluation (IHME), Road Accidents are the second major cause of death in the UAE.

Source: http://www.healthdata.org/united-arab-emirates

Source: http://www.healthdata.org/united-arab-emirates

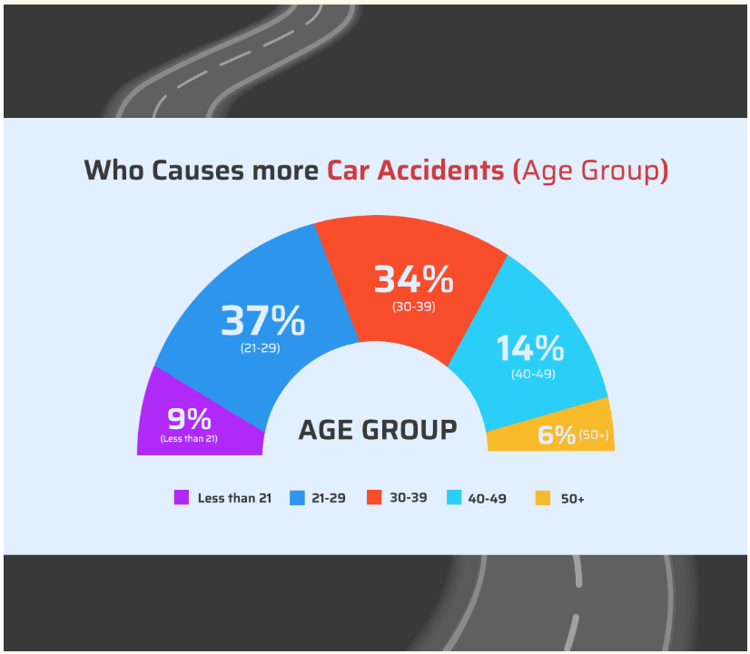

If you work in potentially hazardous conditions (with heavy machinery, working at heights, offshore, or underground) or drive more than average (either for work or for personal reasons), you should consider adding the accidental death benefit to your policy.

Source: https://www.pitstoparabia.com/en/news/infographic-on-uae-road-accidents

The accidental death benefit is generally inexpensive and can be easily added to your policy without any additional medical tests or a lengthy underwriting procedure.

It is paid in addition to the life cover If the life insured dies as a result of an accident or dies up to 30 days after an accident due to any injuries sustained.

The Dismemberment benefit pays a lump sum if the life insured loses his limbs or sight in an accident.

Zurich will pay the dismemberment benefit as follows;

| 100% of dismemberment sum insured For loss of: | 50% of dismemberment sum insured for loss of: |

| Both Hands | One hand |

| Both Feet | One foot |

| Sight of Both Eyes | Sight of one eye |

| One hand and one foot | |

| One foot and sight of one eye | |

| One hand and sight of one eye |

This benefit can be very useful to professionals like Chefs, Surgeons, Pilots, Technicians, Drivers, heavy machinery operators, Teachers, Health Coaches, etc...

The other riders less commonly used on Futura are as follows;

Permanent and total disability benefit

Waiver of premium benefit

Family income benefit

Hospitalization benefit

Riders are a great solution to increase the scope of your insurance coverage without having to buy a new policy. Most of the riders on Futura are Living Benefits, which are paid before the death of the insured. The following are some of the benefits of Riders;

We all have unique financial and personal situations, and hence, our protection needs are diverse. The riders can be tailored to meet your specific needs and budget. The easiest and most dependable way to ascertain the best riders for your Futura is to speak with an Independent Financial Advisor about your protection needs.

They can explain to you in detail the scope and limitations of each rider and the additional cost you will have to pay to add the specific rider. Weigh the cost vs. benefits to enhance the benefits of your Futura and choose accordingly.

You can also arrange a Free Consultation with me to help you customize your Futura to suit your personal situation and protection needs.

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

Imagine going to the supermarket with a cartload of money and still not being able to fill your...

-2.png?width=300&name=Day%2014%20-%20Will%20in%20Time%20(350%20%C3%97%20250%20px)-2.png)

%20(1).png?width=300&name=financial%20decisions%20based%20on%20facts%20or%20opinion%20(350%20%C3%97%20250%20px)%20(1).png)

Making well-informed decisions is crucial for financial success and well-being. However, knowing...