The Vanguard Story: A Revolution in Investing

On May 1, 1975, John C. Bogle launched Vanguard Mutual Funds with a mission to help investors build long-term wealth at minimal costs. Unlike traditional investment firms, Vanguard was structured as a mutual company, meaning investors who own Vanguard funds also own the company itself.

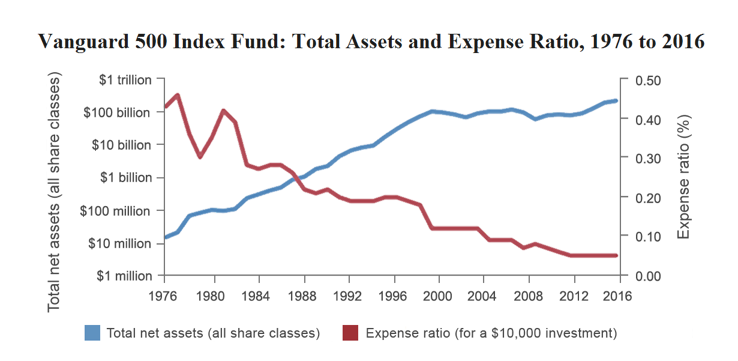

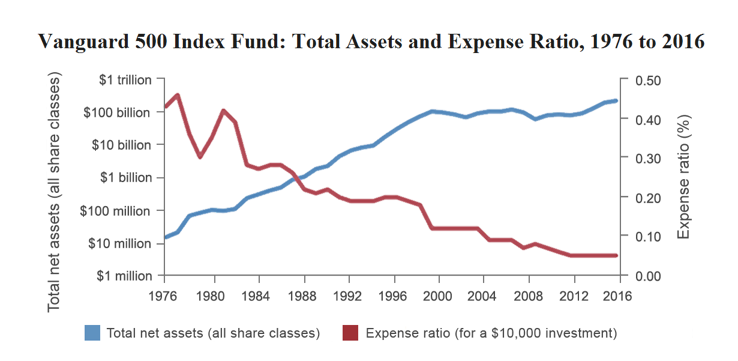

This unique model allowed Vanguard to eliminate conflicts of interest, reduce fees, and pass on maximum returns to investors. In 1976, Vanguard introduced the world’s first index fund for retail investors, the Vanguard 500 Index Fund, which tracked the S&P 500.

Initially dismissed as "Bogle’s Folly," index investing is now the foundation of many portfolios worldwide, with Vanguard leading the charge.

Why Vanguard Index Funds Are Popular Among UAE Investors

As of May 31, 2024, Vanguard manages $9.3 trillion in assets across 170 countries, making it a global leader in low-cost investing. UAE investors are increasingly drawn to Vanguard’s index funds and ETFs due to:

✅ Low Expense Ratios – Some of the lowest fees in the industry

✅ Diversification – Exposure to global markets

✅ Transparency & Trust – Investor-owned structure

✅ Long-Term Growth – Passive investing beats active trading over time

John Bogle’s Investment Strategy: The Foundation of Smart Investing

John Bogle’s investment philosophy is simple:

“Don’t look for the needle in the haystack. Just buy the haystack!”

His approach to investing centers around long-term wealth creation using broad-market, low-cost index funds. By minimizing costs and staying invested, investors can compound their wealth efficiently over time.

How to Invest in Vanguard Index Funds from UAE?

UAE residents can invest in Vanguard funds through various platforms and investment plans:

1. Investment Platforms

These platforms allow direct access to Vanguard ETFs and index funds:

💡 Invest $100K+ with a Bespoke, Expert-Managed Portfolio 💡

Get exclusive access to Vanguard index funds & ETFs with a tailored portfolio designed for long-term growth.

✔ Custom-built investment strategy

✔ Ongoing portfolio management & rebalancing

✔ Global diversification at ultra-low costs

👉 Book a Consultation to start investing smarter today!

2. Investment Plans offering Vanguard Funds

For those preferring structured investment plans, the following options provide access to Vanguard and other leading funds:

As an Independent Financial Advisor, I can help you structure a cost-effective investment portfolio using Vanguard’s index funds and ETFs to align with your financial goals.

👉 Book a Free Consultation Today to start investing and growing your wealth in the UAE.

8 Rules of Investing Like John Bogle

To truly invest like John Bogle, follow these eight timeless rules:

1️⃣ Invest for the Long Term

- Wealth is built over decades, not days.

- Stay committed and avoid market noise.

2️⃣ Keep Costs Low

- Expense ratios matter – they eat into returns.

- Choose low-cost index funds & ETFs to maximize profits.

3️⃣ Avoid Market Timing

- Even professionals fail at predicting the market.

- Time in the market beats timing the market.

4️⃣ Diversify Broadly

- A single stock is high risk; an index fund provides natural diversification.

- Consider S&P 500, Total Market Index, and global ETFs.

5️⃣ Stick to Simple Strategies

- Buy and hold beats speculative trading.

- A passive investment approach yields better results over time.

6️⃣ Minimize Taxes & Fees

- Consider tax-efficient funds and long-term investments.

- Avoid frequent buying and selling.

7️⃣ Ignore Market Hype

- The media loves sensational headlines.

- Don’t react emotionally to market swings.

8️⃣ Stay Disciplined

- Investing requires patience and discipline.

- Stick to a solid investment plan through bull and bear markets.

Final Thoughts: Start Investing in Vanguard Index Funds Today

Vanguard has revolutionized investing by making low-cost, passive investment strategies accessible to everyone. Whether you're new to investing or looking to optimize your portfolio, Vanguard index funds offer a proven path to long-term wealth.

If you’re ready to start investing in Vanguard index funds from the UAE, let’s build a smart, cost-efficient investment plan tailored to your goals.

Click here to book a Discovery Call

-2.png?width=300&name=Best%20investment%20options%20in%20UAE.%20(350%20%C3%97%20250%20px)-2.png)