Financial Planning, Zurich Insurance

Zurich Insurance Dubai - Life, Savings & Investment Solutions.

Zurich International is a leading international insurance and investment provider.

They serve...

Protecting our portfolio against market volatility is a tricky task, albeit a necessary one given the rocky journey we have ahead.

Gold would usually be the best option given its longstanding role as a protection against market drops: but even this has recently lost its reliability, as since we’re seeing dropping bullion prices even as markets go downwards. That’s why we need a new buddy for the next market bloodbath, and we believe we’ve got the answer for you.

Introducing the Volatility Index (VIX).

The VIX is known as the market’s “fear gauge”: in other words, it indicates when investors expect a fair amount of volatility and how intense the market swings might be. This makes its price move opposite to the market: if stocks fall, fear generally rises, and that’s why the VIX will usually go upwards instead.

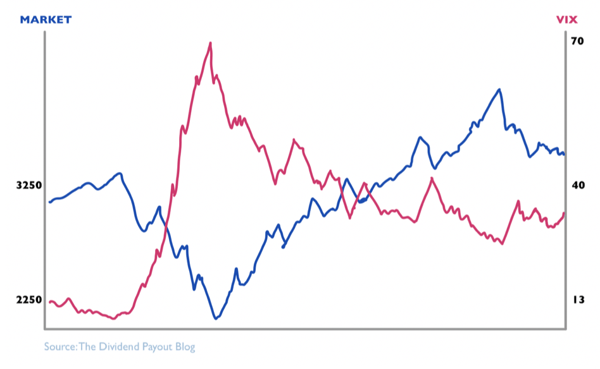

Figure 1: VIX vs Market (S&P500) Performance in 2020

The unique selling point of this asset relative to the cadre of other investments we can choose is that it clearly protects us from market drops, and sometimes even allows us to profit. Figure 1 depicts how markets dropped ~35% in March while the VIX skyrocketed over 600%: meaning that if you had $500 in stocks and only $100 in the VIX, your profit from the latter would cover any losses in the former.

The lethal interplay of the VIX as described above may be well worth looking into, as a few key indicators suggest we should load up on the volatility index now.

Tiger 21, an elite club of investors with over $100 million in assets each, have said that a majority of their members are lying in wait: hoarding cash to pounce on opportunities AFTER another market crash.

“This rise in cash is an extraordinary change -- statistically, this is the largest, fastest change in asset allocation Tiger 21 has seen. n trying to build resources prudently, members have gained liquidity (money) and will not immediately reinvest to keep and build cash to weather this storm.”-Michael Sonnenfeldt, chairman of the club.

UBS Wealth Management has backed Tiger 21’s sentiment in saying that “ultra-rich” clients have been saving cash for two key reasons:

Both sources suggest that the wealthiest 5% of investors are incredibly cautious going into 2020Q4 and foresee a tumultuous next few weeks: the first indication that the VIX is set to have an exciting path forward.

The VIX has historically enjoyed a massive uptick in the weeks preceding a presidential election, with the narrative this year seems even more potent.

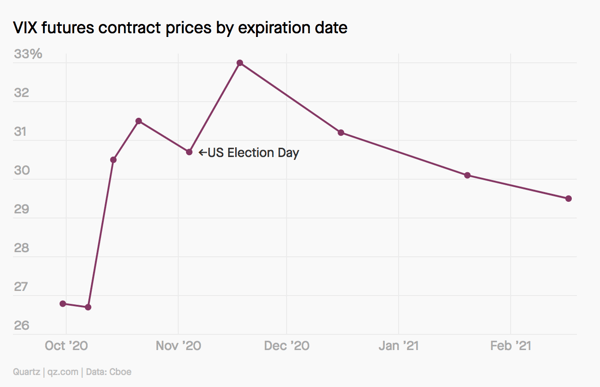

Figure 2: The forecasted path of VIX prices (green arrow)

Figure 2 shows an immense roil upwards from the beginning of October until post-election day: the result of several factors including coronavirus cases creeping upwards and Trump “all but promising to dispute the results” if he loses the election. These factors subsumed together suggest a high degree of uncertainty from now on: creating a paradigm for the VIX to freely move upwards without any real downward pressure.

Such strong fundamentals provide investors with a lucrative opportunity to buy protection at a relatively low price now: although caution must be asserted to the length of a VIX investment. This trade-only holds merit if the investing environment is uncertain: in other words, hold this asset through the election and potentially a little while after, but indeed, exit once the market begins to recoup a sense of normalcy.

There is little doubt that the next few weeks will incur volatile trading: even more so as markets now closely watch the caveats of President Trump’s health.

The dividend payout here - so to speak - will come from positioning your portfolio to profit in any scenario: whether the market continues upwards or plummets downward.

“My analytical side tells me that markets’ recent muddled moves could signal greater [volatility coming soon], and that may prove problematic this time around.”- Mohamed El-Erian, Chief Economic Advisor to Allianz and President of Queen’s College, Cambridge.

Given wealthy investors’ views on the VIX and its history of profiting in pre-election downfalls, what better way to counter this “problematic” volatility than with the eponymous index itself?

Saahil Menon is an undergraduate student at the London School of Economics and chief content writer of his blog, The Dividend Payout. Through his financial columns - featured on his website, Gulf News and various other outlets - he aims to simplify finance for teenagers and encourage them to begin investing during their youth. His internship experience with the Abu Dhabi government and Lazard’s investment banking division has also expanded the scope of his articles: allowing both a local and global perspective on current market affairs.

Zurich International is a leading international insurance and investment provider.

They serve...

Critical Illness Insurance-Real Stories That Prove Its Value

When it comes to NRI insurance and investment, many...