How to Retire in Dubai / Abu Dhabi? – A Practical Guide.

Want to Retire in Dubai?

Yes, it is absolutely possible, if you start planning well in advance.

Dubai, Abu Dhabi, and Ras Al Khaimah are increasingly becoming preferred retirement destinations for both long-term residents and new expats in the UAE.

Long-term residency options such as the Golden Visa and the 5-Year Retirement Visa have strengthened the case for retiring here. At the same time, continued improvements in healthcare and medical insurance are making retirement in the UAE more secure and predictable.

For those who plan early and structure their finances with intention, retiring in the UAE is no longer a distant dream, it is a realistic and increasingly attractive option. Yet, while many aspire to retire here, only a small number are actually on track for a truly comfortable retirement.

The Retirement Dream vs. Reality

A 2024/25 Zurich International Life–YouGov survey (Khaleej Times) revealed a striking truth:

- 7 out of 10 UAE residents want to retire here.

- But 61% admit they have little or no savings.

That’s not just a gap. It is a serious mismatch between dreams and reality.

How Much Does Retirement Cost in Dubai?

One of the most common questions expats ask is deceptively simple:

How much do I need every month to retire in Dubai/UAE?

The answer depends on your desired lifestyle, housing, and healthcare, and most people underestimate how much they need.

For a comfortable, middle-to-upper-middle lifestyle in Dubai or Abu Dhabi, typical monthly retirement expenses for a couple can look like this:

- Housing (owned, maintenance + service charges): AED 2,000–7,000

- Housing (If Rented): AED 5,000–15,000

- Utilities, internet, mobile: AED 800–1,200

- Domestic Help: 600-2500

- Food & groceries: AED 2,000–4,500

- Transport & fuel: AED 1,000–1,500

- Healthcare & insurance: AED 1,500–3,000

- Leisure, travel, contingencies: AED 2,000–4,000

That puts realistic retirement costs in Dubai at AED 10,000–25,000 per month as of today and before inflation.

And this is the part most people miss:

Retirement costs don’t stay flat.

They rise quietly every year, especially healthcare and living expenses.

This is why retirement planning cannot rely on today’s numbers alone.

Why Most Expats Aren’t Yet Ready to Retire in the UAE

The survey highlighted a clear pattern:

- 65% rely on gratuity or workplace savings, but overestimate how long that money can last.

- Only 4% invest in real retirement plans.

- Investments are heavily concentrated in gold (50%) and real estate (47%).

- 73% want to retire between 50–65 — but very few have an actual roadmap.

This isn’t an income problem. It’s a planning problem.

As a financial advisor, I meet expats every week who believe their gratuity, a property back home, and maybe some fixed deposits will be enough. Most are shocked when we run the numbers.

The Gratuity Myth

Gratuity feels like a cushion, but it’s not a pension. It’s a one-time payout. Retirement, however, can last 25–30 years or more.

💡 “Relying only on gratuity is like trying to fuel a lifetime journey with a single tank of petrol.” – Ashika Tailor

For example:

- If your basic salary is AED 20,000, your gratuity after 20 years might be around AED 400,000–500,000.

- At a safe withdrawal rate, that’s just AED 1,500 per month — nowhere near UAE living costs.

The reality: gratuity is a nice supplement, but not a retirement plan.

👉 See what consistent investing can realistically generate over time.

Is AED 5 Million Really Enough to Retire in Dubai or Abu Dhabi?

A recent survey revealed a common belief: AED 5 million is enough for retirement in the UAE.

Spread over 25 years, AED 5 million works out to roughly AED 16,600 per month — before inflation, healthcare costs, and lifestyle changes. Many residents also believe AED 2 million is enough, which is about AED 6,600 per month — barely covering rent in Dubai.

Reality check: Retirement isn’t about how much money you have on day one, it’s about whether your income can last for 30+ years without running out.

👉 See how inflation impacts your retirement income over 25–30 years.

How Much Retirement Corpus You Need?

How much retirement corpus you need depends on several key factors like:

- Inflation over time

- Your tax residency or residencies

- Healthcare shocks and rising medical costs

- Increasing life expectancy

- Market risks

- Lifestyle changes during retirement

As a starting reference, many financial planners recommend 25–30 times your annual expenses to estimate a retirement corpus. This provides a useful baseline, but it should be treated as a guideline, not a guarantee.

👉 Book a discovery call to calculate the retirement corpus you actually need — based on your goals, timelines, and where you plan to live.

Property in UAE : The Foundation of Retirement

For expats, owning property in Dubai or Abu Dhabi is more than a financial asset , it’s the cornerstone of retirement security.

A Roof Over Your Head

Renting in retirement means uncertainty: rising costs, possible relocations, and the risk of being priced out of your community. Owning your home means certainty.

It gives you stability, freedom, and the peace of mind that no matter what happens to rents or markets, you will always have a place to call your own.

A Pathway to Residency

Property ownership isn’t just emotional security, it’s legal security as well. UAE retirement visas are tied to assets, and property is the most straightforward route:

- 5-Year Retirement Visa: Requires property worth AED 1M+.

- Golden Visa: Unlocks at AED 2M+.

The Emotional Anchor

After years of moving between countries for work, many expats long for one thing: a permanent base. A property in Dubai or Abu Dhabi offers exactly that. It’s not just bricks and mortar, it’s the emotional anchor of your retirement years. A home away from home.

UAE Retirement Visa Options

If you plan to retire in Dubai or Abu Dhabi, long-term residency is a critical part of the equation. Today, most retirees qualify through one of the two pathways below.

- Typically for expats aged 55+

- Meet at least one condition:

- Property value of around AED 1M+

- Savings of around AED 1M

- Monthly income of AED 20,000+

- Renewable if criteria remain valid

Best suited for retirees with stable assets or income.

- Long-term residency (typically 10 years)

- Commonly linked to property investment of AED 2M+

- Also available through other categories (business / talent)

- Renewable with family sponsorship benefits

Best suited for investors and long-term residents seeking flexibility.

Important: Visa eligibility solves residency — not retirement. Your income plan still needs to fund 30+ years of living in the UAE.

Benefits of Retiring in the UAE

- Tax-Free Income: No tax on pensions or investment returns.

- Healthcare: Access to world-class medical facilities.

- Lifestyle: Safety, global connectivity, and vibrant communities in Dubai & Abu Dhabi.

- Family Residency: Retirement visas allow dependents to join.

The Truth About Retirement in the UAE

Without a plan, retirement becomes a struggle. With the right plan, it becomes your longest holiday.

The key is to:

- Calculate your retirement needs.

- Build a diversified portfolio that grows faster than inflation.

- Align your finances with UAE retirement visa requirements.

- Secure a property that gives you both a home and residency stability.

3 Steps to Retire in the UAE

1️⃣ Secure Your Roof

Buy property in Dubai or Abu Dhabi to guarantee both a home and visa eligibility.

2️⃣ Build Your Income

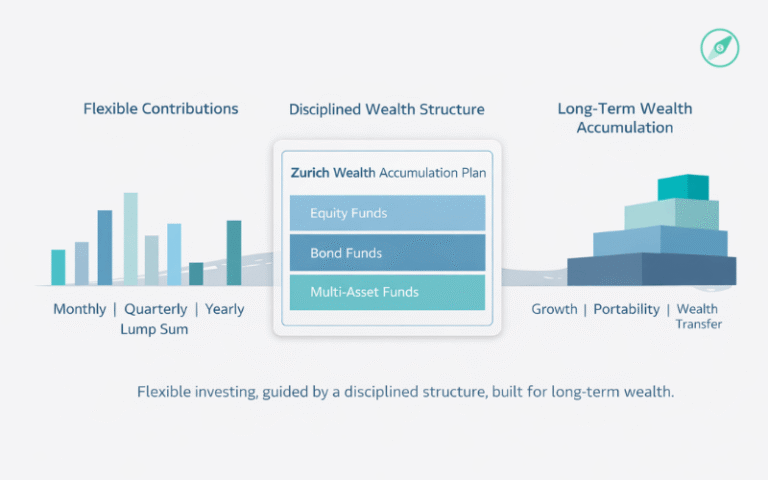

Diversify into investments that grow faster than inflation and provide monthly cash flow.

3️⃣ Plan Your Numbers

Know exactly how much you’ll need for 25–30 years of retirement and create a roadmap that works.

💡 Retirement in the UAE isn’t about guesswork — it’s about building certainty.

✅ You now know the three pillars of retiring in the UAE: a roof over your head, income that lasts, and a clear plan for your numbers.

But knowing isn’t enough, you need to see exactly how it works for you.

👉 That’s where the One-Page GAiM Plan comes in. In just 2 sessions, you’ll see your roadmap to:

- How much you really need to retire in Dubai or Abu Dhabi

- Whether your property, savings, and gratuity are enough

- How to structure your investments to fund 25–30 years of retirement

Book your GAiM Plan session today and take the first confident step toward retiring in the UAE.