Investments

What is Asset Allocation And How It Can Help?

What Is Asset Allocation?

"Do not put all your eggs in one basket."

We have heard this before,...

While savings

The purchasing power of money decreases as time passes (inflation), so just saving money may not help you achieve big and long term goals

Investing makes it easier to achieve bigger goals like retirement, paying for higher education or buying your dream house.

While your intention and purpose of investing

Despite the challenges, you can still find lucrative investment opportunities in the UAE, helping you grow wealth and create passive income if you choose the right approach.

Before choosing any investment it is necessary to establish the following in writing;

Every individual has various financial goals/dreams/aspirations in their life( Small,

Every individual has various financial goals/dreams/aspirations in their life( Small,

Hence it is important to Decide which goals you may want to prioritise, based on the resources and investment opportunities currently available.

It is important to align our investments to our personal goals to give it a purpose and direction.

The following are the typical goals people look to achieve through investing;

Determine what you are trying to achieve through this investment For Eg:

Like with all endeavours knowing your outcome is the first and foremost step. This helps you establish other key aspects of your investment.

Determine how much time are you willing to give your investment to achieve its objective. This totally depends on your personal goals and your investment objective.

If you are young and are looking to accumulate & grow wealth for your retirement, then your investment horizon should be long, but if you are saving to buy a property next year, then your horizon is very short.

If you are a pre-retiree, then you might be interested in protecting wealth and generating a regular and dependable income over

Sharing your investment objective and horizon with your financial advisor in writing is crucial. This helps them improve their recommendation and regular review of the investment.

I have met many investors is UAE with investment plans misaligned to their objectives and investment horizon. They usually end-up surrendering the plan early, paying a huge surrender penalty and usually falling short of their goals.

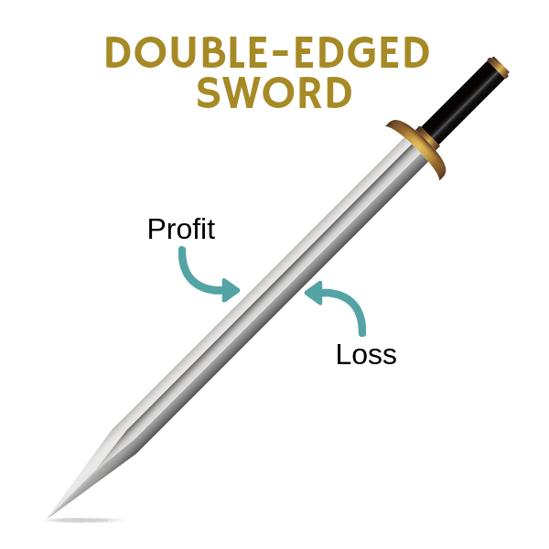

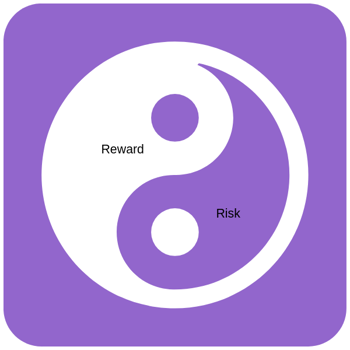

Risk and return are Yin and Yang of the investment world!

Depending upon your age, income, net worth, and horizon you may want to take or avoid a certain

Typically the amount of return an investment can generate is directly proportionate to the risk you are willing to take.

There are many risks associated with an investment, but the foremost is the possibility of losing a part or whole of your capital invested due to market movements, such risk is known as Market Risk or Systematic Risk.

While it is impossible to avoid market risk, it can be mitigated to a large extent by an efficient diversification into different asset classes, industries and geographies.

Hence it is important to determine your risk profile

Choosing the right blend of asset classes, aligned to your investment objectives, horizon and risk profile is known as asset allocation.

The following video explains asset allocation in layman terms;

Given the wide range of investment options in UAE, choosing the right investment can be a challenge, however following these 5 steps can help you choose the right investment;

As a qualified and independent financial advisor, I can help you with the process of choosing the right investment, and I can also help you regularly review them to ensure that meets your investment objectives

Schedule a free 15 minutes discovery call to understand if we can work together on your investment needs/goals.

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

"Do not put all your eggs in one basket."

We have heard this before,...

Smart Invest is a unique & compelling short-term investment proposition from Oman Insurance.

As an NRI in the UAE, your biggest motivation for living and working in UAE could...