Critical Illness Insurance, Life and Critical Illness Insurance

Why buy equal or more critical illness cover for a non working spouse?

Buying life and critical illness insurance for a working member in a family is a no brainer. It...

Critical Illness Insurance is a living benefit that helps you protect against loss of income on the diagnosis of a major illness covered by the policy.

It pays a cash lump sum when claimed, enabling you to focus on your health and well-being instead of worrying about bills and payments.

It helps you maintain your financial self-dependence, even when you are unable to earn an income due to a major ailment or accident.

You can use the claim proceeds for the following and more...

Moreover, health insurance covers only until you are employed. In the event of a job loss, the visa, the medical card, and other benefits are canceled.

Having at least 3 to 5 years of annual income is recommended as critical illness coverage.

It will help you sustain yourself in the UAE or any other part of the world; without an income when struggling with a dreaded disease like cancer, heart attack, etc...

Generally, critical illness plans don’t provide insurance coverage for the following:

Leading insurance companies in UAE like Zurich Intentional Life, Friends Provident, Metlife, Salama, LIC International, and Arab Orient are providing a comprehensive critical illness benefit via two major plan types;

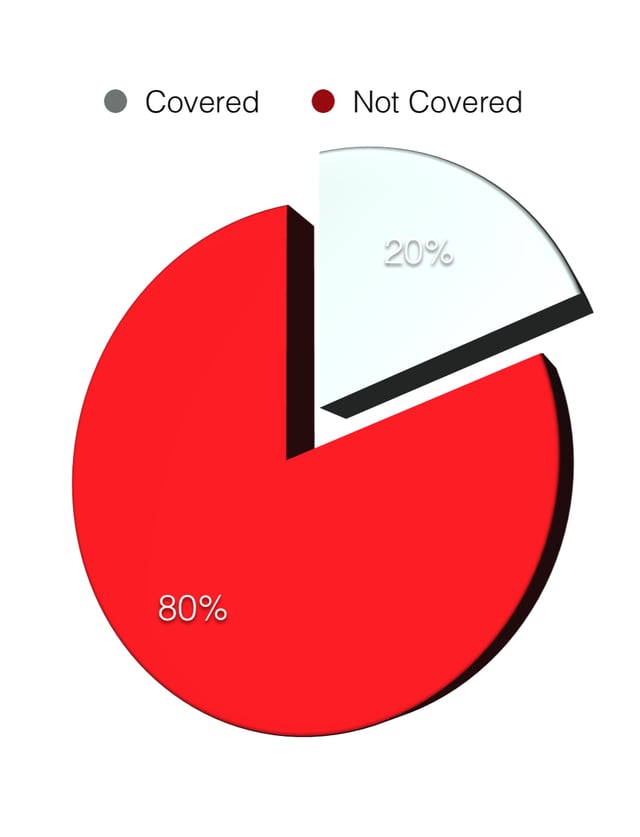

A recent survey by UAE’s leading insurance provider, Zurich International Life, reveals that 80% of UAE residents do not have critical illness coverage...

If yes!!!

What are you waiting for?

Do you know that you can buy a critical illness plan for as low as AED100 per month?

I can help you determine the ideal life cover and critical illness benefit required to address your protection needs. Explore various options and finalize the best critical illness insurance for you and your family.

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

Buying life and critical illness insurance for a working member in a family is a no brainer. It...

Major Ailments like Cancer, Stroke or organ failure can keep a person away from work for months or...

A major critical illness like Cancer, Heart attack, or Stroke can take a long time for recovery,...