Investments, Mutual Funds

What is a Mutual Fund and What are its Benefits?

"Mutual funds were created to make investing easy, so consumers wouldn't have to be burdened with...

It is a well-known fact that money doesn’t grow on trees, but you can certainly grow money when you save and invest wisely.

Many believe that saving and investing are the same, but in fact, they are entirely different.

Saving involves setting aside a portion of your income for future needs and goals. Whereas Investing is putting your savings at work at work to make more money

While the objective of savings is to keep you from spending your income entirely, the purpose of an investment is to either generate additional revenue (Passive income) or appreciate in value(Capital Gains) or do both in some cases.

Annuity, Rent, dividends and interest from a bond are good examples of passive income.

Growth stocks/Mutual Funds, Gold and land, are good examples of assets capable of providing capital gains.

Now that we know what is investing and how it is different from savings, next we will analyze why you must invest?

An increase in income can undoubtedly improve your lifestyle, but this lifestyle largely depends on the continuity of such income. Also, it is not uncommon to see people with substantial incomes struggling to manage their expenses and debt.

Click here to learn from the stars on how to strike a balance.

Investing your savings will create passive income, helping you improve your lifestyle. Whether it is purchasing a new house, buying a bigger car or the fancy vacation paying it through your investments is much more rewarding.

A good lifestyle attained through passive income is more sustainable and fulfilling than the one built just on salary income.

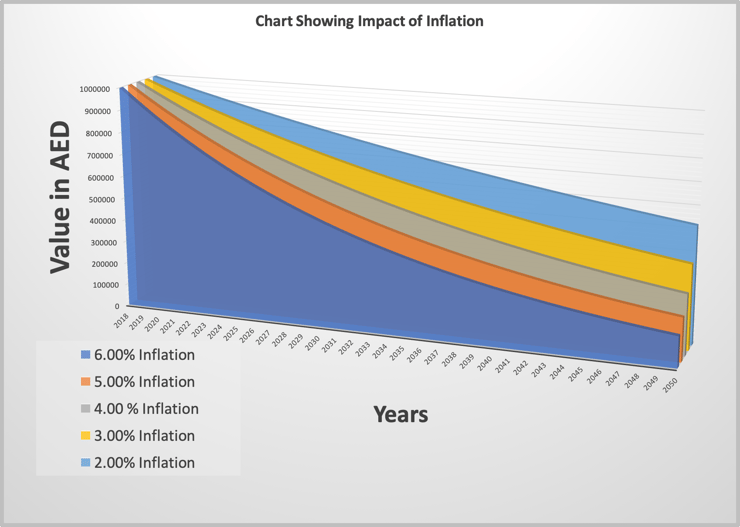

This is perhaps a more significant reason to invest your savings because money kept idle will keep losing its spending power. Which means that every dirham you earn and save, will buy a smaller percentage of goods and services in the future.

In the long term Inflation is the most potential financial risk, but often is not seen as a threat by many. It is negative compounding working against you day and night.

Your money should be put to work to make sure that it earns a return higher than the prevailing inflation, i.e., Real Return.

For Eg: If the current inflation is 4.00% then your money should earn more than 4.00% to keep up with the inflation.

Usually, bank deposit rates on savings are lower or just equal to the inflation, hence investing your savings is necessary to sustain the purchasing power of your money.

Financial Freedom is when you don't have to rely on active employment/enterprise to maintain the lifestyle of your choice. It is when your assets are able to generate a sustainable income to meet your living expenses for a lifetime.

Investing your savings makes Financial Freedom possible. It helps you build wealth enough to last for a lifetime and beyond.

In the current world where people are finding it difficult to manage the day to day expenses, very few can afford to leave a lasting legacy for their family and society.

Those few are the ones who understand the importance of regular savings and prudent investing. Investing your savings for the long-term helps you create wealth and a lasting legacy.

While we all may have distinct financial situations and different money motives, investing your savings can help you create long-term wealth and achieve your unique goals and needs.

Want to invest your savings? Book a Discovery call to know how to invest in UAE.

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

"Mutual funds were created to make investing easy, so consumers wouldn't have to be burdened with...

What brought you to the UAE?

"Life finds a way." - Dr Ian Malcolm (Jeff Goldblum) - Jurassic Park

"Life finds a Way". It always...