Critical Illness Insurance

Is Critical Illness Insurance Worth It? Real Stories That Make You Think

Critical Illness Insurance-Real Stories That Prove Its Value

Zurich Futura: A Premier Whole Life Insurance in the UAE

It's not just an insurance policy; it's a commitment to your family's future security.

While Futura offers many essential benefits; I, as a Financial Adviser and, more importantly, an policy holder since 2009, chose Zurich Futura life insurance for the following reasons;

Zurich International is known for the prompt and hassle-free claim settlement process. Their average claims settlement period for the year 2023 was 72 hours and the quickest claim was processed in 24 hours from the time of receipt of complete documents.

Every year, they publish a claims paid report with a detailed breakdown of the claims paid and the settlement ratio, along with the reason for declined claims.

This gives me peace of mind that my family will not have any hassles or delays in the claim process.

Click here to view the summary of the 2023 Benefits paid report.

Here is also a testimonial of one of the claimants.

Zurich Futura Life Insurance offers an International - Whole of Life Cover. I am covered even if I move out of UAE and back to India or any other country.

Zurich Futura Life Insurance offers an International - Whole of Life Cover. I am covered even if I move out of UAE and back to India or any other country.

It is portable; I can pay the premiums on the plan via account transfer or via international credit card from any country. I can also claim the benefits even after moving out of the UAE. It has 24/7 online access, allowing me to manage my policy from wherever I am.

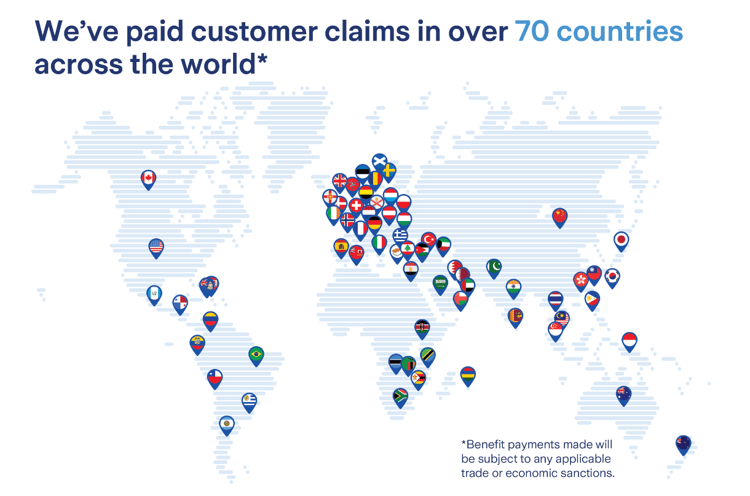

According to the 2023 benefits paid report, Zurich has paid out claims in 70 countries in the last three years.

On the death of a UAE resident, all assets, including bank accounts, gratuity, property, and car, are frozen until all their liabilities are paid. It can take weeks to months until all the liabilities of the deceased are cleared and the balance is distributed to the family members.

In the absence of a will, the balance of cash and assets is distributed among the family according to the Sharia law of inheritance.

If you have Zurich Futura Life Insurance, it can pay the claim proceeds directly to your nominees in the unfortunate event of your death.

It could help your family manage financial commitments, even while your assets are frozen.

Zurich International Life is licensed and regulated by the Isle of Man Financial Services Authority, renowned for its stringent financial regulations.

If an insurance company registered in the Isle of Man is unable to meet its liability to the policy owners, then the Authority would pay policy owners upto 90% of any liability from the Policyholders’ Compensation Fund.

I chose Zurich Futura because of this most important reason, and I would have availed it, even if the plan offered only this benefit. It provides critical illness coverage on 36 major illnesses, and most of them cover up to age 95.

Just last year, a claim was paid for an 80-year-old policyholder, highlighting the plan's extensive coverage. This helps me and other policy holders maintain financial independence even in the face of major health challenges.

However, it is crucial to understand the impact of inflation on the level of cover you hold. Hence, you should review your coverage needs at least every five years and make sure that your plan covers you adequately.

For Eg, if you hold a critical illness benefit of enough to cover three years of income at age 40, and at age 45, if your income doubles, then you should also increase your critical illness cover accordingly!

If not, it might not be enough to replace your income for at least three years while you are working.

And when you are retired, it might not be adequate to pay for medical expenses, forcing you to break your bank or borrow.

Although Futura covers me up to age 95, it provides the flexibility to choose a premium payment term between 7 - 50 years. I selected a 15-year premium payment term to suit my budget.

Learn more about five ways Zurich Futura can adapt to changing life situations.

We all go through a difficult financial patch at least once in our lives, don’t we?

We all go through a difficult financial patch at least once in our lives, don’t we?

Despite this, we would not want to stop our insurance premiums! But what if we are unable to pay our insurance during that awkward phase?

After 3 or 4 years of premium payments, you may take a break for up to 6 months (Make your plan paid up) and still enjoy the life cover with other riders.

In most cases, you may not have to redo medical tests or provide additional medical information to recommence your premiums. Your financial advisor can help you understand how long you can stop premium payments.

Zurich Futura provides access to some of the best investment funds, including Vanguard Index funds, India Equity Funds, and funds focussed in technology and healthcare, as well as diversified global equity and bond funds. These funds have a consistent growth record, ensuring the increase in my investment value and the sustainability of the policy benefits.

In addition to the above-mentioned benefits, it offers many other benefits like;

What about you? Do you have Life or Earlier Critical Illness Insurance? If not, what are you waiting for?

Don’t have a life or critical illness insurance plan yet? Zurich Futura is an excellent choice. Contact me for a free consultation and unbiased advice to select the best plan for your needs

If you like this post, please share it with your friends or colleagues who can benefit from such information.

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

Critical Illness Insurance-Real Stories That Prove Its Value

-2.png?width=300&name=What%20is%20Whole%20Life%20Insurance%20Why%20consider%20buying%20it%20(350%20%C3%97%20250%20px)-2.png)

Why do I need Whole life insurance? It is the immediate question people ask when they hear about...