Financial Resolutions

Useful Financial Resolutions To Make And Keep In 2022 And Beyond.

How often have you read an article on Financial resolutions and found it irrelevant to your...

Discover how MetLife Future Protect offers comprehensive protection and performance for UAE residents & non-residents seeking life insurance with investment flexibility. Learn about its advantages, potential drawbacks, and how it compares to Zurich Futura.

MetLife Future Protect combines Whole life insurance with smart investment options, meeting your protection needs while building cash surrender value for long term financial goals. It is like Zurich Futura in many ways, and yet has distinguishable features that make it stand out.

With a strong presence in the Middle East, MetLife serves expats and locals across the region. Backed by over 150 years of global expertise, MetLife is a trusted provider for life and investment solutions.

MetLife Future Protect Review SummaryFuture Protect stands out as a flexible Whole of Life Insurance plan tailored to meet diverse protection needs and long term investment goals.

Key benefits include:

MetLife Future Protect is a strong contender for UAE residents seeking financial security and investment opportunities.

Single or Joint Life Options:

Accidental Death Benefit: Up to 3x the base coverage, capped at USD 5 million.

1. Critical Illness Coverage:

| Stroke | End-stage Lung Disease | Motor Neuron Disease |

Multiple Sclerosis |

| Major Cancers |

Kidney Failure |

Parkinson’s Disease |

Paralysis |

| First Heart Attack |

Loss Of Speech |

Benign Brain Tumor | Poliomyelitis |

| Fulminant Viral Hepatitis |

Aplastic Anemia | Major Head Trauma | Encephalitis |

| Heart Valve Replacement |

Loss Of Hearing | Bacterial Meningitis | Apallic Syndrome |

| Serious Coronary Artery Disease |

Major Organ / Bone Marrow Transplant |

Systemic Lupus Erythematous withLupus Nephritis | HIV due to Blood Transfusion and/or occupationally acquired HIV |

| End stage Liver failure |

Muscular Dystrophy | Coma | Progressive Scleroderma |

| Primary Pulmonary Hypertension |

Alzheimer’s Disease / Irreversible | Major Burns | Blindness |

3. Permanent and Total Disability (PTD):

Choose from three strategies:

Free Fund Transfers: Make up to four transfers annually to capitalize on market opportunities.

These disadvantages are inherent in life insurance plans with investment components, as they aim to balance long-term protection, flexibility, and affordability.

While the fees and charges support the plan's robust features, market-linked performance offers potential for higher growth through a diverse range of index funds and actively managed mutual funds.

Additionally, surrender charges act as a deterrent to early withdrawals, ensuring policyholders retain the vital protection benefits over the long term.

| Features | MetLife Future Protect | Zurich Futura |

|---|---|---|

| Coverage Amount | USD 100,000 to 50 million | USD100,000 to 20 Million - above 20 million on case to case basis. |

| Age Eligibility | 1 month to 65 years | 18 years to 74 years |

| Premiums affordability | Premiums can be lower than Futura for some age bands | Premiums can be lower than Future Protect for some age bands |

| Stand Alone Critical Illness Cover | Yes | No |

| Critical Illness Benefits | 32 | 36 |

|

Permanent Partial Disability Cover |

Yes | No |

| Investment Funds | Direct | Wrap Funds |

| Non residents | Yes - subject to insurable interest in the UAE | Only GCC residents signing the policy in the AUE |

|

Key Exclusions |

Suicide Before 2 years | Suicide Before 1 year |

|

Grace period |

31 days | 90 days |

|

Loan Facility |

Yes | No |

This plan is ideal for:

However, consider consulting with a financial advisor to evaluate its suitability for your specific needs.

MetLife Future Protect offers a robust combination of protection and investment growth. Its flexibility and critical illness coverage make it a standout choice for residents and non residents. However, understanding its fees, surrender charges, and market risks is essential.

If you're evaluating MetLife Future Protect against Zurich Futura or need assistance setting up an investment strategy, feel free to reach out.

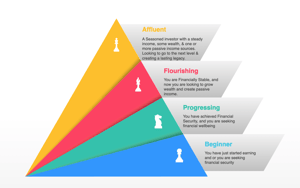

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

How often have you read an article on Financial resolutions and found it irrelevant to your...

-2.png?width=300&name=8%20Steps%20to%20Financial%20Independence%20-%20Ebook%20for%20UAE%20residents%20(350%20x%20250%20px)-2.png)

Why I wrote the book 8 Steps to Financial Independence?

When there are several Self Help books on financial success, why UAE residents should read my ebook...