Zurich Wealth Accumulation Plan – Simply Put

Build Long-Term Wealth, With Ease & Flexibility

Most UAE residents earn well, but only a few convert that income into lasting, portable wealth.

Why?

Because investing here often forces you to choose between

- Long term plans with Rigid monthly commitments, or

- Unstructured DIY investing with tax, inheritance, and continuity risks

The Zurich Wealth Accumulation Plan (WAP) exists to solve this exact problem.

It is not just an investment account.

It is a wealth accumulation engine that balances discipline, growth, and flexibility, designed specifically for UAE residents.

It gives you:

- Flexibility over when and how much you invest

- Global investing within a regulated structure

- Built-in estate and tax efficiency, without micromanagement

Table of Contents

Who This Plan Is Designed For

This plan works best if you:

- Want to accumulate wealth consistently within a regulated framework

- Prefer investing your savings without rigid commitments

- Want the flexibility to add funds when surplus cash or market opportunities arise

- Value professional strategy over constant DIY decision-making

- Want your investments to remain intact if you relocate

- Care about wealth transfer, not just returns

This plan is not for you if:

- You need the money within 3 years

- You’re chasing short-term or speculative returns

- You want the cheapest execution-only platform with zero guidance

Clarity upfront saves time, money, and unnecessary friction.

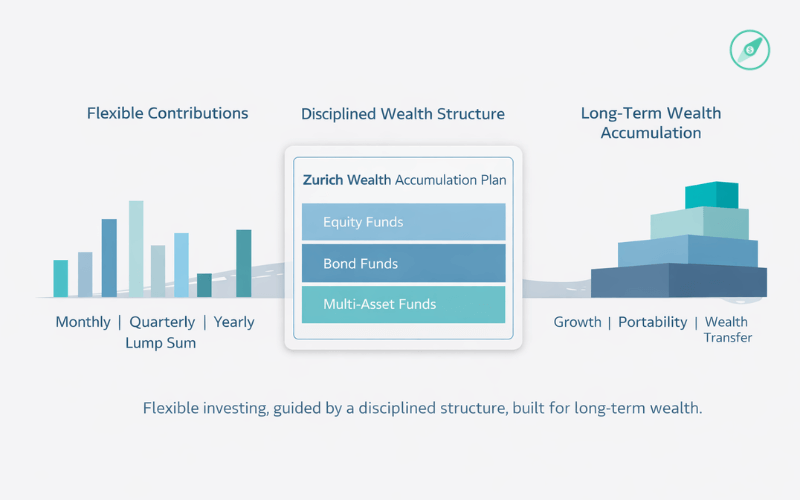

How the Zurich WAP Works (Simply Put)

You start with a minimum lump sum of USD 32,500.

From there, you add USD 2,500 or more whenever you choose:

- Monthly

- Quarterly

- Half-yearly

- Yearly

- Or completely ad-hoc

There is:

- No mandatory contribution schedule

- No penalty for pausing

- Hassle-free restart anytime

You stay in control. The structure stays intact.

I’ve seen many clients use this plan effectively to build wealth over time, primarily because it combines investment choice with a disciplined, long-term framework.

What You Invest In

Inside the plan, you get access to a global investment universe, including:

- Index funds

- Actively managed mutual funds

- Multi-asset & risk-rated portfolios

- Target date retirement funds

Across asset classes:

- Equities ( Including India Equities in USD)

- Bonds

- Sovereign & corporate debt

- Gold & defensive assets

Your portfolio is aligned to your goals, risk tolerance, and timeline. Not a one-size-fits-all allocation.

Why the Insurance Wrapper Actually Matters

The Zurich Wealth Accumulation Plan is an investment platform wrapped inside an insurance structure.

There is no sum assured and no insurance premiums charged.

The wrapper exists purely for structuring and planning advantages, including:

- Clear beneficiary nomination (up to 4 beneficiaries)

- Efficient wealth transfer without inheritance delays

- Tax-deferred growth, enabling effective tax planning

- Stronger estate and liquidity structuring than most DIY setups

A will or trust helps with distribution after wealth is created.

Zurich WAP helps with building, structuring, and transferring wealth — all within a single accumulation vehicle.

What Happens If You Leave the UAE?

Nothing breaks.

Your WAP:

- Continues uninterrupted

- Remains accessible online

- Keeps the same investment structure

- Retains beneficiary nominations

This portability is one of the biggest advantages for expats with uncertain residency timelines.

The Isle of Man Advantage (Short & Relevant)

Zurich WAP is issued from the Isle of Man, a globally respected insurance jurisdiction.

Key points that matter:

- Strong regulatory oversight

- Mandatory capital adequacy rules

- Policyholder protection framework

In the unlikely event of insurer failure, up to 90% of liabilities may be covered under the Compensation of Policyholders Regulations.

This adds a regulatory layer many offshore DIY platforms simply don’t offer.

Charges — Transparent, Not Hidden

Fees on WAP includes the advisory costs,( Financial Planning, Investment Advisory and regular reviews), Intial Plan set up, buying and selling of funds, custody and switching of funds.

Also there no additional fees for AED to USD conversion as the exchange rate is fixed.

Establishment Charge

- 2% in years 2 and 0.50% in year 3

Policy Management Charge

Applied monthly based on policy value:

- 0.80% from $30K – $225 investment

- 0.50% from $225K+ investments

Policy Fee

- USD 165 per year, only applicable on investments less than $60,000

- Stops once total contributions reach USD 60,000 (or equivalent).

All charges are deducted transparently via unit cancellation.

You can always cross-check everything in Zurich’s:

- Zurich Wealth Accumulation plan – Key Features Document

- Zurich Wealth Accumulation plan – Policy Terms & Conditions

No fine-print surprises.

How This Compares to DIY Platforms

Platforms like Interactive Brokers, Saxo, or Swissquote may appear cheaper on paper.

But most investors underestimate:

- FX conversion costs

- Custody & transaction fees

- Administrative friction

- Cross-border inheritance complications

- Time, discipline, and behavioural mistakes

For investors who:

- Have demanding careers

- Don’t want to monitor markets daily

- Prefer structured guidance

A platform like Zurich WAP often works better in real life, not just in spreadsheets. Also the costs are only marginally higher.

Important Limitations (Please Read This)

- Nominal Surrender charges apply in the first 3 years per contribution

- End of first year 3.50%, End of second year 1.50% and end of 3rd year onwards 0% ( of the amounts invested – not the account value)

- Not suitable for short-term goals – although partial surrender is possible

This is a long-term wealth accumulation vehicle, not a parking account.

Want to See What Long-Term Investing Can Actually Do?

Use these tools to understand compounding in practice:

📈 S&P 500 Investment Calculator

See how long-term market growth works over time.

📊 Lump Sum Investment Calculator

Model how a one-time investment compounds.

🔁 SIP Calculator UAE

Understand how consistent investing converts income into capital.

These tools show the difference between invested money and idle cash.

Independent & Professional Advice

As an independent financial advisor working with UAE residents, I help you:

- Clarify financial goals

- Structure contributions realistically

- Select the right fund mix inside Zurich WAP

- Review and rebalance as life evolves

No pressure. No product pushing. Just structured decision-making.

Stress-Test This Before You Commit

Before you invest a single dollar, we’ll:

- Understand your financial goals

- Project your cashflows and wealth accumulation potential

- Map exit scenarios

- Asses your risk profile

- Build a robust investment strategy aligned to your risk apetite and investment horizon

- Check if Zurich WAP fits into your overall financial plan

👉 Book a Free Strategy Call

Let’s see if this plan actually makes sense for your numbers.