30 Days Challenge

Day 21 - Basics of Mutual Funds

Mohammed Rayful won the AED 35,000,000 grand prize of the Big Ticket iN January 2023.

Luxuries of the past have become the needs of today; e.g. Private Schooling, Branded Clothing, Mobile Phones, Cars, and Air Conditioning.

Our needs and desires have grown multifold, and so has inflation, yet income and employment are not as stable as they were before.

Unlike in the past, merely earning and saving more money cannot make you Wealthy. To win with money, you may have to do one more thing right, i.e. Investing.

Investing is putting your money to work. The harder it works, the better it is for you. Choosing the right investments is the key to success.

Mutual Funds and ETFs are ideal for both beginners and seasoned investors over the medium to long-term investment horizon.

A Mutual fund is a pool of money, managed by professionals to grow wealth/provide income or do both; while mitigating business and liquidity risks. It typically invests in one or more of the following asset classes;

An index fund is also a Mutual Fund; but with a predetermined investment objective of mirroring an index or a benchmark. It is a passive investment strategy.

E.g., The Vanguard U.S 500 Stock Index Fund. This fund aims to mirror The S&P 500 index, which tracks the volume and the share price of 500 large U.S. companies.

You can choose to invest from a wide range of index funds varying considerably according to the indices they track.

Click here to know more about Index Funds

Contrary to popular belief, An ETF is a slightly more complex investment vehicle. It is also a pool of money, investing in an index or a commodity. However, it is actively traded on a stock exchange, with its price varying throughout the day, in line with the underlying investment.

Direct investment in Stocks, Bonds, and Commodities is ideal for both, seasoned and sophisticated investors. They are more risky and volatile than Mutual funds/ETFs

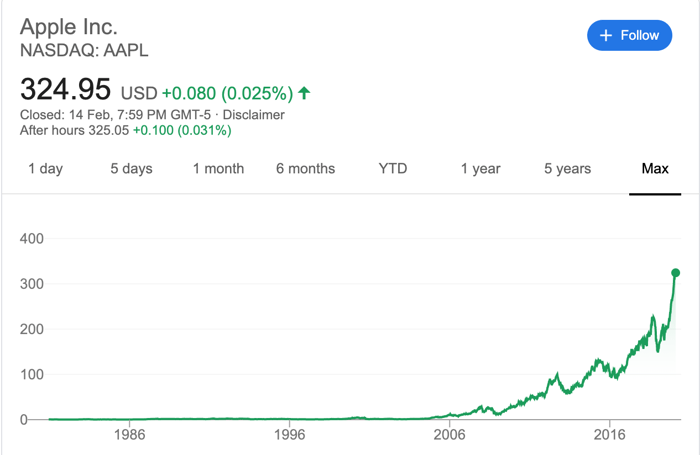

A stock is a certificate that confirms your partial ownership of a company. When you buy a company’s stock, you are purchasing a small portion of that company, thus participating in its profit and losses.

Investors buy stocks of companies they believe will go up in value and or will provide a share of profits in the form of a dividend.

When the value of the stock goes up, it may be sold for a profit.

A bond is a certificate that confirms a loan advanced by an investor to a borrower - Corporates, States, or Countries. The borrower is usually known as the issuer. The issuer promises to pay regular interest, known as a Coupon.

The risk and returns of a bond are based on the credit rating of the issuer, bond currency, and many other factors. Sovereign and State issued bonds are considered to be safer than Corporate or Municipal bonds. An investment in bonds is usually less risky than an investment in stocks or commodities.

Typical examples of commodities are Gold, Silver, Crude Oil, Platinum, and Copper. The demand and supply of a particular commodity drive its prices up or down.

The trading of commodities happens through futures and options on exchanges like the Dubai Gold & Commodities Exchange. They facilitate and regulate trading activity to ensure fair treatment of the investors.

The trading of commodities happens through futures and options on exchanges like the Dubai Gold & Commodities Exchange. They facilitate and regulate trading activity to ensure fair treatment of the investors.

Even seasoned investors avoid trading in commodities, due to the higher risk of loss of capital and lack of expertise in the field.

You may, however, invest in Gold via gold certificates, ETFs, or index funds for liquidity and as a hedge against inflation and market risks.

An Annuity or a pension is insurance for retirement. It is a contract issued by an insurance company, against an upfront payment, for providing a regular income over the life of a person who buys it.

Annuities can be a dependable source of steady income for retirees for their whole life.

Fixed, Variable, Immediate and Deferred annuities are some variants of annuities available for investing.

Click here to know more about Pension Plans in UAE.

An endowment plan is life insurance and a savings plan bound together. Much like a crossover car or CUV, that offers the space & comfort of an SUV and the fuel efficiency of a sedan, at an affordable cost.

Image Source: https://www.lexus.com/models/NX

An endowment policy may not be the most ideal life insurance or investment. Nevertheless, it works exceptionally well for expats looking for disciplined long-term capital accumulation with little or no capital risk and stable returns.

Endowment plans are well suited for non-negotiable goals like; Child Education, retirement, etc.

Unlike market-linked investments, Endowment plans provide a definite outcome on maturity or death; making the achievement of your goals more certain.

Click here to know more about Endowment Plans in UAE

While the above-discussed options are for long-term investments, there is a definite need for short-term investments as well.

National bonds offer 1.00 - 2.00% returns along with an opportunity of winning a lucky draw. You can easily invest in National Bonds online or via various Money exchanges

NRIs can invest in US Dollar Bank deposits (FCNR Accounts) with leading Indian banks like ICICI, HDFC, and SBI for their short-term and emergency savings needs

Given the peerless infrastructure, tax-free income, and low crime rate, there is a steady increase in the number of UAE residents. Addedly, ex-pats are now living longer in UAE than in the past.

The Long-term Visa offered by the UAE government makes it more attractive for ex-pats to live here longer.

Dubai is continuously growing in length and breadth. A new supply of both high-end and affordable housing projects hitting is the market every month.

Post-Russia/Ukraine War property prices in the UAE have done up swiftly, but so have the rentals. Despite the constant supply of new properties, prices are still rising.

Thanks to affordable housing projects, the easy availability of mortgages, and relatively low-interest rates, many investors are buying property for end use.

While buying an investment property is debatable, buying property for self-occupation is undoubtedly a good idea.

The Holistic Financial Planning process, including cash flow planning, helps you identify appropriate goals, establish investment horizons and allocate savings wisely.

Engaging with an Independent Financial Advisor can help you;

As an Independent Financial Advisor, I help ex-pats in UAE choose the best investments to accumulate wealth, create passive income and achieve financial independence.

Schedule a Free Consultation to understand if we can work together on your Financial Planning needs and Investment goals.

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

-2.png?width=300&name=Day%2021-Mutual%20Fund%20Basics%20(350%20%C3%97%20250%20px)-2.png)

Mohammed Rayful won the AED 35,000,000 grand prize of the Big Ticket iN January 2023.

"Anyone can cook!" - Chef Gusteau, Ratatouille