CashFlow & Budgeting, how to save money

How to Save Money in Dubai: 10 Smart Ways to Cut Costs & Build Wealth

What brought you to the UAE?

Many residents dream of starting and managing a successful business for creating wealth and a steady source of income.

Barring a few individuals, a majority are unable to achieve this dream, as they are not ready to leave their comfort zone of stable employment or they do not have adequate skills and resources.

By Investing in the shares of a company of their choice, residents can achieve this objective without having to discontinue their current employment and with very minimum resources and skills.

They can piggyback on the skills, business acumen, scale, and size of successful businesses like Amazon, Visa, Paypal, Tesla, etc... by investing in their shares to create wealth and passive income.

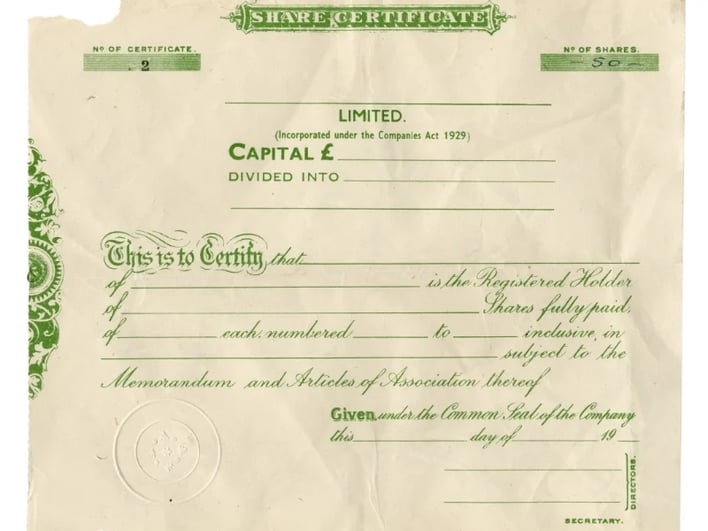

A Share is a certificate that establishes your part ownership in a company. When you buy shares, you actually buy a small portion of that company.

As a part-owner of the company, you become eligible to participate in the profits, losses, and capital gains of the company.

You can be a part owner of successful companies like Apple, Google, and Microsoft by buying shares of these companies with a small investment and a basic knowledge about investing.

Depending on the type of shares you invested in, you may also get a right to vote on significant decisions of the company.

Shares are also known as Equity or Stocks.

You can buy/ sell Stocks on stock markets/exchanges across the world. Stock exchanges are regulated virtual/physical places where investors buy or sell shares of the companies listed on the exchange.

The price of such stocks is constantly changing based on the demand and supply of the particular stock.

The most common stock markets are New York Stock Exchange and the Nasdaq Stock Market, London Stock Exchange, and the Bombay Stock Exchange. We also have DFM and ADGM in the UAE, that list and trade stocks from the UAE.

The possibility of trading stocks on the exchange at the market price makes this type of investment liquid. It is also an easy way to determine the value of your investment at any point in time.

Stocks are classified based on factors like ownership, size of the company, industry, dividend, risk, etc.

As the name suggests, Preferred Shareholders enjoy some privileges like

However, they do not have a right to vote in. the meetings of the company

It is the most common type of stock. This shareholding allows you to participate in the company's profits and a right to vote. Dividends paid on these shares are variable and not guaranteed, unlike preferred stocks.

Such stocks are usually preferred stocks with an option to be converted into common stocks at a specified time. They may or may not have voting rights due to their hybrid nature.

These stocks usually represent small-sized companies with a market value of between $300 million - $2 billion.

The pros of this stock are that it can generate massive gains in the long term as small companies have the potential to grow in the future. Also, the stock is available at a cheaper rate initially.

On the flip side, since these are small/new companies, it is difficult to predict their growth, and thus stocks are highly volatile.

These stocks are of medium-sized, well-known companies with a market value of between $2 billion - $10 billion.

Such stocks have the dual advantage of good growth potential with stability.

These are the stocks of Blue-chip companies with a market value of $10 Billion and more.

They offer higher dividends and also help the long-term preservation of capital.

Income stocks distribute profits in the form of dividends. These stocks are best for generating passive income.

Typical examples of Income stocks are; (IBM)

International Business Machines Corp, (MMM) 3M Co, AT&T Inc, etc...

These stocks are preferable for long-term growth potential. Such Companies reinvest their profits for faster growth, and thus their share prices also rise continuously.

Typical examples of growth stocks are; Amazon.com (AMZN), Facebook (FB), Alphabet (GOOG, GOOGL), Microsoft (MSFT), etc...

Investment in shares not only gives you a part of ownership in the company invested but also innumerable other benefits like:

Despite all the benefits, many residents are still apprehensive about investing in stocks, due to one or more of the following reasons;

If you also have similar apprehensions, you are not alone, a majority of residents prefer keeping their savings idle in a bank.

Without a doubt, Stocks are volatile, and it is impossible to predict the markets. Stock prices are affected by many aspects; We all wonder what factors influence the stock price.

Investing involves risk, and it can be overwhelming. But avoiding stock markets altogether can put you at the risk of not being able to achieve your financial goals.

The following are the key strategies that can help you mitigate the risks to a large extent and enjoy the benefits of stock market investment

The best way to combat risk is by diversifying your investments in different asset classes, geographies, industries, and companies. An efficient asset allocation can go a long way in preserving the capital and growing your wealth.

When it comes to stock market investment, It is wise to invest in the long term. It will help you ride out the market storms and give more time for your money to grow.

While Stock market investing is not rocket science, it is no child's play either. Learning the basics of investment and developing an investor's mindset can help you make wise investment decisions.

The Do it Yourself(DIY) approach can help you save on fees, but it can be time-consuming and error-prone.

Hiring an expert and Independent Financial advisor can help you learn quickly, avoid frequent and big losses and grow your wealth quicker.

Arrange a Free Online meeting to discuss your investment objectives, horizon, and attitude to risk, based on which I can suggest suitable investment opportunities to consider.

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

What brought you to the UAE?

-2.png?width=300&name=Best%20investment%20options%20in%20UAE.%20(350%20%C3%97%20250%20px)-2.png)

Investing is crucial for achieving financial security and reaching your life goals.