life insurance, Zurich Futura

How to improve Zurich Futura Fund Performance?

Are you looking to get the most out of your Zurich Futura plan?

Off late Stocks have been getting a lot of attention, particularly the US technology stocks like Apple, Amazon, Tesla etc...

Almost everyone is looking to invest in them.

No doubt, Stocks are doing well, and they can help you grow wealth, but they can also be volatile and risky...

Plus, they aren't the only investments that can help you get rich. There is a wide range of investment options available in the UAE, and Bonds are one of the most important.

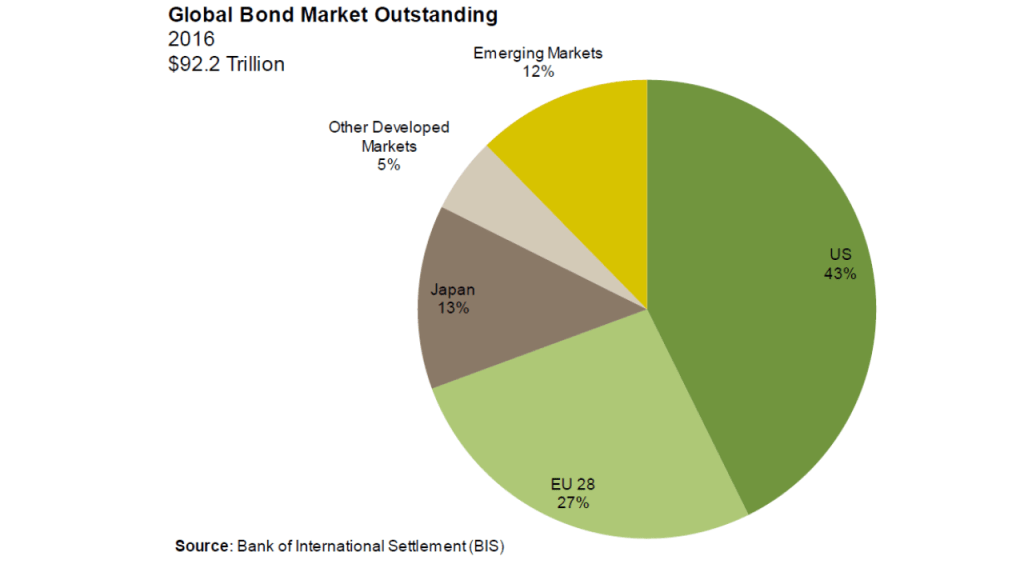

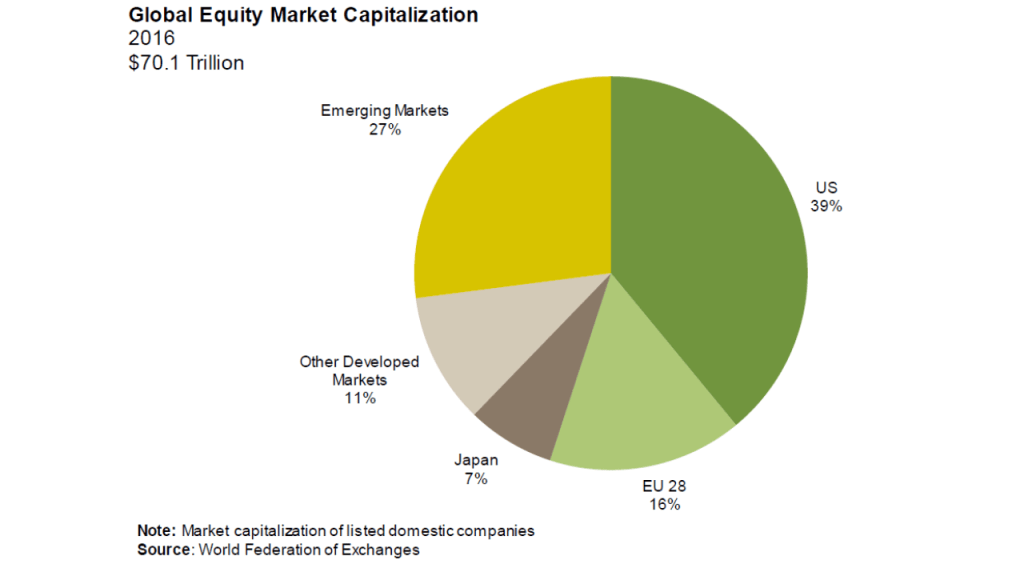

In Fact the global bond market is much bigger than the global stock market, and the following charts from https://www.theifod.com/ confirm the same.

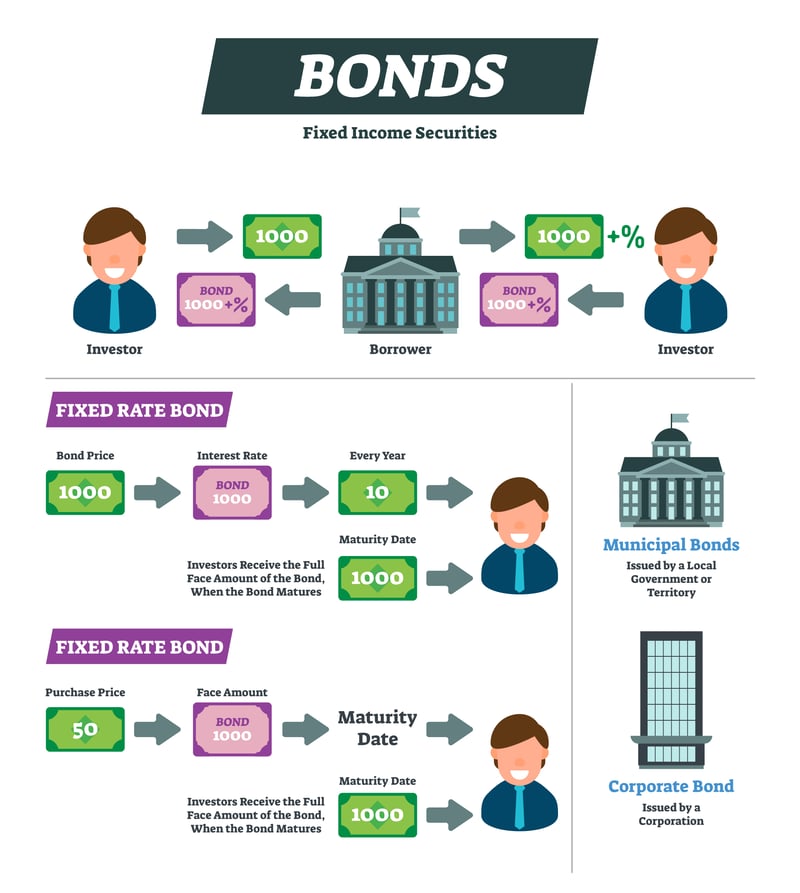

Bonds are instruments used by Governments, Municipalities and Companies to borrow large sums of money from retail and institutional investors.

When you buy a bond, you are actually lending to the company, Country or a Corporation.

In return, the issuer promises to pay you a specified amount of interest( Also known as yield or coupon)at regular intervals till the maturity and to repay the principal when the bond matures.

When you buy shares, you actually buy a part of the company. With bonds, you lend to the company or country.

Shares are open-ended, which means that there is no specific maturity date when the investment is returned back to you. So you will have to sell your shares on an exchange to liquidate your holding. Whereas bonds have a specific maturity date and the borrower has to redeem the bond on that date.

Companies distribute the profits to the shareholders in the form of a dividend, while bonds guarantee an annual interest/coupon payment. With shares, dividend payment depends on the profits and management decision.

Unlike shares, bonds are less volatile as the interest payments and the capital repayment on maturity is guaranteed.

Bonds issued by Governments are known as Sovereign Bonds or sometime treasury bonds. They issue these bonds to raise money to finance infrastructure projects, social programs, or other spending measures when tax revenue isn't adequate.

Bonds issued by governments are considered to be safest as the probability of default of a sovereign bond is relatively lower than other bond types.

The interest paid by the governments for such borrowing largely depends on the following risk factors;

Credit Risk: The ability of the country to pay the interest regularly and the capital on maturity.

Country Risk: Political stability and other governance policies of the country

Currency Risk: Sovereign Bonds are typically issued either in the local currency or in Hard currency like the US Dollar, Pound or Euro.

Exchange rates fluctuations have a significant impact on the interest earned by bond subscribers. Hence the coupon rate can be high or low depending on the amount of volatility of the local currency bond.

Moody's, Fitch and Standard & Poor's are the leading independent rating agencies, which rate bonds based on the above and other essential factors.

Ratings of these agencies broadly impact the interest or coupon paid by Sovereign and Corporate bonds.

|

Risk

|

Moody’s

|

Fitch

|

Standard & Poor’s

|

Grade

|

|

Lowest

|

Aaa

|

AAA

|

AAA

|

Prime

|

|

Low Risk

|

Aa

|

AA+

|

AA+

|

High Grade

|

|

A

|

AA

|

AA

|

Investment Grade - Upper Medium

|

|

|

Medium Risk

|

Baa

|

BBB

|

BBB

|

Investment Grade -Lower medium

|

|

High Risk

|

Ba, B

|

BB / B

|

BB / B

|

Junk Bonds

|

|

Highest Risk

|

Caa / Ca / C

|

CCC / C / D

|

CCC / CC / C

|

Junk Bonds

|

|

Don’t even think

|

C

|

|

D

|

In default

|

Corporate bonds are debt instruments issued by companies to raise capital for improvements, expansions, debt refinancing, or acquisitions.

The default probability of Corporate bonds is relatively higher than Sovereign bonds; hence they offer a higher coupon to offset this disadvantage.

They are further classified into Investment Grade Bonds and High Yield bonds.

1. Investment-grade corporate bonds: High-quality bonds issued by companies with a strong balance sheet.

The financial ratings of such companies are at least or above BBB. The risk of default of such bonds is relatively low.

Investment-grade corporate bonds are widely used by investors to provide stability to the portfolio while generating a decent return on the investment

2. High-yield corporate bonds: Bonds issued by companies with relatively weak balance sheets and ratings below BBB. The risk of default on such bonds is typically high.

To offset this disadvantage these bonds are issued with a high coupon/interest, hence they are known as high-yield bonds

A few benefits of bond investment are as follows;

Bonds can help you make money in 2 ways

You can buy and hold bonds on various platforms like Ardan, Saxo Bank, Quilter Cheviot ERB, FPI Reserve, Royal London PIM or other open-architecture platforms.

The minimum investment on bonds typically is $50,000+. So the direct investment is only useful when you are looking to invest large sums of money in bonds

There is a wide range of Mutual funds, Index funds on both open architecture platforms and investment plans provided by Insurance companies in UAE like Zurich, MetLife and Royal London 360.

However, ETF investment is only possible on open architecture platforms like SAXO or Ardan.

Investing in bonds through Mutual funds/index funds or ETFs is the most affordable and convenient, and it also helps you diversify your investment in many bonds within a fund.

Traditionally conservative investors have preferred bank deposits and real estate over other forms of investment. Given the prevailing low-interest rates and struggling real estate market, Bonds can be a good alternative, as they offer better returns and are relatively safe.

On the other hand, if you are someone who has a substantial equity investment, adding bonds to your portfolio can help you diversify and mitigate market risks to a certain extent.

If you are a pre-retiree or already retired, bonds can provide you with a regular stream of passive income in the form of coupons.

As an Independent Financial Advisor, I can help you create a Holistic financial plan and an investment portfolio aligned to your goals.

I can also help you manage your investments to ensure that you can achieve your goals with the desired ease.

Don't wait!

Arrange a Free Consultation today and jumpstart your journey towards wealth creation.

Happy Investing!!!

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

Are you looking to get the most out of your Zurich Futura plan?

Zurich International is a leading international insurance and investment provider.

They serve...

Critical Illness Insurance-Real Stories That Prove Its Value