Market Linked

Oman Insurance Smart Invest: Short Term Investment Plan

Smart Invest is a unique & compelling short-term investment proposition from Oman Insurance.

"Life finds a way." - Dr Ian Malcolm (Jeff Goldblum) - Jurassic Park

"Life finds a Way". It always does.

Despite the risk of exposure, loss of lives and unprecedented challenges like lockdowns, quarantine, job losses, pay cuts and working from home, we are slowly but surely finding a way out of the Covid-19 pandemic.

2020 was no doubt a challenging year, but it was also the year we learnt to adapt and innovate many aspects of our lives. We now see things in a new light, and our priorities have changed substantially. Perhaps the new normal is here to stay!

One of the critical lessons we learnt in 2020 is the importance of financial stability and building a strong financial foundation for our future. We can achieve financial security and independence through diligent savings and prudent investing.

Lump sum or Systematic Investment Plan(SIP) are the two ways you can invest for securing your future and achieving your financial goals.

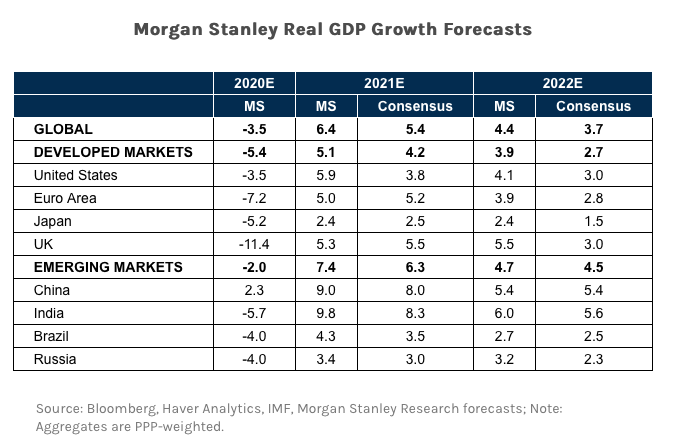

With the market valuations so high, which is the best way to invest money in 2021?

With interest rates at all-time lows, bank deposits are no longer able to keep up with inflation. Lumpsum investing helps you deploy your idle capital into investments in line with your financial goals and risk tolerance, without largely compromising on the liquidity.

Lump-sum investments can help you participate in the prevailing bull market and grow wealth relatively quicker, making it easy to achieve medium term financial goals.

Lump-sum investing provides access to some of the best investment options at lower fees, thus increasing the net returns every year.

It enables you to build a robust investment portfolio with better diversification and efficient risk management.

You can generate regular and dependable passive income by investing lump-sum capital into income yielding bonds/bond funds/equity funds, structured products or pension plans.

Yes, markets can go up or down and so will the value of your investments that is why it is crucial to follow prudent investment strategies like;

As discussed above, both SIP and lump-sum investments have their benefits and limitations. Choosing between must depend on your financial objective; i.e.,

SIP or a regular savings plan is pocket-friendly and easy to start and continue; A lumpsum investment during a bull market can generate higher returns.

However, a lump sum investment requires significant knowledge and market analysis before investing your hard-earned savings.

So if you are a beginner to investing in Mutual funds, it is better to start with a SIP/Regular Savings Plan. If you are someone with idle lump sum savings, you may consider investing a part of it to benefit from the prevailing bull market.

However the best strategy would be combining both. If you have $35,000 or more as investable surplus you can start with an initial lump sum and keep adding additional funds every month, or ad hoc at your convenience giving you the best of the both worlds.

As an Independent Financial Advisor, I can help you set up an efficient SIP or Lump-sum investment plan, in line with your goals and risk tolerance.

I can also help you Rebalance your portfolio at regular intervals to ensure that it stays aligned with your financial plan.

Don't wait!

Arrange a Free Consultation today and jumpstart your journey towards wealth creation.

Happy Investing!!!

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

Smart Invest is a unique & compelling short-term investment proposition from Oman Insurance.

Zurich Simple Wealth, as the name suggests is a simple & straightforward lump-sum investment plan...

%20(350%20%C3%97%20250%20px)-2.png?width=300&name=Ardan%20Wealth%20Platform%20(700%20%C3%97%20350%20px)%20(350%20%C3%97%20250%20px)-2.png)

Wealth management today is no longer about picking the best investment.