Life Insurance, Zurich Futura

Zurich Futura insurance With Enhanced Living Benefits

Zurich International Life (ZIL) has recently launched an updated and enhanced version of Zurich...

The Story of Critical Illness Insurance.

Critical illness insurance was invented by Marius Stephanus Barnard a Heart Surgeon, who realized that his patients were suffering financially after surviving a major illness like Heart Attack, Stroke, or Cancer...

The plight of his patients was overwhelming as they were threatened not only by an increase in medical expenses but were also unable to manage their living expenses due to their inability to earn. This was creating additional stress in the minds of his patients, delaying recovery or aggravating the symptoms of the ailment.

He perceived a distinct need for a solution that would help his patients manage the loss of income and increase in expenses due to their health conditions.

While exploring insurance as a solution, he realized that there was Life Insurance to pay in the event of death and disability insurance in case the insured was disabled, but none covered major ailments like Cancer, Heart Attack, Stroke, Kidney Failure, etc..

Thanks to medical advancements his patients were no longer dying, they survived for many years after the treatment of such diseases, but the lack of money was making them feel that they would be better dead!

Dr. Barnard worked with an insurance company to design a new product, which could pay out a cash lump sum on diagnosis of a major ailment, but the challenge was finding reinsurers.

After several attempts over 3 years, with the help of Crusader Life Assurance Corporation Limited, the first policy was launched on 6th August 1983 in South Africa. This covered 4 major conditions: Heart Attack, Cancer, Stroke, and Coronary Artery Surgery.

From South Africa, this product spread to several countries like the United Kingdom, Ireland, Australia, New Zealand, and North America.

Today such policy is known as Critical Illness Insurance and is available all over the world.

Unlike Life Insurance, this is a living benefit.

It pays out a cash lump sum in the event of diagnosis of a major ailment covered under your policy. It can be availed as a rider on term insurance or on Whole of Life Insurance. It can also be availed on a stand-alone basis.

Despite all its benefits, about 76% of UAE residents do not have a critical illness cover.

Among those who have only a small percentage have adequate cover. Lack of awareness and misconceptions are the two important reasons why residents are ignoring a very important protection aspect.

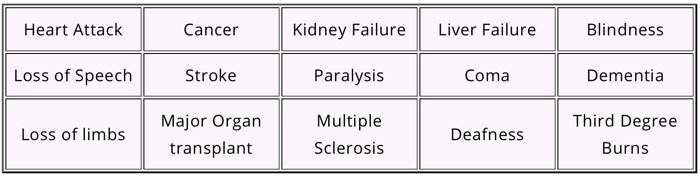

Leading Insurance companies in UAE like Zurich International Life, Friends Provident, MetLife, LIC International, and Salama provide insurance plans which cover 32 - 36 critical illnesses.

Some of the ailments covered by plans in the UAE are;

Do you have critical illness cover? Are you adequately covered?

If not, then what are you waiting for?

Do you know that you can buy critical illness cover for as low as AED100 per month?

Schedule a Free15 minutes discovery call to assess your protection needs and to know more about Critical illness Insurance in UAE.

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

Zurich International Life (ZIL) has recently launched an updated and enhanced version of Zurich...

Critical Illness Insurance-Real Stories That Prove Its Value

`'The biggest room in the world is the room for improvement.`' - Helmut Schmidt