Understanding Life Insurance

In the UAE, life insurance is more than a policy—it's a safety net for your loved ones. It's the assurance that your family will have financial support, ensuring their life can go on, even if you're not there.

The Importance of Life Insurance in Dubai and UAE

Life insurance is crucial in the UAE, It’s about providing for your family’s living expenses, schooling and keeping their dreams alive, even in your absence. From daily expenses to future goals, life insurance ensures that your family’s journey continues smoothly.

Types of Life Insurance Available in the UAE

The following are the three major types of life insurance in the UAE

- Term Life Insurance - Affordable, fixed-term coverage for peace of mind.

- Whole of Life Insurance - Providing security for a lifetime with cash value

- Endowment Plans - A combination of savings and insurance, supporting future financial goals.

The primary purpose of all kinds of plans is to provide lump-sum cash to your family, helping you secure their future in the unfortunate event of your death.

Benefits of Having a Life Insurance Policy in the UAE

The Role of Life Insurance in Joint Income Families

Marriage unites two people in a shared journey of joy, challenges, and mutual financial responsibilities.

In the UAE, couples often plan their lives around their combined incomes. This might include loans for a dream home, a family car, or memorable vacations.

But, if tragedy strikes and one partner passes away, the surviving spouse faces not just heartbreak but also the daunting task of managing debts and living expenses alone.

Life insurance in the UAE steps in during these critical times, offering essential financial support and peace of mind.

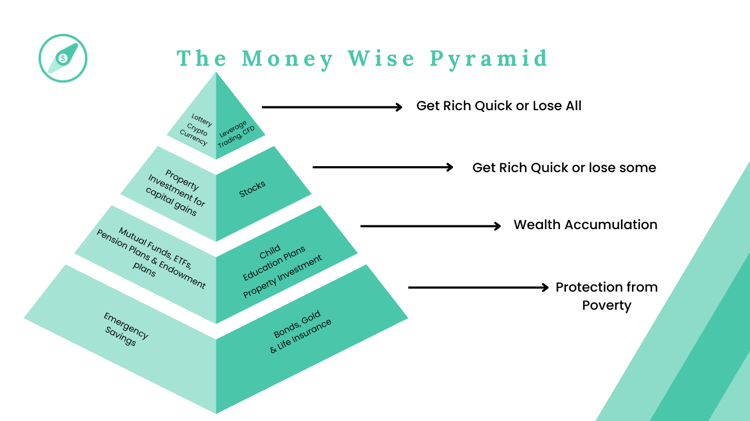

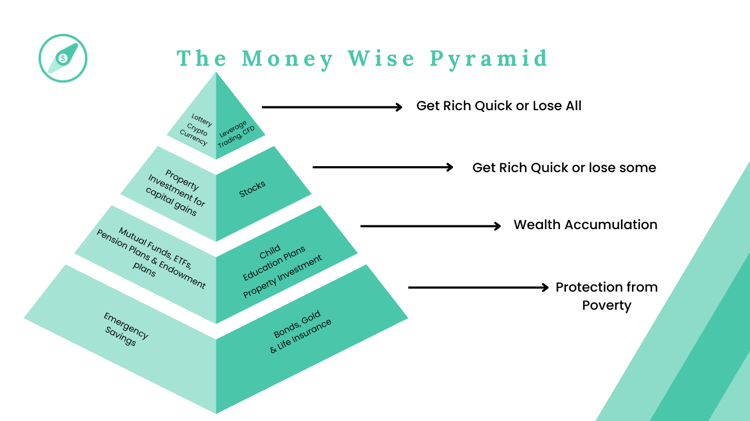

The Financial Planning Pyramid and Life Insurance

Life Insurance provides a solid base for your financial plan, enabling you to work on your dreams and goals, knowing that your family's financial future is secure.

It supports your efforts in creating a strong financial foundation for your family.

Who Needs Life Insurance in UAE?

- Singles: Even without dependents, securing low premium life insurance at a young age is prudent to protect against loss of income due to critical illness and disability.

- Newly Married Couples: Joint financial planning becomes crucial, and life insurance safeguards against the unexpected.

- Families with Young Children: It's vital for both parents to have life insurance to cover all eventualities.

- Single Parents: It's essential to have adequate coverage to secure your child's future.

- Those with Older Children: Life insurance remains necessary to support your spouse and children to maintain their lifestyle.

- Retirees: To avoid burdening your children or spouse, life insurance can cover estate taxes or create a legacy.

Life Insurance for Business Owners in UAE

For business owners, life insurance is crucial for the continuity of the business and financial security of employees and partners. KeyMan Insurance or Partners Insurance is especially important.

Get Started with Life Insurance in UAE

Thinking about life insurance?

It's easier and more affordable than you'd imagine!

I am here to help you find the perfect fit for your life’s unique protection needs

Reach out today to start this important conversation.

Book a Discovery Call

.png?width=300&name=Hemaya%20Plus%20-%20Family%20Takaful%20%20Islamic%20Insurance%20in%20the%20UAE%20%20(350%20%C3%97%20250%20px).png)