I don’t want to retire…

Why should I?

I am not a salaried employee to retire at a certain age!

As a Business Owner / Partner, Why should you plan ahead and save for your retirement?

You have spent all your energies, risked all that you have earned and saved throughout your life, and made many sacrifices in creating a business empire, why should you retire and watch somebody else run the show?

Reason No. 1: You should plan for your retirement and succession, so that the business outlives you, like Andrew Carnegie, Bill Gates & Ratan Tata, etc...

Reason No. 2: You may want to retire to be able to spend time with your family & friends

Reason No. 3: To focus on your/your spouse's health

Reason No. 4: To pursue your passion(s) other than business, which had taken a backseat while you were building your empire...

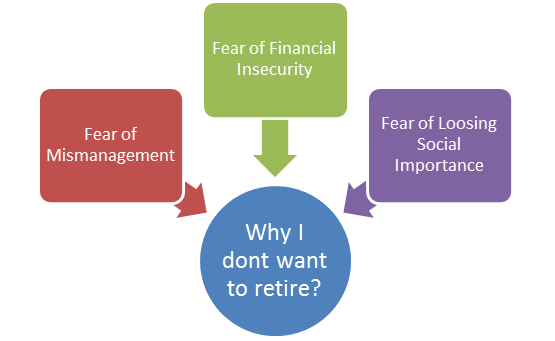

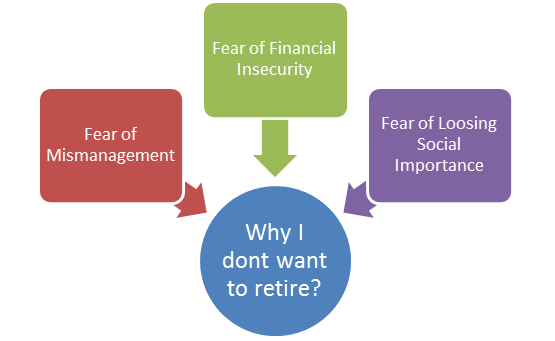

Why I don't want to retire?

- Lack of an efficient exit strategy

-

Fear, that their business would not be managed by the successors efficiently.

-

Fear of Financial insecurity in the future, when they have retired from the business, and have to rely on their successors or on family, for money to pursue their dreams, medical expenses, charity, or for whatever purpose they feel the money is needed.

-

Fear of losing importance, within the family, organization, business community, and society if they are not active in the business.

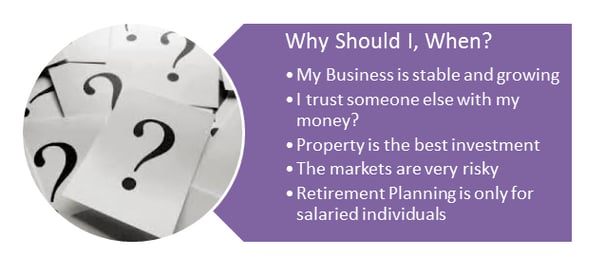

While the above-mentioned reasons contribute to the fears of business owners as far as retirement is concerned, they fail to plan their retirement due to the following misconceptions;

-

My business has grown to be stable, and it will take care of my expenses when I am old

-

No other investment is as good as my business!!!

-

Why should I trust someone else with my money?

-

Property is the best investment, and I have properties that are currently appreciating in value and are providing a stable rental income....

-

The markets are very risky and many people have lost money in the stock market!!

-

Retirement Planning is only for salaried individuals, and not for me

The following are some of the facts, which aim to clear such misconceptions and fears about retirement planning for business owners.

You should, because things can change..

- The world is changing very fast and many businesses are being affected due to changes in technology, government policies, political risks, and market practices

- If you are not in tune with the changing technology and market practices, the future of your business could be a big question mark.

- Think what happened to Kodak film rolls, Nokia, Blackberry, Floppy disk, and Cassette Tapes….

You should, protect your savings…

- When Business Owners / Partners borrow for business needs, they have to provide a personal guarantee.

- This means if the business is unable to repay, the lender can call for the personal assets of the owner/partner; like the homes, they live in and or their personal savings for repayment of the debt.

- If your business has setbacks due to market conditions, you also stand to lose your personal assets along with the business.

- So it is prudent to set up an offshore retirement plan, out of the creditor's reach to protect your retirement income….

Succession By Choice, Not Because No Other Choice….

- As an individual grows older, his experience grows, but the enthusiasm and zeal diminish along with the age of the business owner, which affects the business performance.

- The retirement planning of a business owner also includes identifying a suitable successor of the business. Succession planning provides an opportunity to the successor to actively involve himself in the business and sharpen his management skills. This helps them manage the business effectively in case of death or critical illness of the business owner.

Think about Shari’a…..

- If Personal assets are not classified separately, and set aside in an offshore location, they will also be frozen along with other business assets, in the event of death of the business owner or any of the partners of the business.

- The surviving family of the deceased or the surviving partners of the business can access the funds, only if anything is left after all creditors are paid.

Property Investments have limitations too….

- Rent-fetching Property Investments are no doubt a good investment. I always recommend my clients invest in properties that can provide a regular rental income. However, property prices and rental yields are decreasing globally

- In light of the increasing costs of owning and maintaining a property in Dubai, It is recommended that the income from property investments cannot be solely relied upon for support during retirement.

- When in need of cash for an emergency, a property cannot be liquidated at a desired price quickly, hence it is advised to include investments that can easily be liquidated in the event of an emergency.

Peace of Mind…..

A prudent retirement plan will shield the business owner/partner, from all uncertainties and provide him with a secure future irrespective of the performance of his business.

To know more about Retirement Planning for Business Owners please Arrange a Free Consultation.

Click here to arrange Free Consultation

-2.png?width=300&name=5%20Easy%20Steps%20to%20Achieve%20Your%20Short-Term%20Financial%20Goals.%20%20(350%20%C3%97%20250%20px)-2.png)