Market Linked

Oman Insurance Smart Invest: Short Term Investment Plan

Smart Invest is a unique & compelling short-term investment proposition from Oman Insurance.

MetLife in UAE has launched Investor Advantage - a unique Investment Plan.

It offers both Lump-sum or Regular Premium Investment options.

It is the only savings plan in UAE with the premium payment term as low as one year...

.jpeg?width=712&name=House%20standing%20out%20of%20crowd%20isolates%20over%20a%20white%20background%20(1).jpeg)

The Investor Advantage Plan aims to help expats save and invest during the current times of uncertainty, where they are not sure if they can continue investing for the long term.

The following are the highlights of the features and benefits of the plan, followed by my summary and review.

This plan has the following five premium payment options;

In addition to the above premium payment options, it is also possible to invest additional lump sum premiums at any point (Minimum Investment $250)

The wide choice of premium options helps investors with different investment needs and cash flow situation to invest on their own terms.

For Eg: You can invest in this plan by paying only 12 months premiums with a maturity term of 5 years only...

Which means you can pay 12 monthly premiums only and average his unit buying cost over a period of 12 months.

MetLife offers more than 180 direct funds for investing

This wide range of investment funds helps you create a robust portfolio of low-cost index funds & Mutual Funds depending on your investment goals and horizon.

|

Contribution period

|

12, 24, 36 or 48 months

|

|

Payment Modes

|

Single/Annual/Monthly

|

|

Currency

|

USD, GBP, EUR

|

|

Maturity

|

Age 95

|

|

Death Benefit

|

101% of the account value

|

|

Payout Option

|

Lumpsum or annuity

|

|

Partial Withdrawals

|

Four free partial withdrawals per year subject to maximum withdrawal limits

|

|

Fund Switching

|

Unlimited and free

|

Investor Advantage has built-in life insurance. In the event of the policy holder’s death, 101% of the account value will go directly to the beneficiary. It helps avoid unnecessary inheritance challenges and implication of Sharia Law.

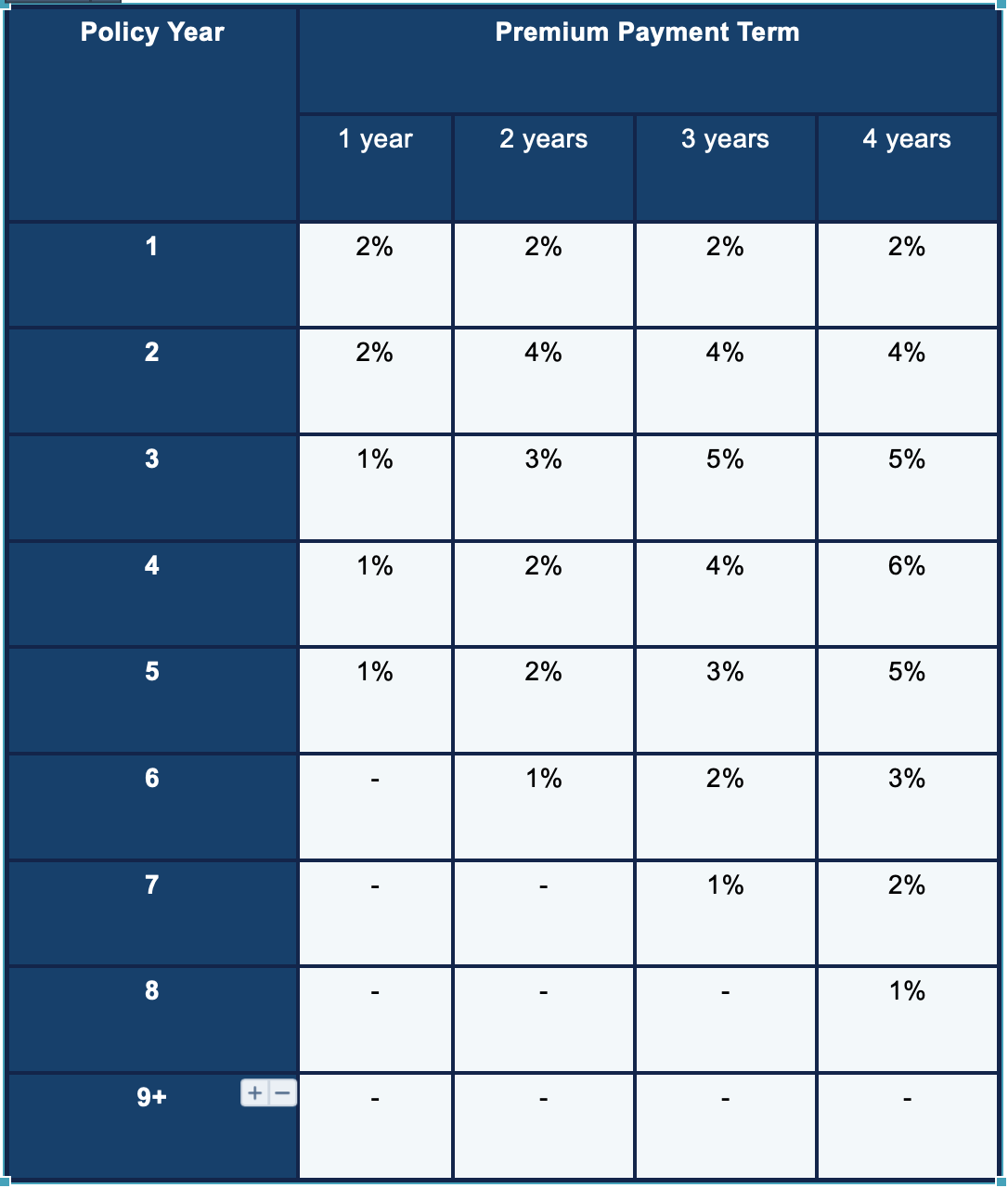

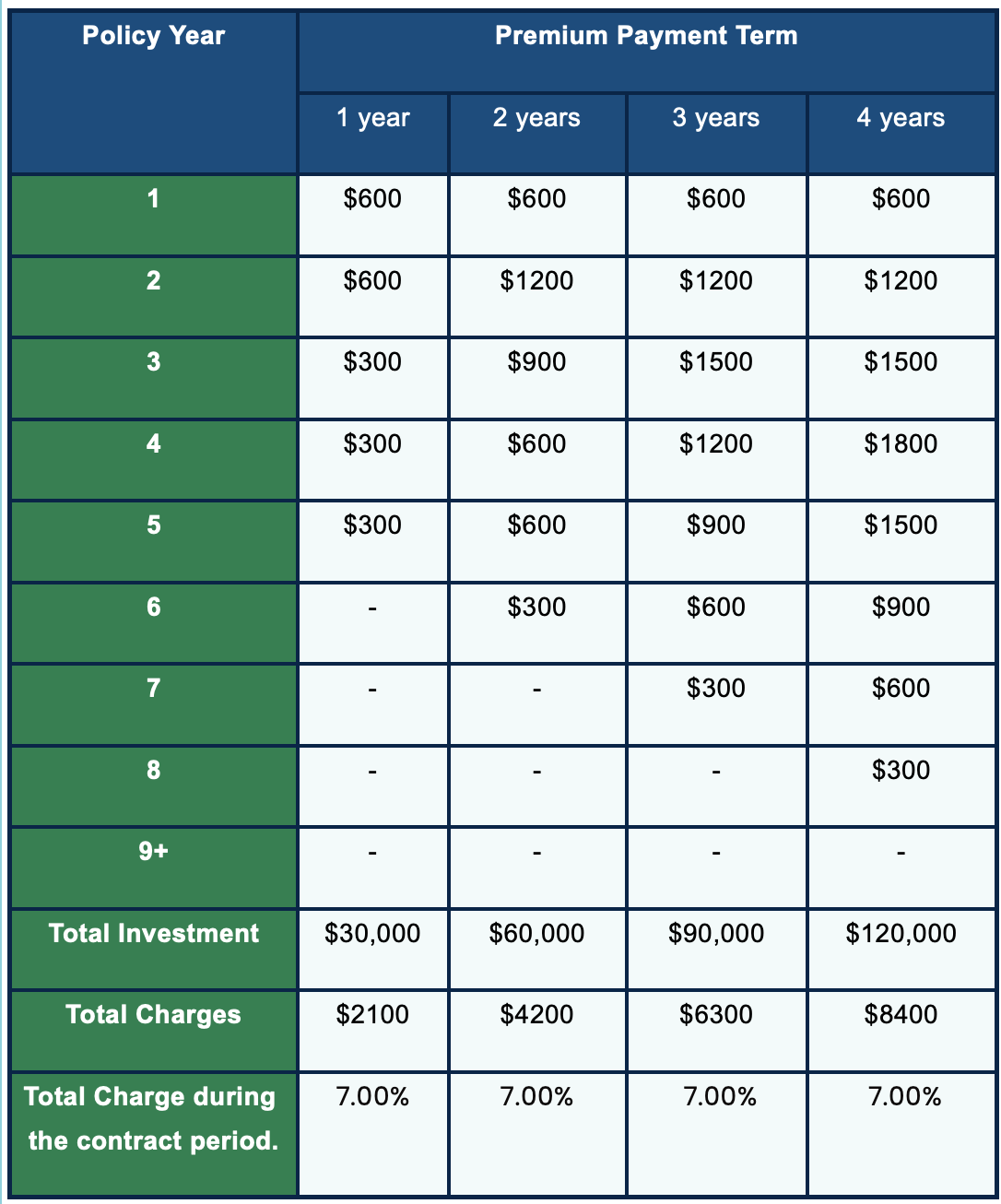

The charges of this plan are based on the planned premium or the first year premium.

The following table shows you the charges payable each year for an investment of $30,000 for different premium payment terms;

The following table shows you the charges payable each year for an investment of $30,000 for different premium payment terms;

The charges are based on the contract term (between 5 - 8 years for different premium options). There are no premium charges after the contract period.

Also, there are no surrender charges after the contract period.

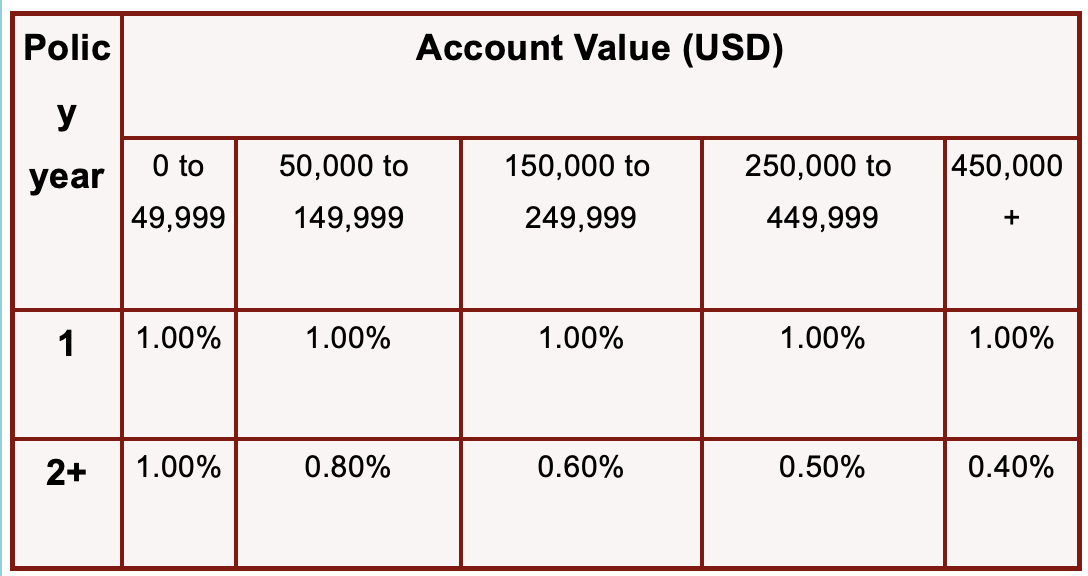

While the premium charge is taken only during the contract term, the M&E charge continues throughout the period the investment is held with MetLife.

Given the short term contract of the Investor Advantage(5 to 8 years) surrenders are better avoided. In the event of early surrender, the charges for early withdrawal are a lot.

However, partial withdrawal is free four times a year.

-2.png?width=154&name=Damodhar%20Round%20Home%20(1)-2.png) As an Independent Financial Advisor, I can help you set up a Holistic Financial Plan and choose the most suitable investment/protection plans available in UAE.

As an Independent Financial Advisor, I can help you set up a Holistic Financial Plan and choose the most suitable investment/protection plans available in UAE.

My professional qualifications include certifications in Financial Planning, Investments and Insurance from CII - The Chartered Insurance Institute - UK - the premier professional organization in the insurance and financial services industry.

You can view the testimonials of my clients here.

Click here to arrange a free consultation

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

Smart Invest is a unique & compelling short-term investment proposition from Oman Insurance.

The Vanguard Story: A Revolution in Investing

Are you looking to get the most out of your Zurich Futura plan?