Medical Insurance companies in Dubai, Medical Insurance Dubai, Essential Benefits Plan

Essential Benefits Plan or DHA Plan for Dubai Visa holders

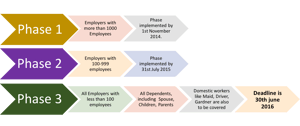

The Health Insurance Law of Dubai No 11 of 2013 makes it mandatory for all Residents of Dubai to...

Medical Insurance for Dependent Parents in Dubai, is now mandatory according to the DHA Health Insurance Law.

It can be broadly classified into the following 2 categories;

Comprehensive Medical Insurance.

If you are looking to know more about the essential benefits plan, click here.

If you are looking to know more and buy the comprehensive benefits plan, read further;

The following is the list of Medical Insurance companies that provide comprehensive medical insurance for parents in Dubai;

The premium plans offer the following benefits;

These plans can only be availed after Full Medical Underwriting for each individual applicant. Prior to availing of the insurance, each applicant has to complete a comprehensive medical questionnaire to provide complete details of medical history, lifestyle, and current health status.

Based on the underwriting the final premiums will be confirmed by the insurance company.

Please note that the insurance provider can decline cover for non disclosed pre-existing conditions

Each insurance company and plans have specific exclusions, it is advisable to obtain a copy of the TOB and the policy wording and review them thoroughly before buying a policy

The Premium or Comprehensive Benefits Plans offer a much better for dependent parents in UAE, however, the premiums can be higher in comparison to the Essential Benefits Plans.

For people who are looking for medical insurance only for visa purposes, it is better to buy the Essential Benefits Plan. For those who are looking to avail of proper medical coverage at premium hospitals, you can choose from one of the above-mentioned companies

Click here to arrange a Discovery call to discuss your coverage needs.

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

The Health Insurance Law of Dubai No 11 of 2013 makes it mandatory for all Residents of Dubai to...

The post provides a list of Medical Insurance companies in Dubai.