life insurnace, Life Insurance mistakes

6 Crucial Life Insurance Mistakes to Avoid in UAE

Financial mistakes are not uncommon.

You may get away when you make some, but a mistake while...

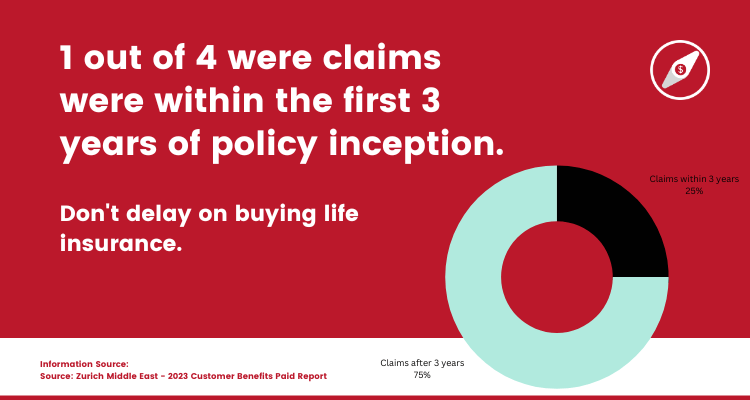

25% of Zurich's claims were from policies issued within just three years of inception.

Even more startling, 85% of these claimants had no prior medical history or existing ailments.

(Source: Benefits Paid Report 2023 - Zurich Middle East)

Pause for a moment...

And imagine the dire consequences if they had postponed their decision to purchase a policy for another year or two.

The outcome could have been devastating.

Fortunately, these claimants had the foresight to make a wise choice early on.

Do you have adequate life or critical illness insurance?

If not, what’s holding you back?

Waiting too long can mean higher costs—or worse, the inability to secure coverage due to age or health. If you have loved ones depending on you, now is the time to act.

The best time to buy life insurance was when you were 18. The next best time is now.

Life insurance is more than a policy—it’s a safety net for the people who mean the most to you. It’s the promise of stability when life is unpredictable

When you buy life insurance, you’re not just protecting against the unknown. You’re investing in peace of mind for you and your loved ones.

Here are five practical steps to make an informed decision:

Talk to a financial advisor to determine how much coverage you must ideally have. Take into account your family's lifestyle, goals, and aspirations, and most importantly, provide for inflation.

Compare different types of policies and providers. Understand the features, benefits, and costs.

Read the terms and conditions to understand the scope & limitations.

Nominate both primary and contingent beneficiaries on the plan.

Review your protection needs every 3 - 5 years or when a major life event like promotion, marriage, childbirth, or immigration happens.

Act now - Don't delay buying life insurance.

Imagine setting aside just AED 500 per month today. Over time, this small investment can create a safety net worth millions for your family.

Now imagine waiting until next year. The cost will certainly increase—or worse, health issues might leave you uninsured.

Why take that risk?

Every day you wait, you’re taking a gamble on tomorrow. Remember: those 25% of claimants didn’t expect to need their policies so soon—but they were prepared.

Be prepared, too. Start today.

Click here to schedule a no-cost discovery call to learn more.

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

Financial mistakes are not uncommon.

You may get away when you make some, but a mistake while...

Did you know that someone recently bought a staggering $250 million life insurance policy in Hong...

-2.png?width=300&name=should%20working%20couple%20buy%20life%20insurance.%20(350%20%C3%97%20250%20px)-2.png)

In their mid-thirties with two children, John and Jane approached me for financial planning and...