Financial Planning, Whole life insurance

What Is Whole Life Insurance: Explore Pros, Cons & Best Plans In UAE

Why do I need Whole life insurance? It is the immediate question people ask when they hear about...

It helps you achieve two goals with one plan, viz Wealth Accumulation and leaving a legacy for your loved ones.

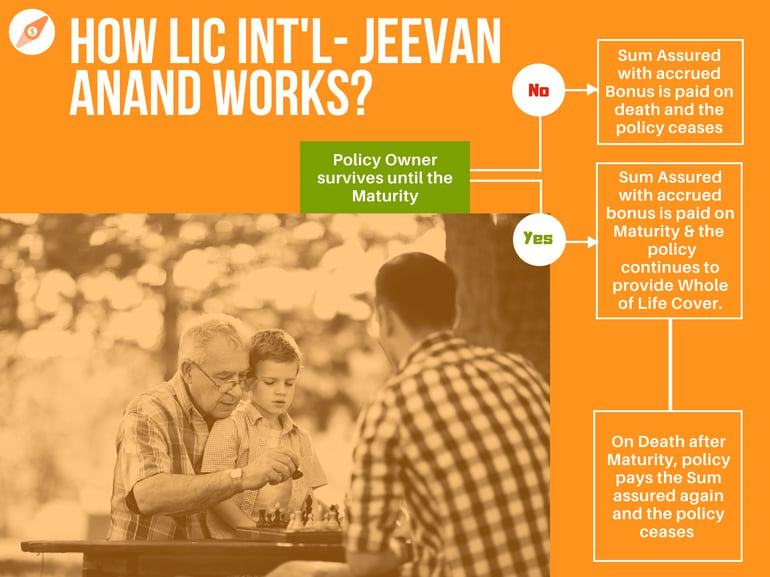

There are two possible scenarios of a claim payout and Maturity of the plan.

Scenario 1: Policy Owner survives until the Maturity

Like an Endowment Policy, Jeevan Anand will payout the Sum Assured with accrued bonus on Maturity and then it will continue to provide Whole of Life Cover.

On the death of the insured after Maturity, the policy will pay the Sum assured again to the beneficiaries.

After Maturity, the policy also provides a facility to surrender the life cover in lieu of cash value. Investors who are not very keen to continue the life insurance can cashout to maximise the returns on the plan.

Scenario 2: Life insured does not survive until Maturity

Jeevan Anand pays the Sum Assured with accrued bonus on death, and the policy ceases to exist.

This plan is ideal for expatriates looking to save for long term goals like retirement or children's higher education, with the whole of life insurance. It helps them save and protect at the same time.

| Particulars | Minimum | Maximum |

| Sum Assured | USD 5000 & then multiples of USD 1000 | No limit |

| Age at Entry | 18 Years | 65 years (age nearer birthday |

| Age at Maturity | 23 Years | 70 Years (Nearer Birthday) |

| Term | 5 years for regular and 15 years for Single Premium Policy | 20 Years |

| Mode of Premium Payment | Yearly, Half Yearly, Quarterly, Single | |

The Policyholder can avail a loan against the policy from LIC International, after three years of regular premium payment or after two years of a Single Premium Plan.

Our financial situation may not be constant throughout the term of the plan, and this should not be a reason stopping you from investing for your future.

After paying premiums for a minimum period of 3 years, if you are unable to pay further premiums; you have the flexibility of stopping future premiums by making the policy paid up.

Once the policy is made, paid-up LIC Int'l will reduce the Sum assured and other benefits in proportion to the premiums paid.

You can choose to pay your policy premiums from the following options;

If you are an NRI(Non-Resident Indian), you can have the policy serviced by a LIC branch in India if you prefer to do so. However, you would have to convert the policy to rupee denomination.

You may keep the policy as it is in USD denomination and have it serviced by your financial advisor in UAE

Jeevan Anand Policy can be the right choice if you are looking for disciplined long-term capital accumulation with stable returns and a Whole of Life Insurance.

Schedule a Free Discovery call to know more about this plan and to understand if Jeevan Anand can help you achieve your protection/investment goals

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

-2.png?width=300&name=What%20is%20Whole%20Life%20Insurance%20Why%20consider%20buying%20it%20(350%20%C3%97%20250%20px)-2.png)

Why do I need Whole life insurance? It is the immediate question people ask when they hear about...

-2.png?width=300&name=Term%20or%20Whole%20Life%20Insurance%20(350%20%C3%97%20250%20px)-2.png)

When buying life Insurance in the UAE, you mainly consider a term life or whole life insurance.

Zurich Futura: A Premier Whole Life Insurance in the UAE