NRI investment, Returning NRI, RNOR Income Tax

Simple Tax Guidelines for NRI Returning to India

INTRODUCTION:

As an NRI in the UAE, your biggest motivation for living and working in UAE could...

Rising like a Phoenix.

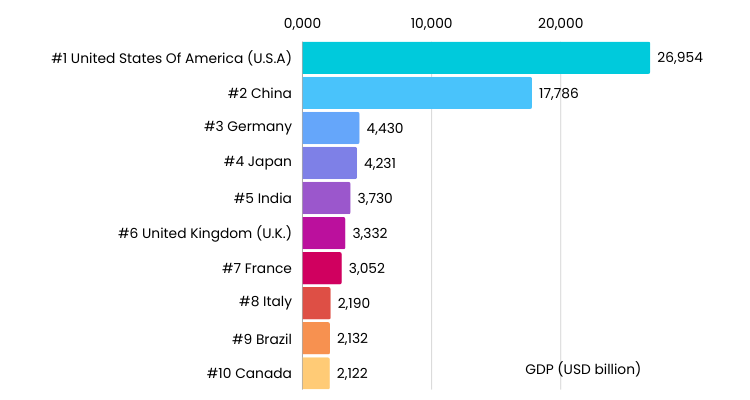

In 2013, India and 4 other countries were put in a "Fragile Five" group as they were vulnerable to various economic instabilities. In less than a decade India has made it to the top 5 economies of the world.

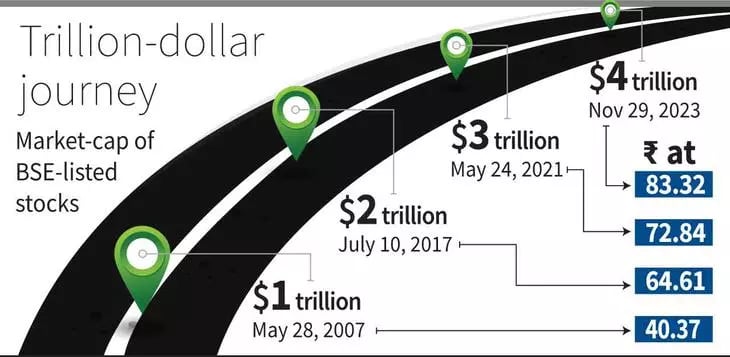

In the process Indian stock market also entered the top 5 club last year, crossing the 4 trillion dollars market cap just behind the US, China, Japan, and Hong Kong.

The growth story so far has been phenomenal and the outlook in the near and medium terms is robust.

This success is not just a reflection of the country's economic strength but also of the growing confidence of both domestic and international investors in India's market potential.

Deloitte's recent report from January 2024 is really positive about India's economy. They've increased their predictions for India's economic growth for the year 2024. They predict that economy could grow by 6.9% to 7.2%, or maybe even more in 2024. This is because India's industries are doing well and the overall economy is strong.

Also, Deloitte thinks that as the world's economy gets better in 2024, India will gain a lot from it. They believe that the global economy getting stronger will help India grow even more, making it an even bigger player in the world economy.

In Dec 2023 the Sensex breached the 70,000 mark, posting 14.46% annualized returns in the last 5 years.

Despite the harrowing impact of the pandemic, 2 wars, high inflation and a weak rupee, a young and digitally-enabled India is pushing forward its growth agenda slowly but steadily. Both local and international investors are bullish on India's growth outlook and are continuing to invest in India.

There is an enormous opportunity for domestic and NRI Investors to create and grow wealth by participating in India's growth story.

"If India continues on its present growth course, it could have a US$5.6 trillion economy in 20 years. To create a US$10 trillion economy, India will need to accelerate its growth to 9% CAGR over the next 20 years" - Future of India - The Winning Leap by PWC

While the potential for investing in Indian Mutual Funds is substantial, Non-Resident Indian (NRI) investors often face concerns regarding capital gains tax and the complexities involved in repatriating funds when these investments are made in rupee denomination.

A straightforward solution to these concerns is investing in Indian Mutual Funds denominated in US dollars or other major currencies. This approach not only enables NRIs to tap into India's growth potential but also offers several key advantages:

Hedge Against Rupee Depreciation: Investing in US dollars provides a heddle against the falling value of the Indian Rupee to some extent.

Tax Efficiency: These investments can also save you the Short term Capital gains tax(15%+surcharge) or Capital Gains tax (10%+Surcharge LTCG), making them a more tax-efficient option.

Alignment with Financial Goals: Such investments are particularly well-suited for meeting significant financial objectives, including children’s education savings, retirement planning, and immigration-related funds.

Ease of Investment and Repatriation: Investing in US dollar-denominated funds simplifies the process, eliminating the challenges associated with repatriating investments.

Given the opportunity and the above advantages, NRI can invest in India in US Dollar-Denominated Mutual Funds.

Additionally there are also many US dollar denominated ETFs and Stock ADRs as well.

There are many platforms, facilitating a seamless and tax efficient investment experience in Indian Mutual funds for NRIs.

With one-sixth of the global population, India has the necessary Intellect, Passion, Hunger, Energy, Entrepreneurship, and Creativity to grow as an economic superpower in the next 2 decades.

"Growth of 7% to 8% is a given in India provided we don’t do something drastically wrong. If we start executing and implementing, we can achieve growth of another 2%". Raghuram Rajan - Ex Governor Reserve Bank of India

Investing in Indian Mutual Funds and ETFs in USD can provide an NRI in UAE a best of both worlds advantage.

As an Independent Financial Advisor, I am able to help you set up a Holistic Financial Plan and choose the most suitable investments to help you achieve your goals.

My professional qualifications include certifications in Financial Planning, Investments, and Insurance from CII - The Chartered Insurance Institute - the UK - the premier professional organisation in the insurance and financial services industry.

You can view the testimonials of my clients here.

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

As an NRI in the UAE, your biggest motivation for living and working in UAE could...

When it comes to NRI insurance and investment, many...

10% LTCG was re-introduced yesterday in Budget 2018 by India's Finance Minister, Mr Arun Jaitely.