Life Insurance, Zurich Futura

Zurich Futura insurance With Enhanced Living Benefits

Zurich International Life (ZIL) has recently launched an updated and enhanced version of Zurich...

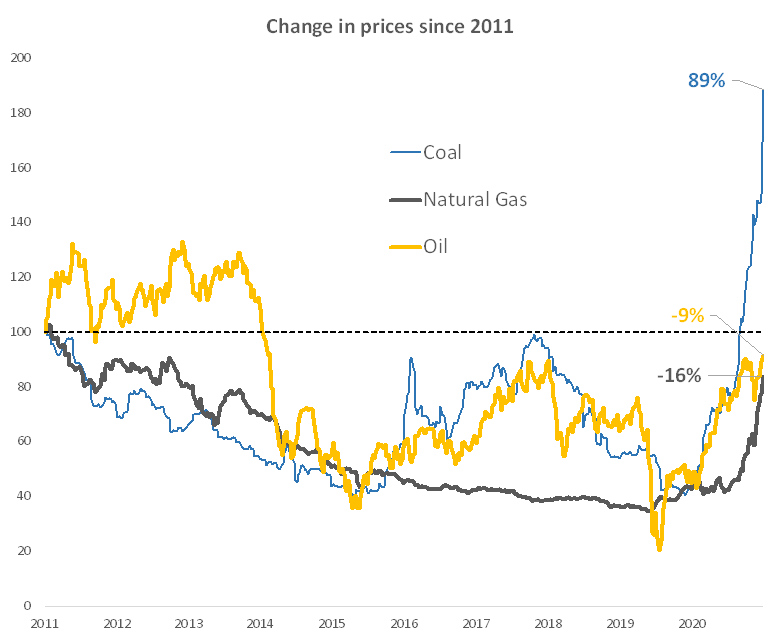

After reading all the negative news during the weekend, investors with an itchy-trigger-finger clicked the sell button on Monday last week. The markets opened in the red as the energy demand and prices skyrocketed.

US crude oil prices climbed for the seventh week in a row to almost $80 a barrel. Oil, gas, and coal prices continue to rise due to increasing consumption and supply chain fears.

Source: Bloomberg

Source: Bloomberg

Later in the week, the markets rose sharply to pare the losses as a temporary deal to raise the debt ceiling by USD 480 billion was signed. This puts to rest the concerns of the government shutting down or the US treasury default until December 2021.

By the end of the week, The S&P 500 was up by 0.8%, the DOW by 1.2%, and the Nasdaq by 0.1%.

The Earnings season is back in action with a positive outlook, with major banks set to release the Q3 results during the week.

Thanks to stellar earnings growth in Q1 and Q2, S&P 500 companies' dividend payout has increased by $20.90 billion this year. According to S&P Dow Jones, this is the most significant net gain in the last nine years.

Although volatile during the week, European equities ended the week higher. The Euro Stoxx index was up by 0.97%, and so were individual country indices, with Italy's FTSE MIB Index being the highest climbing 1.70%.

Natural gas prices rose to record levels as demand increases and supply is short. With the economy opening up and the winter around the corner, energy demand will continue to increase in Europe.

Stocks in Japan continue to slide for the third week in a row, as the Nikkei index fell by 2.51% last week.

Despite energy shortages and corporate debt crisis the CSI 300 Index was up by 1.31%, and the Shanghai Composite Index gained 0.67%.

With celebrity investors like Charlies Munger leading the way, investors are looking beyond China's regulatory challenges and debt crisis to buy the dip.

Both on global cues and accommodative monetary policy, Indian equities ended the week on a high note.

During the week, the Sensex gained 1,293.48 points, settling at 60,059.06, and the Nifty rose by 363.15 points to settle at 17,895.20.

Rating agency Moodys upgraded the Indian sovereign outlook rating from negative to stable as India is slowly emerging from the COVID crisis.

The Rupee continues to depreciate reaching 20.50 to AED on Friday. Expats in UAE were unsure whether to be happy for being able to send more rupees home or be concerned about their declining wealth when expressed in AED or US Dollar terms.

With appreciating dollar, rising energy costs and potential increase in interest rates, Indian equities could see some volatility in the short run.

While investors were value shopping for companies like Alibaba, I was shopping for groceries during the weekend and noticed a significant increase in prices across the board!

Did you also see this increase?

Dairy, pulses, vegetable, and meat prices have risen significantly, with some items witnessing double-digit growth in prices.

The rents and property prices are also increasing sharply, indicating a bullish trend in UAE. Hopefully, the salary rises come next year as predicted by analysts.

While the recent increase in inflation impacts many households' budgets, it also highlights the impact of inflation in the future.

Inflation is the most potential, but least understood financial risk. It works against you relentlessly, eating away the purchasing power of your wealth.

With the interest rates expected to be low for at least a few years, the only antidote for inflation is diligent savings and prudent investing in assets in line with your risk appetite and financial goals.

As stated last week, if you were uncomfortable with the volatility in September, it is likely that your portfolio is not aligned with your risk appetite. Speak to your financial advisor to reduce risk and realign your portfolio to your risk appetite, investment goals and horizon.

Arrange a free consultation for a quick review of your financial plan and investment portfolio.

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

Zurich International Life (ZIL) has recently launched an updated and enhanced version of Zurich...

Critical Illness Insurance-Real Stories That Prove Its Value

In the UAE, choosing the right life insurance often comes down to Term Insurance or a Whole Life...