Life Insurance Dubai

How to determine how much life insurance you need?

Life insurance is perhaps the only product you will buy, hoping you don't have to use it anytime...

Humans are creatures of habit.

Although we like to believe that we live by our free will, most of our actions are guided by our habits and environment.

Psychologist John Bargh of Yale University says, "It's difficult for people to accept, but most of a person's everyday life is determined not by their conscious intentions and deliberate choices, but by mental processes put into motion by the environment."

This may be why we do things we don't want to and avoid things we should be doing. for Eg: spending more than we should be instead of saving and investing.

Does that mean that we have no agency in our actions?

That is also far from the truth...

We can guide our actions to a large extent by managing our habits and the environment we are in.

To manage our environment and habits, we must find the patterns influencing our desirable and undesirable actions.

Like how you can influence your actions by managing your habits and environment, you can also influence your expenses.

Welcome to Day 5 of the 30-Day Win With Money Challenge.

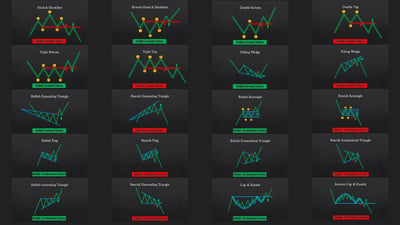

Patterns are powerful, we can obtain useful information by interpreting patterns.

(Did you know that Chart Patterns are used by technical analysts to determine market trends for making trading decisions accordingly)

Today's task is to identify your spending patterns over the last 3 - 6 months to help you manage your expenses efficiently.

How do you do this?

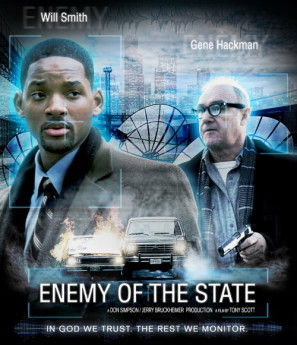

Have you seen in crime movies a detective usually goes through the bank/credit card statements to find patterns and know about the suspect

You are going to do the same thing today.

Pull out your last six months' bank and credit card statements, wear your detective hat and execute the following steps.

( Source: https://movieposters2.com/)

Scrutinize your expenses to find the following;

You will be surprised to find a distinct pattern in your spending.

Carefully analyze each expense and classify them into one of the following categories;

You can use an excel sheet to make the calculations easy. Once you have completed the classification, you can understand how much you are spending on needs, wants and luxuries.

While it is difficult to determine your situation's ideal ratio of expenses, you can use the broad 50/30/20 rule to guide you.

US Senator Elizabeth Warren and author of the book All Your Worth: The Ultimate Lifetime Money Plan prescribes the 50/30/20 rule.

Suppose your spending pattern is in line with or better than the 50/30/20 rule, Kudos. Keep it going this way.

If you spend more than 50% on needs and 30 % on wants and luxuries, then you have little or no opportunity to build long-term wealth.

If this is the case, you should look for ways to reduce expenses and debt.

Tomorrow we will focus on devising a strategy to destroy debt, and on Day 7, we will learn how to trim the fat(expenses).

All the best with your investigation.

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

Life insurance is perhaps the only product you will buy, hoping you don't have to use it anytime...

Major Ailments like Cancer, Stroke or organ failure can keep a person away from work for months or...

Buying life and critical illness insurance for a working member in a family is a no brainer. It...