There was an unprecedented erosion in bond values in 2022. We have not seen such a crash in the last two centuries!

Traditionally bonds play the role of a lifebuoy when the stock markets sink. Last year was an exception when even the bonds went down with the stocks.

Why did the bonds go down in value?

Bond prices crashed last year as the U.S. Federal Reserve aggressively raised interest rates to fight inflation.

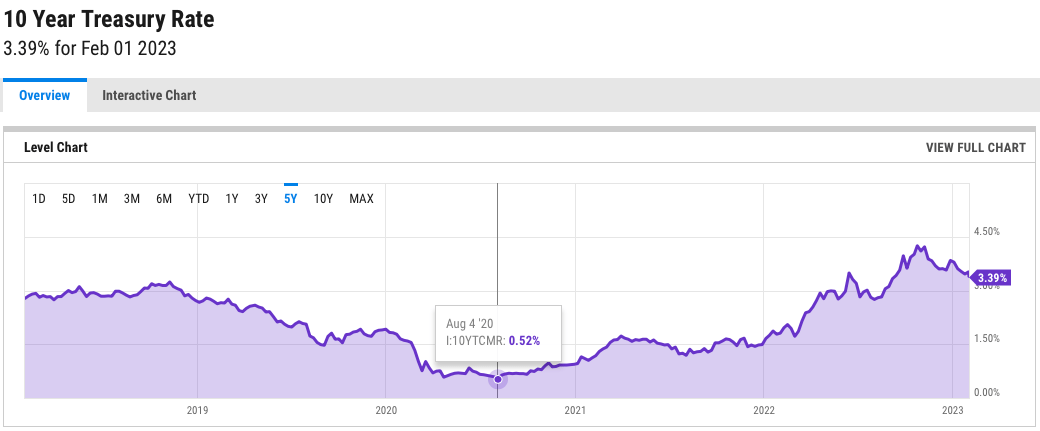

Over the last year, the Fed has raised rates from zero to almost five percent. At the same time, 10-year bond yields have increased from 0.52% in 2020 to 3.39% in 2023.

What is the connection between interest rates and bond values?

Typically bond prices have an inverse relationship with interest rates. Bond prices go down when the interest rates go up and vice versa.

Imagine you and your friends jointly owned properties in a community. There is a new community developed nearby where the rental yields are higher than yours.

People seeking a higher rental income would sell the property in your community and flock to buy in the new community. As a result, the prices of your community will start falling to the level where the rental yields are similar to the new community.

This is precisely what is happening in the bond markets.

When bond prices go up, the value of the bonds you and others already hold will decrease because people will start selling them to buy new bonds that offer higher interest on the money lent.

On the other hand, when interest rates start falling, existing bonds will be more in demand because they will offer a higher return than the new bonds being issued.

Are bonds no more a safe haven?

Considering that the Global bond market was $126.9 trillion as of 2022, it is too big to remain volatile for an extended period.

Also, inflation more or less peaked, and the rate of increase of interest rates has come down; we expect the return of sanity in the bond markets shortly.

Also, given the sharp reduction in bond prices, it can be an opportunity for long-term investors.

Click here to learn more about bonds.