Business Protection, Keyman Insurance

Keyman Insurance in Dubai for SME - Financial Planning in Dubai

Who is a Keyman?

A keyman is a person who is responsible for the revenue, profits, growth, and...

Why do I need Whole life insurance?

It is the immediate question people ask when they hear about such policies.

I guess you also have this question in your mind.

Let’s discuss further why a Whole Life Plan can benefit you and if you should consider buying one.

As the name suggests, it provides life cover for the whole of your life. In addition to life cover, it also includes investment, accumulating a cash value over the life of the plan. The cash value is one of the crucial elements of whole life insurance.

In UAE, most whole-of-life policies are unit-linked and offer the most important critical illness benefit for the insured’s whole life.

Zurich Futura, Metlife Future Protect, and Hyat Plus from Salama are Unit Linked whole of life plans available in UAE.

Such policies were designed to address the shortcomings of term insurance.

The biggest challenge with term life insurance is that it offers cover for a fixed term and fixed benefits.

If the insured dies after the policy term ends, the beneficiary does not receive the death benefit, nor do they get back the premiums paid.

All the premiums paid into a term insurance plan are an expense, and the money cannot return.

You can compare Term Insurance to a rented house, where you can live as long as you pay rent; if you stop, you can no longer live there. When you leave the house, you do not get back the rent you have paid.

On the other hand, Whole Life Plans are like your own house on a mortgage payable over a certain period; Once the mortgage is paid, the property is yours.

When you sell the property, you can expect to get more than what you have paid; similarly, a whole-of-life plan pays out a cash surrender value when you feel that you no longer need cover and surrender the plan with its benefits.

Buying a whole-of-life insurance policy is a good idea if one or more of the following benefits are important to you;

People are more likely to get major ailments during old age. Thanks to medical advancements, people survive even after a Major heart attack, cancer, or other complicated illnesses.

However, the treatment of such ailments can deplete your retirement savings quickly. Hence having a Whole Life cover with critical illness benefits can protect your retirement savings and ensure that you can maintain financial independence and lifestyle when recovering from a major ailment.

Most whole-of-life insurance plans in UAE cover critical illness till age 95 - 100. If you are concerned about depleting your retirement savings in the event of critical illness after 60/65, then a whole-of-life plan is ideal for you.

Whole-of-life Insurance is an ideal tool for building a significant legacy at an affordable cost. It is the quickest and most affordable way to ensure your loved ones have a big inheritance.

You may have to earn, save and invest for many years to build a multi-million dollar legacy. However, you can achieve this goal through Whole Life Insurance at a fraction of the cost.

For people who are young, especially less than 40 years of age, buying a whole of life plan with critical illness benefits is a very good idea.

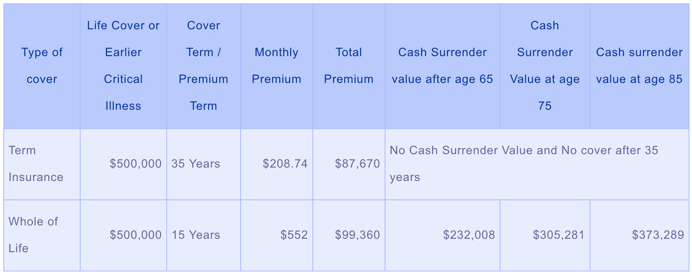

Let us see the following example: John is 30 years old, Non-Smoking Male.

In this example, it is evident that although Whole of Life Insurance seems costly because of higher monthly premiums, it is cheaper than term insurance if a long-term view and cash surrender value is considered.

Most Whole of Life Insurance plans in UAE are very flexible.

You can increase or decrease the premiums and cover after two years, you can also add or remove additional riders like permanent total disability benefit, Accidental death benefit, dismemberment benefit, and Family income benefit at any point in time.

Sometimes you have many financial commitments or a job loss situation. Subject to the cash value being available in your plan, you can take a premium break by making your policy paid up.

You can avail of this facility if you are unable to pay premiums for a certain period while the continuing cover and other benefits during the premium holiday facility.

As discussed earlier, the Whole of Life policy has an investment component and hence a cash surrender value. You can choose to surrender your plan in lieu of cash if you decide that you no longer want the life and critical illness cover.

If you surrender your plan early, then the surrender value would be low, and if you wait till you are more than 70 or 80, your cash surrender value will be significantly high in comparison to the premiums you would have paid into the plan.

Click here to learn more about the difference between Term Insurance & Whole Life Insurance.

Whole of Insurance is ideal for long-term protection needs; although the monthly premiums are usually higher than term insurance, it costs less in the longer term.

Zurich Futura, Metlife Future Protect, and Hyat Plus from Salama are some of the good whole-of-life plans available in UAE.

To know more about Whole life plans or to help you choose the most suitable plan with complementing riders, Arrange a free Initial Meeting.

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

Who is a Keyman?

A keyman is a person who is responsible for the revenue, profits, growth, and...

Understanding Life Insurance

The Story of Critical Illness Insurance.

Critical illness insurance was invented by Marius...