Financial Planning, Zurich Insurance

Zurich Insurance Dubai - Life, Savings & Investment Solutions.

Zurich International is a leading international insurance and investment provider.

They serve...

When it comes to NRI insurance and investment, many Indians prefer investing back home in India.

The challenge with sending money to India for investing in FDs, Mutual funds, Stocks, or Bonds is the continually depreciating Rupee and repatriation of money.

A wiser alternative would be to Invest in US Dollar-denominated investment and insurance plans in UAE.

The following are some of the benefits of buying a US Dollar based Life Insurance plan in UAE from companies like Zurich International Life, LIC International, Friends Provident, and Oman Insurance;

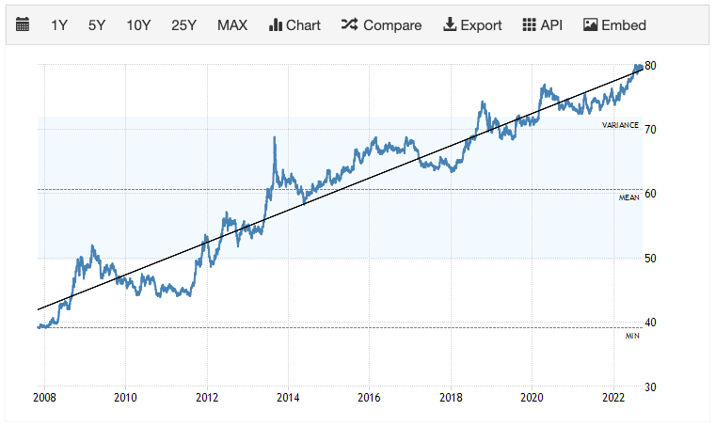

Indian Rupee has depreciated by more than 50% between 1st Nov 2007 and Sep 2022, losing more than 3.36 % in value each year.

If you purchased an insurance plan for INR 1 Cr in 2007 to protect your family, with an exchange rate of INR 39.45 per Dollar, amounting to $253,485/-

Its current value in US Dollars would be $125,549.27/- at an exchange rate of INR 79.65 per Dollar( as of 20/09/2022)

If you had purchased a US Dollar-denominated policy for $253,485/-, its current value in INR would be 2,01,90,080/-( as of 20/09/2022)

As an NRI, when you have an option of investing in a USD denominated insurance or investment! Why would you want to invest in plans whose value is going down consistently?

The money they would get after currency exchange from an insurance policy in India would be much less. Thus defeating the whole purpose of having insurance in place.

Insurance plans in India have a limited scope of Critical Illness coverage. The terms of critical illness cover not well defined, leaving ample room for misinterpretation and misselling.

Insurance plans in UAE have a wide and defined scope of Critical Illness cover on par with international standards.

Some companies cover up to 36 Critical illnesses, including Permanent Total Disability.

Also, the concept is relatively very new to Indian Insurance companies, with very little or no data or history on claims.

Most of the insurance plans in the UAE are offshore-based. Hence they are portable around the world. The claim proceeds can be paid tax-free into the account chosen by the beneficiaries.

Being offshore plans, these plans are out of Shari'a law's purview. They ensure that the beneficiaries get the proceeds of the claim without any hassles.

Thanks to the higher life expectancy in UAE, better living conditions, and quicker access to emergency medical assistance, the cost of Life insurance is more economical in UAE than in India.

Many insurance providers like Aviva, HDFC Standard Life, Aegon Religare, Birla Sunlife, max New York, LIC of India, and ICICI Prudential, in India, provide online term insurance plans at very attractive rates, but most of these do not cover NRIs.

After Covid-19 only HDFC and TATA AIA provide life insurance for NRI, and they also do not provide critical illness benefits and other riders.

The cover items of insurance plans in the UAE are longer than that of India. Most term Assurance Plans cover up to the age of 74; a few also cover up to age 100.

The Whole of life plans from Zurich, MetLife, and Salama provide a Whole of Life cover for both life cover and critical illness, providing an ideal protection solution.

The claim process is simple with clearly defined claim processes.

To know more about Dollar-based NRI Insurance and Investment plans in UAE, clcik the link below.

Schedule a Free Discovery Call

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

Zurich International is a leading international insurance and investment provider.

They serve...

-2.png?width=300&name=Six%20crucial%20differences%20between%20Islamic%20&%20traditional%20life%20insurance.%20(350%20%C3%97%20250%20px)-2.png)

For Muslims, Islamic Life Insurance or Takaful Plans are an excellent alternative to traditional...

Zurich Futura: A Premier Whole Life Insurance in the UAE