Investments

Why Invest Your Savings? 4 Key Reasons

It is a well-known fact that money doesn’t grow on trees, but you can certainly grow money when you...

"Anyone can cook!" - Chef Gusteau, Ratatouille

It's a powerful message—that greatness can come from the most unexpected places, and with the right mindset, anyone can achieve it.

.webp?width=595&height=578&name=Anyone_Can_Cook%20(2).webp)

The same principle applies to investing. You don’t need to be a financial expert or have a fortune to start. Like anyone can cook, anyone can invest—including you.

Investing isn’t just for the wealthy or the financially savvy; it’s a tool anyone can use to shape their future.

Whether you’re an expat who’s just arrived or someone who’s been here for years, understanding why people invest, can be the catalyst to start your journey to financial freedom.

Here are ten powerful reasons why people invest—and why you should too.

One of the primary reasons people save and invest is to grow their wealth.

Investments, particularly in assets like stocks, real estate, and mutual funds, have the potential to yield significant returns over time. As an expat in the UAE, you have the unique advantage of tax-free income. By investing your surplus income, you can leverage this benefit to accumulate wealth faster than you could in many other parts of the world.

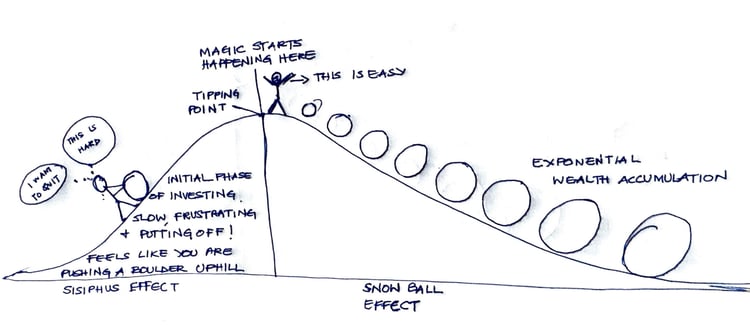

In the initial stages of your investing journey, it can feel like a lot of effort with little visible progress. You might invest regularly, but the growth seems slow, and the returns might not be impressive. This can be discouraging, but it’s a normal part of the process. Early on, much of your investment gains might go towards overcoming initial costs, fees, or market fluctuations, making it feel like you’re constantly pushing that boulder uphill.

Once you reach the tipping point, the snowball effect takes over and magic starts happening. For expats with a tax-free income, this becomes an even more powerful tool—allowing your money to grow exponentially. The earlier you start investing, the more you benefit from compound interest, where your earnings generate even more earnings.

Inflation is the most potential and least understood financial risk. What you can buy today using 100 dhs will cost more next year and every from then. Unless your income and wealth are increasing at a rate on par or higher than inflation, you may not be able to maintain the current lifestyle.

While your income may or may not keep up with inflation, you can certainly invest in assets that can consistently beat inflation.

There is always a higher uncertainty of income for expats. It can reduce drastically when you move out of the UAE. What happens if your income is interrupted temporarily or permanently?

Relying solely on your salary can be risky.

Investing provides an opportunity to create additional and dependable streams of passive income. It could be in the form of dividends, pensions, rental income, or capital gains, these additional streams can provide financial stability and security, which is particularly important for expats like you and me.

Retirement might seem like a distant dream, especially if you’re young and enjoying your time in the UAE. However, the earlier you start investing, the more time your money has to grow. Given the transient nature of expat life, planning for retirement is crucial.

Whether you plan to retire in the UAE, return to your home country, or move to a new destination, a well-thought-out investment plan will ensure you have the funds to enjoy a comfortable retirement.

Whether it’s buying a house, starting a business, or funding your children’s education, investments can help you achieve these goals. As an expat, you might have unique financial objectives—like buying property back home or saving for international higher education for your children.

By investing, you can put your money to work and align the outcome with your life goals, making them more attainable.

Also, when your money is at work you don't have to do all the heavy lifting by yourself.

Offlate, the Financial Independence and Retire Early(FIRE) culture is catching up fast among young and aspiring expats. Investing your surplus income is the path that can make this happen.

By building a diversified portfolio, you can create multiple streams of income. This passive income can one day cover your living expenses, allowing you to work by choice, not necessity.

For expats, who often have a limited working period abroad, investing is essential to ensure you have the freedom to live life on your terms when you eventually return home or move elsewhere.

For many, the dream of owning a big house, a luxury car, or other high-end assets is a powerful motivator to invest. By strategically growing your wealth, you can afford these luxury items without compromising your financial stability. Investments in stocks, real estate, or businesses can provide the substantial returns needed to make these dreams a reality.

Many people invest not just for themselves, but also to build generational wealth. As an expat, you might be focused on providing for your family and ensuring that they have a secure future.

Investing allows you to build a legacy that can support your loved ones long after you’re gone, whether through education funds, property, or a thriving portfolio.

Investing allows you to align your money with your values in two powerful ways:

Investing isn’t just about making money; it’s about the satisfaction of seeing your investments grow and reaching your financial goals.

This feeling can be incredibly motivating and is why many wealthy people, like Warren Buffett and Oprah Winfrey, continue to invest even after achieving financial success.

They enjoy the process of growing their wealth and the fulfillment it brings, showing that investing is more than just a financial activity—it’s a rewarding journey.

If you’re not already investing, the best time to start is now.

The UAE offers a unique environment for wealth accumulation, and as an expat, you have the opportunity to make the most of it. Whether you’re new to investing or looking to expand your portfolio, remember that every investment, no matter how small, is a step towards financial freedom.

Investing isn’t just about growing your money; it’s about securing your future, achieving your dreams, and building a legacy. So, take charge of your financial journey today and start investing.

Your future self will thank you.

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

It is a well-known fact that money doesn’t grow on trees, but you can certainly grow money when you...

Luxuries of the past have become the needs of today; e.g. Private Schooling, Branded Clothing,...

A runway serves two purposes: taking off and landing. Pilots rely on it at the beginning of the...