Weekly Market Update

Energy, Inflation and Value Shopping.

After reading all the negative news during the weekend, investors with an itchy-trigger-finger...

Risk and volatility have been often interchangeably misapplied by investors and finance professionals, more so in the recent past.

There has been a massive influx of novice investors and financial advisors in the last decade, thanks to the internet, social media and the trading apps, increasing awareness and providing easy access to the markets.

When markets go down, people freak out; some even repent their decision to invest in stocks/funds. A few even decide to pull out, hoping to cut the losses.

I have heard many people saying "I have lost XXXX dollars in the stock market, no way I am investing ever again in it" You would also have heard people saying so, haven't you?

Also Read: 5 Reasons why people fail at investing?

My answer to such people is as follows;

If you know the difference between risk and volatility, you can mitigate risk to a large extent, and adapt volatility as an inherent nature of investing. This will help you make better investment decisions and avoid the panic when the markets go down.

While there may be some correlation between market volatility and risk, they are not the same.

Confusion between these two usually leads to irrational investment decisions, causing financial loss in the short term and impairing your wealth accumulation strategy in the long run.

Knowing the difference between these two can vastly improve your investment GAiM plan.

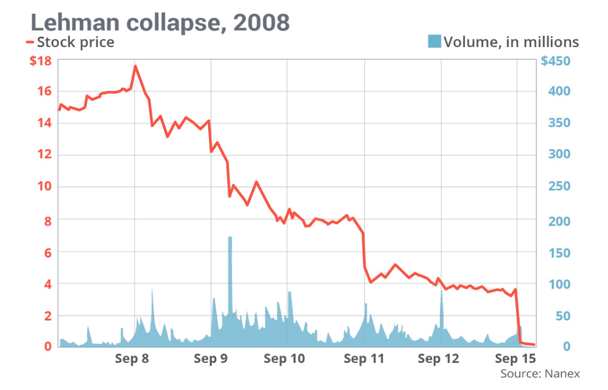

The possibility of you Irrecoverably losing some or all of your capital invested can be defined as Investment risk. For Eg: Investing in a Ponzi scheme, Investing in a CFD, or an investment in a stock/bond and the company going bust.

There is next to nil chances of recovering your capital back when you have lost it in a Ponzi scheme or a CFD speculation.

As an equity investor, you come last in the order, and you will receive whatever is left after paying off all the creditors(if anything is left at all) on liquidation. As a bond investor, you would be higher in the order before the shareholders, so you have more chances of receiving some or all of your capital back.

Source: Marketwatch.com

In everyday life, we tend to think of risk as uncertainty, or what is left over after we have thought of everything else. - Carl Richards

This brings us to another dimension of Investment risk. It happens when the need for your money coincides with uncertainty in the markets, and you have no other option but to sell at a loss.

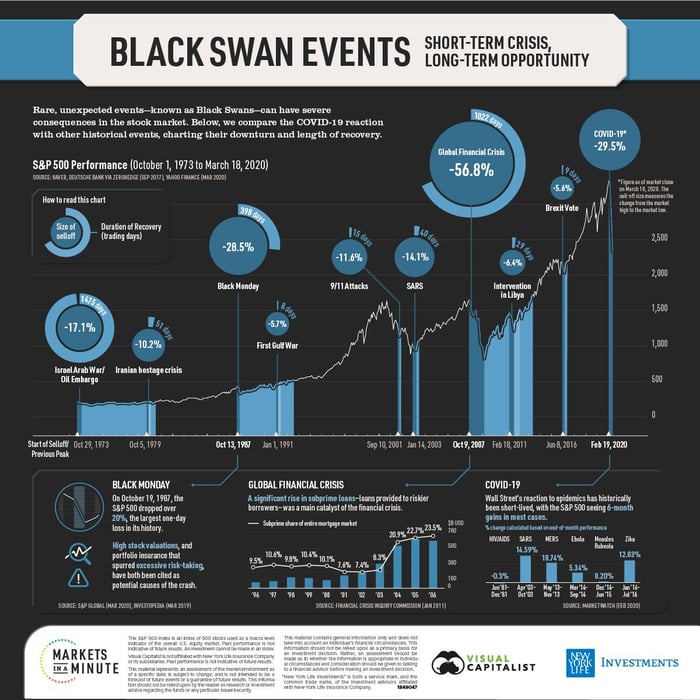

Image Source: https://www.visualcapitalist.com/

So let's assume John invested his savings in the stock market in 2006, just before the Global Financial Crisis and the markets crashed in 2008 by 56.8%. Unfortunately, John's position was made redundant, and his income stopped. He had no other option but to sell his investments at a loss to manage his expenses.

Or let's look at an example of Smith, who was 58 years old in 2006. He had all his retirement savings in the stock market, and he was in a total shock when the markets crashed in 2007/2008, fearing that he will lose it all, he pulled out to get 60 cents on a dollar. So investment risk can be summarized as the probability of you losing some or all of your capital without a chance of recovering it, particularly if you need the money shortly.

Volatility is the increase or decrease of asset prices(Stocks, Bonds, Gold, property, etc.), in response to the uncertainties or opportunities perceived by the investors at any given time.

So when investors see an opportunity to make make money on an asset(Stocks, Bonds, Gold, Property etc.), they flock to buy, resulting in an increase in demand and the price of the asset(s).

On the other hand, if they are clouded by the uncertainty of or if they perceive a possibility of losses, they scramble to sell, causing excess supply and falling asset prices.

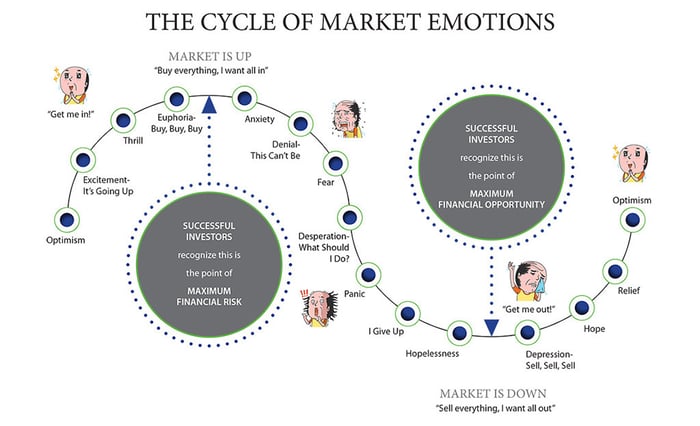

Often investors and traders get carried away by the optimism and end up overbuying the asset at continually increasing prices, thus creating an asset bubble.

Beyond a specific price, the asset(s) loses its edge and is no longer attractive enough to hold. So what seemed like an opportunity at a certain price, may now appear to be a threat. Smart investors/traders perceive this threat early and start selling to book healthy profits on the investment.

However, a majority of investors/traders are still in the euphoria, and they continue to buy the asset until it reaches a point, where there is less or no more demand for it. This triggers a downward spiral in the prices and demand of the asset.

Like how investors/traders got carried away with optimism before, now they go into a selling frenzy, overselling the asset and pushing its prices to the rock bottom.

So what seemed like a threat at a high price, now may start looking attractive and the smart investors/traders would start sensing the opportunity to buy again!

This cycle keeps repeating over and over again, causing volatility in markets.

Source: https://www.ciswealth.com/

Source: https://www.ciswealth.com/

Have you set challenging financial goals? Are your investments aligned to your goals and attitude to risk and volatility?

Is your asset allocation efficient? Or are you sitting on cash, unsure of if, when, and how to enter the markets?

Or are you always worried about a market crash, because you have too much invested in equities?

Let's meet online for a free and comprehensive review of your financial plan and your investments to identify opportunities and threats and understand if I can help you set and achieve financial goals.

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

After reading all the negative news during the weekend, investors with an itchy-trigger-finger...

No, not the one after the advent of Covid-19.

I am referring to the new normal amidst the tight...

Protecting our portfolio against market volatility is a tricky task, albeit a necessary one given...