Equities and Bonds, Investments

What are bonds and how they help in growing wealth?

Off late Stocks have been getting a lot of attention, particularly the US technology stocks like...

Robust portfolio management has two essential processes.

An efficient Asset allocation strategy aims to put together different asset classes in a portfolio to grow wealth and diversify risk.

You can achieve efficient diversification by investing in assets that are not correlated—implying that they don't move up or down simultaneously. When the value of one asset goes up, the other's value goes down, and vice-versa, meaning they are non-correlated.

For Example - Stocks and Bonds. Typically, when stocks' value goes up, bonds' value tends to go down and vice-versa.

By owning two or more non-correlated assets, you can protect your portfolio from extreme volatility.

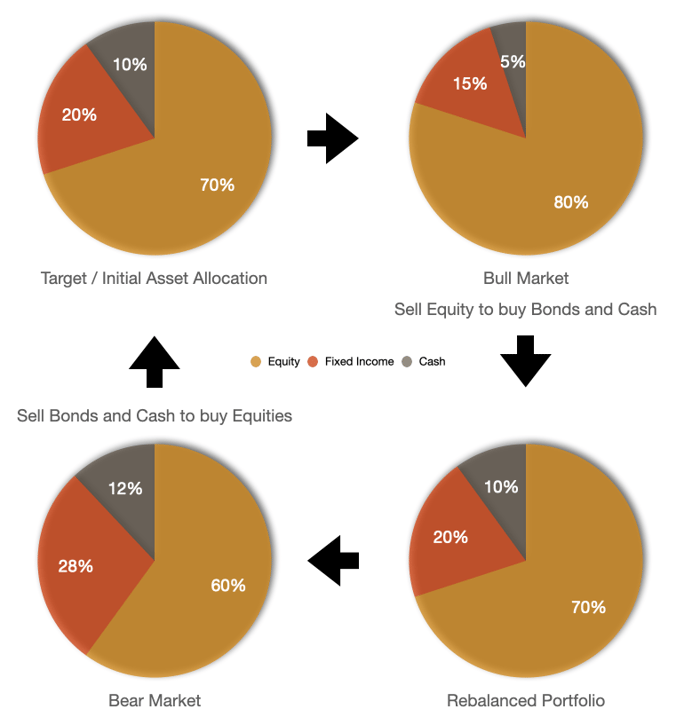

It is a process whereby you sell a specific portion of the assets that have gone up in value to buy assets that have gone down in value.

This is the most crucial but generally overlooked component of portfolio management. Neglecting this process is one of the most important reasons why many investors cannot grow long-term wealth, despite experiencing steep growth during bull markets.

Source: https://goldprice.org/gold-price-history.html

Source: https://goldprice.org/gold-price-history.html

You can see from this graph that the gold price has been very volatile. It is a classic example of where regular portfolio rebalancing could have protected investor wealth while creating value, which otherwise could have resulted in a loss or flat returns.

There are two basic approaches to portfolio rebalancing;

With Periodic Rebalancing, the portfolio is reviewed, and the holdings are restored to the target allocation at regular intervals (monthly, quarterly, or annually).

Target Based Rebalancing is executed whenever any asset class within the portfolio varies beyond a predetermined target level (for example, +/-10%).

As an Independent Financial Advisor, I can help you create a Holistic financial plan and the Right Asset Allocation.

I can also help you Rebalance your portfolio at regular intervals to ensure that it remains aligned to your goals and risk tolerance.

Don't wait!

Arrange a Free Consultation today and jumpstart your journey towards wealth creation.

Happy Investing!!!

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

Off late Stocks have been getting a lot of attention, particularly the US technology stocks like...

"Mutual funds were created to make investing easy, so consumers wouldn't have to be burdened with...

-2.png?width=300&name=Day%2013%20-%20Risk%20reward%20tradeoff%20(350%20%C3%97%20250%20px)-2.png)

A refrigerator is a device to keep food fresh, but it cannot do so forever. Over time food inside...