Don't look for the needle in the haystack. Just buy the haystack! - John C Bogle

What is an index fund?

Choosing stocks wisely and building a robust portfolio can be a challenge for many. Even experts find it difficult.

And more often than not, they don’t beat the market. This is when Index funds come in handy.

An Index fund is a simple, straightforward, and low-cost investment vehicle that helps you invest in assets like stocks, bonds, and commodities.

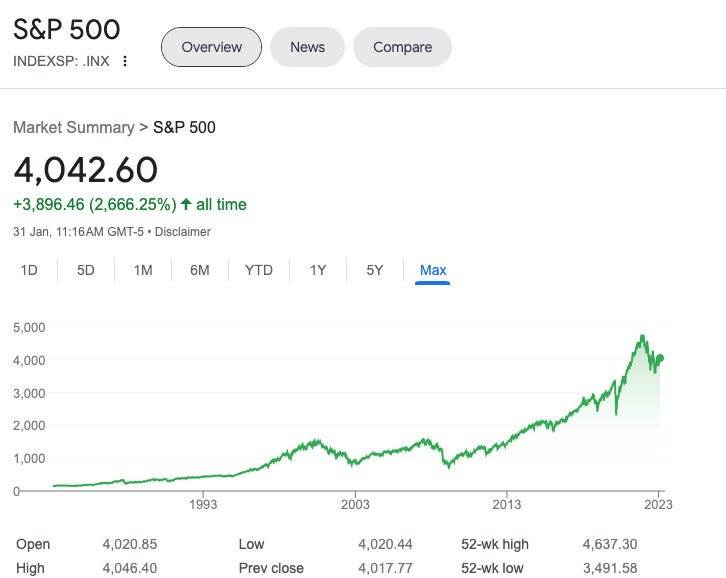

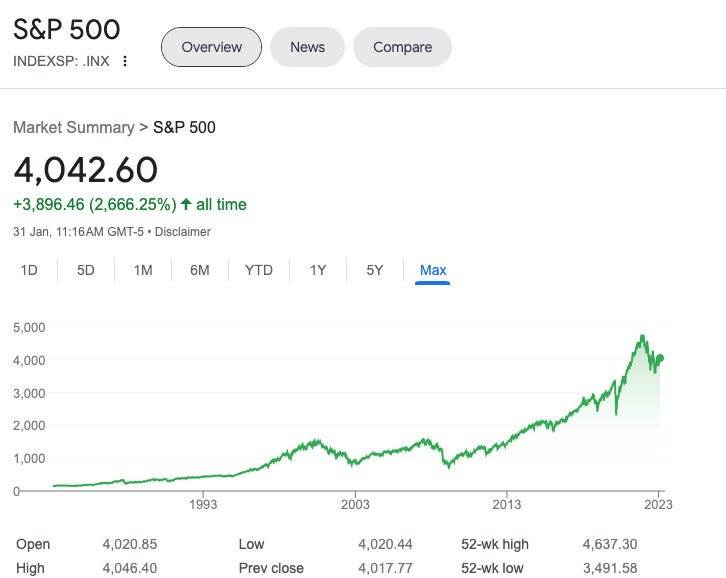

It is a pool of money with a fixed investment objective of mirroring an index or a benchmark like the S&P 500, DOW Jones, Sensex, etc.

It follows a passive investment strategy by tracking a particular index irrespective of the market situation.

How does it work?

An Index Fund manager does not try to beat the market, nor they pick stocks or time the market by actively buying and selling. They simply invest in all companies forming the index to match market returns and risk.

On the contrary, Active fund managers use their research and judgment to invest in assets that they think will grow the most. However, it is easier said than done, that is why index funds perform better than actively managed funds 90% of the time.

As we all know the market movements are typically broad, even if a few stocks in an index don't perform well, others may compensate.

3 Reasons Why you should invest in an Index Fund?

-

Low Costs: Unlike Active managed funds, Index funds charge a very low AMC. Sometimes as little as 0.04%

-

Broader Diversification: You can achieve a broad diversification in a market or a sector by investing in a fund like Vanguard Global Stock Index Fund

-

Index funds eliminate the fund manager’s bias

What is an example of an index fund?

Vanguard 500 Index Fund Admiral Shares (VFIAX) is the first index fund for individual investors. It has more than $500 Billion of assets under management.

When you invest in this fund, you technically invest in 500 of the largest U.S. companies of many different industries accounting for almost 75% of the U.S. stock market's value.

Other examples of Index funds are;

-

Schwab Total Stock Market Index (SWTSX)

-

Vanguard Growth Index (VIGAX)

-

Fidelity NASDAQ Composite Index (FNCMX)

-

Vanguard Total Bond Market Index (VBTLX)

-

Vanguard Balanced Index (VBIAX)

Can I lose money in an index fund?

Like all market-linked investments, Index funds are also subject to market risks. The value of your investment can go up or down according to market conditions. However, prudent asset allocation and regular rebalancing of your portfolio can mitigate this risk to a large extent.

How do I start an Index Fund Investment?

There are two ways you can start index investing.

- Follow the Do it yourself(DIY) approach and invest through platforms like Interactive Brokers, Saxo Bank, Ameritrade OR

- You can invest in Index funds either as a lump sum or as a regular / SIP investment in the UAE.

- Hire an Independent Financial Advisor to help you

-

- Set up a Holistic Financial Plan

- Determine the best Asset Allocation

- Identify suitable index mutual funds or ETFs

- Make rational investment decisions in line with market movements, your goals, and risk appetite.

- Review and Rebalance your portfolio regularly to ensure your investment objectives are met.

As an Independent Financial Advisor, I can help you build an Index fund investment portfolio to achieve your financial objectives.

Arrange a Free Consultation to start the best investment in UAE.

Click here to book a Discovery Call