30 Days Challenge

Day 21 - Basics of Mutual Funds

Mohammed Rayful won the AED 35,000,000 grand prize of the Big Ticket iN January 2023.

"Mutual funds were created to make investing easy, so consumers wouldn't have to be burdened with picking individual stocks."-- Scott D. Cook

A Mutual Fund is an investment vehicle designed by an Asset Management Company(AMC) to pool money from many investors for creating a professionally managed investment portfolio.

In simple words, A mutual fund is a bucket of investments. Each bucket may hold a few or many investments like shares and/or bonds. So, when you buy a mutual fund, you are buying a collection of investments

Every mutual fund has a specific objective/goal. Through this statement, the fund manager states the purpose, scope, and management style of the fund.

For Eg: BGF World Technology Fund

Based on the Fund Objective the manager may invest in one or more asset classes to create a portfolio. The portfolio is divided into several shares which are held by individual investors in proportion to their investment. The price of each mutual fund share is called its NAV or Net Asset Value.

The AMC calculates the NAV at the end of each trading day. It reflects the total value of the portfolio, minus the charges and liabilities of the fund.

The NAV of the fund fluctuates almost every trading day depending on the value of its underlying asset( Stocks / Bonds etc...)

There are many advantages of investing in mutual funds. Here are some notable benefits;

Let’s assume that you want to create a Website and set up a digital marketing strategy to improve your business.

Investing in financial markets demands specific skills and sustained involvement. You would have to track the markets to identify opportunities and threats to determine the best course of action.

You would also need expertise on various subjects like macroeconomics, Fundamental Analysis, Technical Analysis, etc...

You may or may not have the relevant skills, sufficient time or passion for analyzing the financial markets. In this case, investing in mutual funds can be an excellent alternative.

Qualified Professionals manage a mutual fund in line with its objectives and investment horizon. These professionals have the necessary knowledge, resources, and the economy of scale to conduct detailed research on the opportunities and risks involved before making investment decisions.

They regularly monitor the market situation to make the needed changes to achieve growth or protect capital.

"If you invest and don't diversify, you're literally throwing out money." - —Jeff Yass

Diversification is a risk management technique. You can achieve diversification by spreading your investments into different companies, industries, asset classes, geography, etc...

Let's say you have $1000 to invest every month, and you want to invest in US technology stocks. You may diversify the $1000 by buying shares of as many tech companies as possible or you could buy a technology fund like Polar Capital Global Technology Fund.

As of today, this fund holds 80 global technology companies in its portfolio. For an individual investor, it may be difficult and costly to achieve such diversification.

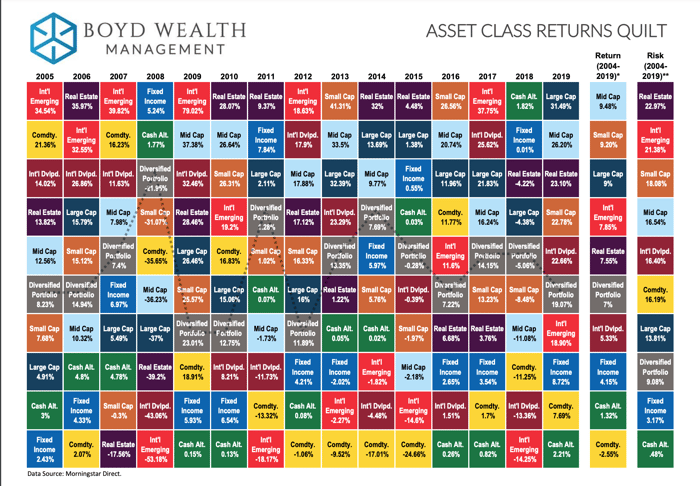

When the economy is booming, stocks typically outperform bonds and Cash. But when the economy slows down, bonds and gold tend to perform better than stocks.

By investing in both stocks and bonds in the ratio determined by your risk appetite, you can reduce the chances of your portfolio crashing when the markets are falling

Source: Boyd Wealth Management

From the above chart, you can notice that diverse asset classes behave differently during different stages of the economy and a diversified portfolio tends to outperform individual asset classes.

You can build a well-diversified investment portfolio by holding 3 - 4 mutual funds, instead of owning and managing hundreds of individual stocks, bonds, and commodities.

Mutual funds make investment simple. They provide easy and safe access to the global markets to every investor, helping them participate in investment opportunities across the globe.

Unlike property, mutual funds are a liquid investment, which means you can buy and sell with minimal effort. Also, you can start a Mutual fund investment with a monthly investment as low as$300.

You can set up a Systematic Investment Plan(SIP) to help you accumulate capital and grow wealth, or you can invest lump sums as well.

As an Independent Financial Advisor, I can help you establish your financial goals and set up a suitable investment strategy using Mutual funds, Index Funds, ETFs, and various other financial instruments.

Schedule an online meeting to discuss further.

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

-2.png?width=300&name=Day%2021-Mutual%20Fund%20Basics%20(350%20%C3%97%20250%20px)-2.png)

Mohammed Rayful won the AED 35,000,000 grand prize of the Big Ticket iN January 2023.

Off late Stocks have been getting a lot of attention, particularly the US technology stocks like...