Weekly Market Update - 15-08-2023

After a dismal 2022, global equity markets witnessed a spectacular rally in the first half of the...

Global Markets tumbled as Russia invaded Ukraine in the wee hours of Thursday. After many days of speculation, the worse finally happened.

The markets opened in the red as the S&P 500 Index receded into the correction territory, reaching 4,115. The Nasdaq swung 6.8% intraday, the highest since the advent of the pandemic.

They say that the markets fear the possibility of war than the actual war itself, which proved to be right again.

Much like the Ukrainian resilience, the global markets recovered later in the day and on Friday to end the week in the green. .jpg?width=700&name=war%2c%20volatility%20and%20resilience%20%20(700%20%C3%97%20400%20px).jpg)

Image Sources: https://www.militarytimes.com & https://www.theguardian.com/

For the week, the DOW was flat, ending at 34,058.8. The S&P 500 was at 4,384.7, up by 0.80%, and the Nasdaq was up by 1.10%, closing at 13,694.6.

The YTD figures of the indices are as follows;

Investors fled towards safe havens as the volatility increased. Gold prices reached $1,961.92 per ounce and then later fell back. It is currently trading at $1,907.27.

Oil prices also spiked to cross $100 per barrel on Thursday, and it is currently trading at $96.47 +5.33% for the week.

European equities fell as Russia's invasion of Ukraine fueled fears of higher inflation and an economic slowdown. The Euro Stoxx Index was down by 1.58%, and the UK's FTSE slipped 0.32%

Russian rouble plunged by 30% after new sanctions were announced, particularly the freezing of Euro and Dollar assets of the Russian Central bank and cutting off the Russian banks from the Swift network.

Germany halted Gazprom's Nord Stream 2 pipeline approval, transporting natural gas from Russia.

The MOEX Russia Index fell by more than 40% on Thursday from 3084 to 1689. However, today it is up by 20%, currently trading at 2,470.48.

Chinese equities were down during the week, as the Shanghai Composite Index dropped 1.1%, and the large-cap CSI 300 Index shed 1.6%.

Indian equities were also down on global cues, firming oil prices and the relentless selling by FPIs. Last week the Sensex lost 3.41% to settle at 55,858, and the Nifty lost 3.57% to settle at 16,658.40.

The rupee weakened as crude oil, gold, and US Dollar spiked. Currently, the rupee is trading at 75.48 per dollar.

The slide could continue as the Ukraine invasion lingers and the US interest rates increase.

Global markets and US futures are down sharply due to stringent sanctions on Russia and the escalating war situation.

A lot depends on the outcome of the negotiation set to happen this morning between Russia and Ukraine in Belarus.

Going by the past, the impacts of geopolitical events on the markets are short-lived, so a kneejerk reaction to falling portfolio values should be avoided.

As the markets are expected to remain volatile throughout the year, building an All-weather portfolio would be wise.

All-weather portfolios aim to trim the extremes and perform well during different market cycles. They typically consist of the right mix of Bonds, Equities, Real Estate, Commodities, and adequate amounts of cash.

"The premise is simple: Diversify investments in such a way that a portfolio can perform consistently during periods of economic growth as well as periods of economic stagnation.

The all-weather portfolio follows a passive investing strategy, in that it doesn't require investors to make any major asset allocation shifts if the market because of things like increasing volatility or rising inflation." - Yahoo Finance.

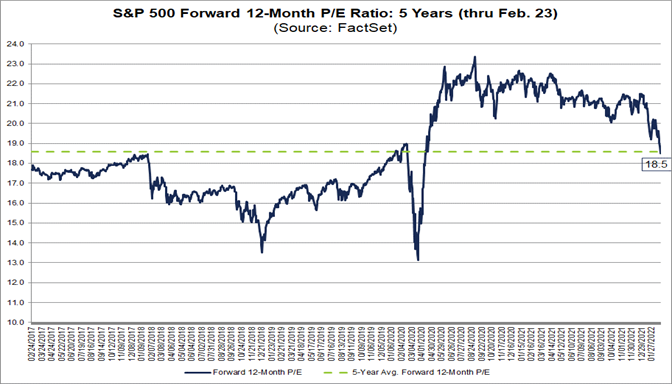

Source: https://insight.factset.com/

The forward 12-month P/E ratio of S&P500 was at 18.5 on February 23, below the five-year average of 18.6, creating a buying opportunity for investors with long-term horizons and a flexible risk appetite.

Are you holding back on your investment, fearing a market correction?

Or are you unsure how to invest for your retirement or other important financial goals?

I can help...

Click here to schedule a free online meeting to help you build a financial plan and a robust investment strategy.

You can also get a free second opinion of your investment portfolio, to help you review and rebalance it.

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

-2-2.png?width=300&name=WEEKLY%20MARKET%20UPDATE%20-%2014th%20August%202023%20(350%20%C3%97%20250%20px)-2-2.png)

After a dismal 2022, global equity markets witnessed a spectacular rally in the first half of the...

-2.png?width=300&name=WEEKLY%20MARKET%20UPDATE%20-%2031ST%20JULY%202023%20(350%20%C3%97%20250%20px)-2.png)

The summer temperatures and the stocks on Wall Street have been soaring high in the last few weeks....

The U.S. equities were marginally up last week, despite the spread of the Delta variant denting...