Investments

5 Golden Rules for Successful Investing.

Why Invest your Savings?

Investing your savings helps you build wealth. It enables you to put your...

The distance between the edge of your middle finger and elbow is known as "Muzham" in Tamil and Malayalam.

It is a unit to measure length, widely used in Tamilnadu and Kerala even today.

It is a unit to measure length, widely used in Tamilnadu and Kerala even today.

Sumerians, Egyptians, and Israelites also used this unit of measurement (cubits).

It was difficult for ordinary people to get exact measurement tools in the past, so they relied on approximate measurements like Cubit(Mulam), Span, and Thumb.

It was easier for people to understand when measurements were expressed in units they could relate to.

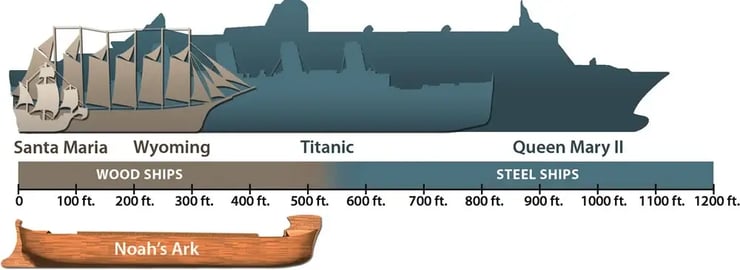

In fact, Noah's ark was also built using the same unit of measurement. 300 cubits long, 50 cubits wide, and 30 cubits high

Image Source: https://answersingenesis.org/

Image Source: https://answersingenesis.org/

Similarly, we use Thumb Rules or Rules of Thumb to express, understand, remember and apply complex concepts(like personal finance) in our day-to-day lives.

Here are some helpful Thumb Rules you can use to win with money.

Rent is one of the biggest expenses of Residents in the UAE.

The general rule of Thumb for rent is that it should not be more than 30% of your household income.

3 - 5 times your annual household income.

3 - 6 months of income

We have seen this already on Day 5.

50/20/30 budget rule

Minimum 10 Times your annual income

Minimum 3 - 5 times your yearly income and 2 - 3 times your annual income for your stay-at-home spouse.

Minimum 10% of your income

You would need at least Twenty Times your annual income as a corpus to fund your retirement.

To determine if you are on the right track to reaching your retirement goal, you can use the following benchmarks;

.jpeg?width=740&height=370&name=Retirement%20Savings%20Benchmarks%20(1).jpeg) Image Source: www.fidelity.com

Image Source: www.fidelity.com

To help you determine your ideal asset allocation between equity and debt. For example, if you are 30, your equity investments can be up to 70% of your portfolio, and the balance can be in debt/cash and gold.

.jpeg?width=740&height=417&name=100-minus-age-rule-en%20(1).jpeg) Image Source: https://www.ifec.org.hk/

Image Source: https://www.ifec.org.hk/

To help you determine how long it will take to double your money. For Eg: If your investment is growing at 6.00%, it will take 12 years(72/6) to double your money.

You can use these 11 thumb rules to easily understand and apply complex financial concepts to budget, save, invest and grow wealth. However,

Have you heard of these before?

Which ones did you find most relevant?

Let me know by dropping a comment on our Facebook group. Also, let me know if you have any questions on the above.

Please be aware that these are only general guidelines. For exact numbers, please consult a financial advisor.

Click here to build a bespoke Financial Plan with pre and post-retirement cash flow projections.

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

Investing your savings helps you build wealth. It enables you to put your...

The biggest room each one of us has is the room for improvement.

When people want to save money, they usually put their net disposable...