Weekly Market Update

Strain of Strains - Weekly Market Update

Investors in the US woke up from the Turkey Coma to the news of a new Covid-19 strain in South...

US equities posted another weekly loss, as the Geo-Political crisis still holds center stage.

Stocks recovered earlier when Russia indicated a positive outcome from talks with Ukraine. But, they declined again as the talks failed and the fighting intensified.

For the week, The S&P 500 was down 2.9%, the DOW by 2.00%, and the Nasdaq by 3.5%.

The YTD numbers for the indices were S&P500 -11.8%, DOW - 9.3%, and the Nasdaq -17.9%.

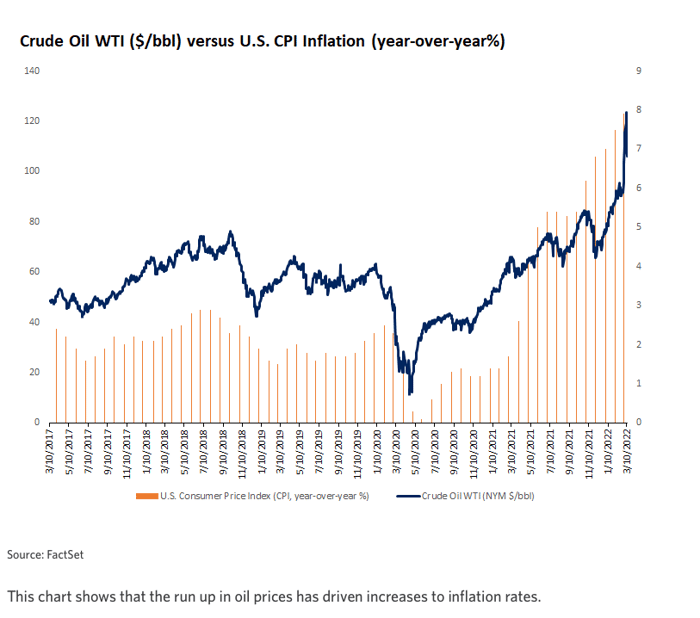

The Russia/Ukraine crisis has heightened inflationary pressures globally on many fronts over the last few weeks.

Oil prices rose sharply worldwide, reaching almost $130, before stabilizing around $110.

Prices of Natual Gas, Nickel, Wheat, and other grains have also risen sharply due to imports ban and supply chain bottlenecks.

The US consumer price index continued to surge in Feb, and the inflation of 7.9%, the highest in the last 40 years.

The surging oil prices and commodity prices will continue to push inflation higher in the coming months. However, experts believe that inflation will subside in the second half of the year as the war ends and its impact dies down.

Markets are also pricing in the possibility of lifting sanctions on Iran and resumption of oil supply in the next few months.

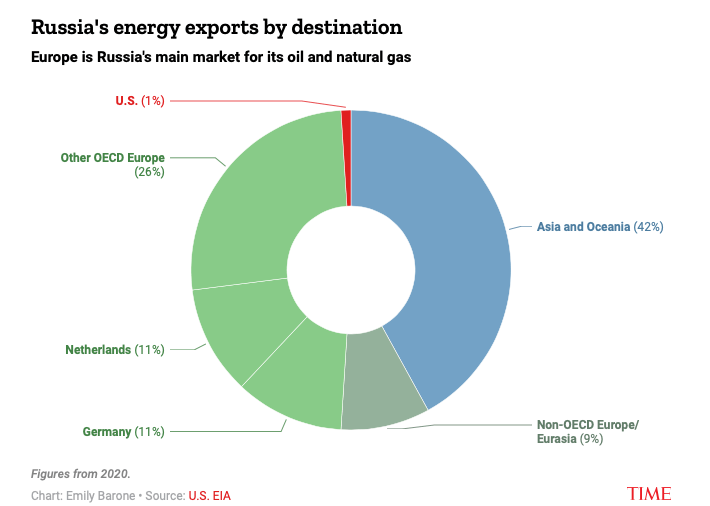

On the other hand, US president Joe Biden announced a ban on Russian Oil imports. Despite the small size of US imports from Russia, it is triggering a domino effect in Europe as well.

European equities reversed some losses from the previous weeks in the hopes of a positive outcome from the talks between Russia and Ukraine.

The Euro Stoxx Index 600 index was up by 2.23%, and the UK's FTSE gained 2.41%

The European Union (EU), the UK, and the US continued to impose sanctions on Russia for invading Ukraine. While the US has banned Oil imports from Russia, the UK said it would phase out Oil imports by the year-end.

The European Union also has revealed their plans to cut gas imports from Russia by two-thirds this year. Germany, however, has refrained from cutting down imports, citing that it would cause unnecessary strain on German consumers.

Source: https://time.com/6156015/us-oil-ban-russia-consequences/

Chinese equities fell sharply last week, as US regulators identified 5 Chinese companies that could be delisted from the US stock markets for failing to meet audit requirements

The five companies are

This also had ripple effects on other Chinese stocks like Alibaba, Baidu, and JD.com.

The companies identified by the SEC on Thursday are the first among the 270 Chinese firms that could be delisted from the New York Stock Exchange or the Nasdaq for not meeting audit requirements.

However, Chinese authorities are confident of reaching an agreement shortly.

The Shanghai Composite index fell by 3.98%, and the CSI index lost 4.21% on weak global cues, firming energy and commodity prices, and regulatory crossfire.

Despite high volatility due to weak global cues, Indian equities ended a 4-week losing streak.

Domestic Institutions and retail investors are quite supportive despite sustained FPI selling and weak global cues.

The Sensex gained 2.24% for the week, closing at 55,550.30, and the Nifty gained 2.37%, closing at 16,630.45.

Given the oversold conditions, a relief rally is likely. Investors can use the relief rally to trim risk and rebalance portfolios.

A diversified portfolio with cash, bonds, and defensive sectors is ideal for weathering the potential volatility during the year.

Investors with long-term investment horizons and flexible risk appetites can find some good deals throughout the year.

Are you holding back on your investment, fearing a market correction?

Or are you unsure how to invest for your retirement or other important financial goals?

I can help...

Click here to schedule a free online meeting to help you build a financial plan and a robust investment strategy.

You can also get a free second opinion of your investment portfolio, to help you review and rebalance it.

Author, Blogger & Independent Financial Advisor. My goal is to give you actionable tools for creating passive income and building wealth. More than 10,000 expats have already used my ideas to jumpstart their journey towards financial independence. Connect with me to start yours...

Investors in the US woke up from the Turkey Coma to the news of a new Covid-19 strain in South...

The much anticipated Fed meeting failed to provide any direction on the potential tapering this...

-2-2.png?width=300&name=WEEKLY%20MARKET%20UPDATE%20-%2014th%20August%202023%20(350%20%C3%97%20250%20px)-2-2.png)

After a dismal 2022, global equity markets witnessed a spectacular rally in the first half of the...